Table of contents

- Main points

- Overview

- Workplace pension reforms (automatic enrolment)

- User engagement

- Total membership of occupational pension schemes

- Active membership

- Active membership of private sector schemes by benefit structure and status

- Pensioner members by sector (pensions in payment)

- Members with preserved pension entitlements by sector (deferred members)

- Contribution rates in private sector occupational pension schemes

- Background notes

- Methodology

1. Main points

Total membership of occupational pension schemes with 2 or more members was 30.4 million in 2014, the highest level recorded by the survey, and an increase of 2.5 million compared to 2013. These estimates exclude participation in other workplace (group personal) pensions.

The numbers contributing, or having contributions paid into a scheme (active members), rose from 8.1 million in 2013 to 10.2 million in 2014, driven by a rise of 2.0 million in the private sector.

For private sector defined contribution schemes, the average total contribution rate was 4.7% in 2014, down from 9.1% in 2013.

The changes in active membership and contribution rates are likely to have been influenced by the recent workplace pension reforms.

2. Overview

The Occupational Pension Schemes Survey (OPSS) is an annual survey of occupational pension schemes in the UK, run by the Office for National Statistics (ONS). The survey was first undertaken in 1953, then in 1956 and 1963, and then every 4 to 5 years until 2004 when it became an annual survey. Until its transfer to ONS in 2006, OPSS was run by the Government Actuary’s Department (GAD).

The OPSS collects information from occupational pension schemes (consisting of 2 or more members), about scheme membership, benefits and contributions. It includes sections on very small schemes (schemes with 2 to 11 members) and those that are winding up. OPSS covers both private and public sector occupational pension schemes registered in the United Kingdom. Results from OPSS provide a detailed view of the nature of occupational pension provision in the UK.

OPSS does not cover state pensions or personal pensions, the latter being based on individuals entering into a contract with a pension provider. This exclusion extends to group personal pension (GPP) arrangements, such as stakeholder and self-invested personal pensions, where the contract is facilitated by the employer(s). Following feedback from stakeholders, we will be collecting data from GPP providers, for the first time, in 2015.

This bulletin provides summary data on membership of schemes and contributions paid. Further information is available in the associated reference tables or on request. To assist users in their understanding of these data, pension definitions are included as part of the background notes of this release with further detail in this glossary.

We are always looking to refine the OPSS questionnaires to improve the estimates and capture data that reflects the changing pensions landscape. Some of the time series presented are therefore not directly comparable over time. If this is the case, caveats are included in the footnotes associated with the relevant chart or table.

Back to table of contents3. Workplace pension reforms (automatic enrolment)

This bulletin draws attention to significant differences in estimates for key variables between 2014 and 2013, and preceding years. It is likely that these changes are a result of the recent workplace pension reforms introduced by the Department for Work and Pensions (DWP).

Starting in October 2012, with gradual roll-out by 2018, all employers have a duty to automatically enrol eligible employees into a qualifying pension scheme and to make contributions on their behalf. Automatic enrolment is being introduced in stages, based on the size of the employers’ PAYE scheme (as of 1 April 2012). Minimum contribution levels have also been introduced, in a phased process, with full implementation by 2018. For further information please see Background note 2.

These 2014 results are the second annual OPSS estimates to be produced following the introduction of the workplace pension reforms. It should be noted that the reforms are not taking place in isolation and other social and economic factors (for example, employment, disposable household income levels, attitudes to saving for retirement, etc.) would also affect membership and contribution rates.

DWP have published an evaluation report on the reforms which references various sources, and is publicly available on the DWP website.

Back to table of contents4. User engagement

We are constantly aiming to improve this release and its associated commentary. We would welcome any feedback you might have; please contact us via email: opss@ons.gov.uk or telephone Hazel Clarke on +44 (0)1633 455633.

Back to table of contents5. Total membership of occupational pension schemes

Total membership of occupational pension schemes consists of:

active members (current employees who would normally contribute)

pensioner members (those receiving pension payments)

members with preserved pension entitlements (members who are no longer actively contributing into the scheme but have accrued rights that will come into payment at some point in the future)

Please note that individuals may have more than one of these types of membership. For example, an individual may be in receipt of a pension from a former employer but still working and contributing to a pension. This person would appear in both the pensioner and active member categories. Similarly, an individual might be working and contributing to a scheme while being entitled to a preserved pension from a previous employer’s scheme. This person would appear in both the active and preserved member categories. As such, the estimates of membership are not counts of individuals.

