1. Main findings

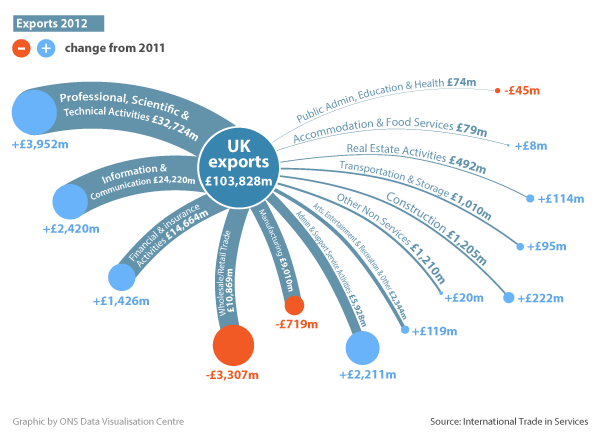

- Total UK exports of services (excluding travel, transportation and banking) in current prices, continued to rise, increasing from £97,311 million in 2011 to £103,828 million in 2012, an increase of 7%.

- Total UK exports of services to Saudi Arabia more than doubled in 2012, rising from £1,525 million in 2011 to £3,483 million in 2012. This rise was predominantly due to increases in UK exports of technical services such as engineering and surveying.