Between 2008 (when directly comparable records began) and 2013, there was a 200,000 increase in total membership (Figure 1). Between 2013 and 2014, total membership rose by 2.5 million. While there are other factors (for example, employment, disposable household income levels, attitudes to saving for retirement, etc.) which would also affect membership, an influencing factor behind these changes is likely to be the introduction of automatic enrolment. This is discussed further in the active and preserved membership sections.

Total estimated membership in 2014:

10.2 million active (employee) members

9.6 million pensions in payment

10.6 million preserved pension entitlements

Figure 1: Membership of occupational pension schemes by membership type, 1991 to 2014

UK

Source: Office for National Statistics

Notes:

- This is not a continuous time series.

- The 2005 survey did not cover the public sector and is therefore not included.

- Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution.

- Changes to the part of the questionnaire used to estimate pensions in payment and preserved pension entitlements in 2008 mean that comparisons with 2007 and earlier should be treated with caution.

Download this chart Figure 1: Membership of occupational pension schemes by membership type, 1991 to 2014

Image .csv .xls6. Active membership

The active members of an occupational pension scheme are those who are contributing to the scheme, or having contributions made on their behalf. They are usually current employees of the sponsoring employer. This release includes breakdowns of active membership by sector (public or private), benefit structure (defined benefit or defined contribution) and status (for example, open or closed).

Between 2013 and 2014, active membership increased from 8.1 million to 10.2 million (Figure 2), a significant increase (see Background note 5). The increase is likely to be due to the establishment of automatic enrolment explained in the “Workplace pension reforms” section. In the private sector, there was a significant increase from 2.8 million (2013) to 4.9 million (2014). There was a slight increase in the public sector (5.3 million to 5.4 million) over this period.

Workplace pensions consist of occupational and group personal pensions (see Background note 3). Although OPSS covers only occupational pension provision, membership of these schemes accounted for nearly three-quarters of workplace pension membership in 2014.

Between 1991 and 2012 there was a slow but generally steady decrease in active membership. Some of this can be accounted for by the growth in the number of employees contributing to group personal pensions. The Annual Survey of Hours and Earnings (ASHE) pensions release estimates that less than 1% of employees had a group personal pension in 1997. By 2014 this had risen to nearly 16%.

Figure 2: Active membership of occupational pension schemes by sector, 1953 to 2014

UK

Source: Office for National Statistics

Notes:

- This is not a continuous time series.

- Due to changes in the definition of the private and public sectors, estimates for 2000 onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector.

- The 2005 survey did not cover the public sector and is therefore not included.

- Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution.

Download this chart Figure 2: Active membership of occupational pension schemes by sector, 1953 to 2014

Image .csv .xls7. Active membership of private sector schemes by benefit structure and status

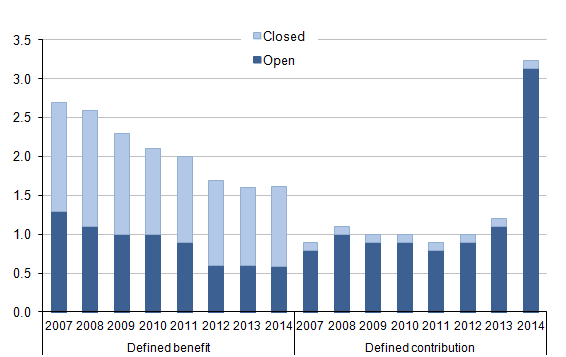

Active membership of private sector defined contribution (DC) schemes, which has remained around 1.0 million since 2006 (Figure 3), rose to 3.2 million in 2014 – driven by a rise in membership of open schemes (those which admitted new members – see Figure 4). The rise between 2013 (1.2 million) and 2014 (3.2 million) is significant (see Background note 5).

Active membership of private sector defined benefit (DB) schemes has remained at 1.6 million in 2014 (Figure 3). Active membership of open private sector DB schemes, fell to 0.6 million in 2014 from 1.4 million in 2006 (Figure 4).

The rise in DC membership is likely to be due to the workplace pension reforms – DC arrangements (including group personal pensions), were seen as the most likely route for employers to meet their new obligations under automatic enrolment. This is because, in DB schemes, the employer bears the investment risk and must pay out pensions at an agreed rate, regardless of the returns made on the invested contributions. In contrast, for DC schemes, members bear the risks as there is no promised level of pension payment. DB schemes are therefore potentially less attractive to employers than providing a DC occupational or group personal pension. While employers could use DB schemes for automatic enrolment1, the minimum requirements for a qualifying scheme focussed on DC provision.

A further reason DC membership was expected to rise was that the National Employment Savings Trust (NEST) was set up as a DC scheme. NEST is a qualifying pension scheme, established under the Pensions Act 2008, to support the introduction of automatic enrolment (AE). Since AE began, various master trust arrangements have also become important players in the pensions market – again with provision typically on a DC basis. Master trusts involve a single provider managing a pension scheme for multiple employers under a single trust arrangement (see examples on the National Association of Pension Funds website).

Figure 3: Active membership of private sector occupational pension scheme by benefit structure, 2007 to 2014

UK

Source: Office for National Statistics

Notes:

- This is not a continuous time series.

Download this chart Figure 3: Active membership of private sector occupational pension scheme by benefit structure, 2007 to 2014

Image .csv .xlsSome schemes have more than one section; offering benefits on a different basis to different groups of members (see Background note 3). In the private sector only 36% of defined benefit members were in sections of schemes that were open to new members compared with 97% of DC members (Figure 4).

Figure 4: Active membership of private sector occupational pension schemes by status and benefit structure, 2007 to 2014

UK, millions

Source: Office for National Statistics

Notes:

- This is not a continuous time series.

- Estimates for earlier years are provided in the excel file.

Download this image Figure 4: Active membership of private sector occupational pension schemes by status and benefit structure, 2007 to 2014

.png (10.2 kB) .xls (28.2 kB)Notes for active membership of private sector schemes by benefit structure and status

- If employers elected to meet their obligations through provision of a DB (rather than a DC) scheme, their “staging date” (the date by which time they needed to be compliant with the new legislation) could be delayed

8. Pensioner members by sector (pensions in payment)

Pensioner members are those who are in receipt of pension payments. This section estimates the number of pensions in payment from UK occupational pension schemes in 2014. It includes pensions in payment to dependants, pension credit members (see Background note 3) and those who are still working for the same employer (for example, where they are partially retired).

These estimates do not represent the total number of pensioners in the country receiving benefits from occupational pension schemes because an individual pensioner may be in receipt of more than one pension. The estimates do not include annuities (or other retirement products), purchased by members of DC occupational pension schemes upon retirement.

While it is not a direct comparison (for reasons mentioned above and that people move between sectors, change employers etc.), the increase in active membership in the 1950s and 1960s (Figure 2) should be broadly reflected in the current pensions in payment figures (Figure 5), as that cohort of employees reaches retirement age. While changes to methodology mean that comparisons over time should be treated with caution, the total number of occupational pensions in payment has risen, from 0.9 million in 1953 to 9.6 million in 2014. Estimates of pensions in payment in both the public and private sectors have risen since 1953, reaching 4.6 million and 5.0 million respectively in 2014, although estimates for the private sector have remained fairly flat in recent years (Figure 5). The change between 2013 and 2014 was not significant (see Background note 5).

Figure 5: Number of pensions in payment for occupational pension schemes by sector, 1953 to 2014

UK

Source: Office for National Statistics

Notes:

- This is not a continuous time series.

- Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector.

- The 2005 survey did not cover the public sector and is therefore not included.

- Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution.

- Changes to the part of the questionnaire used to estimate pensions in payment in 2008 mean that comparisons with 2007 and earlier should be treated with caution.

Download this chart Figure 5: Number of pensions in payment for occupational pension schemes by sector, 1953 to 2014

Image .csv .xls9. Members with preserved pension entitlements by sector (deferred members)

When active employee members leave the employment of the scheme’s sponsoring employer, they usually have a choice of what to do with the benefits accrued in the scheme. The default position for members with more than 2 years’ service1 is a preserved pension entitlement, where the rights remain in the scheme and a pension comes into payment at normal pension age. These estimates do not represent the number of individuals with preserved pension entitlements but show the number of preserved pensions. The estimates also include dependants and pension credit members (see Background note 3) who have a preserved pension entitlement and those still working for the employer (this may occur when an employer stops provision or changes to a different type).

The total number of preserved pension entitlements increased from 10.2 million in 2013 to 10.6 million in 2014 (Figure 6). The increase occurred in both private and public sectors; in the private sector from 6.5 million (2013) to 6.8 million (2014) and in the public sector from 3.6 million (2013) to 3.8 million (2014).

Changes in preserved pension entitlements may be affected by automatic enrolment. For example, if employers close existing schemes and move all their eligible employees to a new scheme based on the automatic enrolment qualifying criteria, these employees will appear in the estimates of both active and preserved members. This may therefore have had a bearing on the increase in numbers of preserved pension entitlements.

Figure 6: Number of preserved pension entitlements in occupational pension schemes by sector, 1991 to 2014

UK

Source: Office for National Statistics

Notes:

- This is not a continuous time series.

- Private and public sector breakdowns are not available for preserved pension entitlements before 1991.

- Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector.

- The 2005 survey did not cover the public sector and is therefore not included.

- Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution.

- Changes to the part of the questionnaire used to estimate pensions in payment in 2008 mean that comparisons with 2007 and earlier should be treated with caution.

Download this chart Figure 6: Number of preserved pension entitlements in occupational pension schemes by sector, 1991 to 2014

Image .csv .xlsNotes for members with preserved pension entitlements by sector (deferred members)

- A “short service refund” may be offered for members with less than 2 years’ service. The period of 2 years applies to most private sector schemes – although this period may vary for example, for some in the public sector. In some cases, the benefits accrued may be transferred across to their new employer’s scheme. Information on exits from schemes is provided in the reference tables – see Reference table 8

10. Contribution rates in private sector occupational pension schemes

Contribution rate questions are only asked of OPSS survey respondents in the private sector. Information on rates in the public sector is not collected as it is already publicly available, for example, from individual scheme resource accounts.

Most member (employee) and employer contributions are made as a percentage of salary, excluding bonuses. However, fixed amount payments can be made as part of the schedule of normal (or regular) contributions. On the other hand, when schemes make “special” cash payments (for example, to address a deficit in a defined benefit scheme’s liabilities), these payments are not considered normal contributions and information on such payments are not collected by the survey.

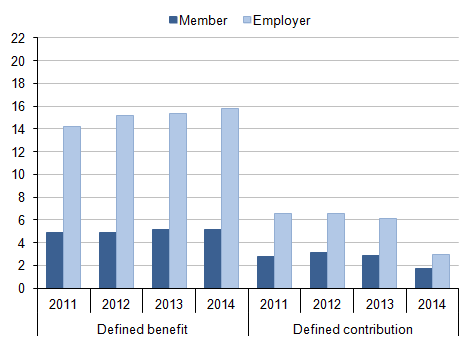

As in previous years, private sector defined benefit schemes had higher contribution rates than defined contribution schemes in 2014 (Figure 7):

for defined benefit schemes, the average total contribution rate was 20.9% of pensionable earnings, 5.2% for members and 15.8% for employers

for defined contribution schemes, the average total contribution rate was 4.7%, 1.8% for members and 2.9% for employers

In private sector career average schemes (revalued in line with prices – see Background note 3), average employer contribution rates were lower than for defined benefit schemes as a whole. In 2014, the rate for career average schemes was 12.7% compared with 15.8% for all DB schemes. Average member contribution rates in career average schemes were fairly similar to the average rate for all DB schemes (5.4% and 5.2% respectively).

As part of the workplace pension reforms, minimum levels for employer and employee contributions will be phased in over the period to 2018 (see Background note 2). While it is not possible to isolate the effect of these reforms, the significant (see Background note 5) falls in average members and employer contribution rates for defined contribution schemes (see Figure 8) may be linked to this policy change. A rise in the number of new members starting on the minimum rates would pull down the average rate. The fall in employer contributions may also be due to employers reducing contributions into existing pensions, referred to as “levelling down”.

As with the other findings presented, the contribution rate figures are estimates which should be interpreted with caution. Measures of the data quality for the main data series (including contribution rates) are presented in Standard errors, 2014 (87.5 Kb Excel sheet).

Figure 7: Weighted-average contribution rates to private sector occupational pension schemes by benefit structure and contributor, 2014

UK

Source: Office for National Statistics

Notes:

- Includes schemes where standard contributions were zero.

- Excludes normal contributions paid as fixed amounts.

- Includes rates for open, closed and frozen schemes.

- Excludes schemes with fewer than 12 members.

- Career average schemes estimated here refer only to those revalued in line with prices (see Background Note 3).

- Weighted-average contribution rates across all schemes were calculated based on the estimates for numbers of active members contributing at each rate. For example, if a scheme had a group of 50 active members contributing at 4% and another group of 100 active members contributing at 6%, then the scheme’s weighted-average contribution rate would be 5.3%.

Download this chart Figure 7: Weighted-average contribution rates to private sector occupational pension schemes by benefit structure and contributor, 2014

Image .csv .xls

Figure 8: Weighted-average contribution rates to private sector occupational pension schemes by benefit structure and contributor, 2011 to 2014

UK, percentage of pensionable earnings

Source: Office for National Statistics

Notes:

- Includes schemes where standard contributions were zero.

- Excludes normal contributions paid as fixed amounts.

- Includes rates for open, closed and frozen schemes.

- Excludes schemes with fewer than 12 members.

- Data for career average schemes are available in the excel file.

- Weighted-average contribution rates across all schemes were calculated based on the estimates for numbers of active members contributing at each rate. For example, if a scheme had a group of 50 active members contributing at 4% and another group of 100 active members contributing at 6%, then the scheme’s weighted-average contribution rate would be 5.3%.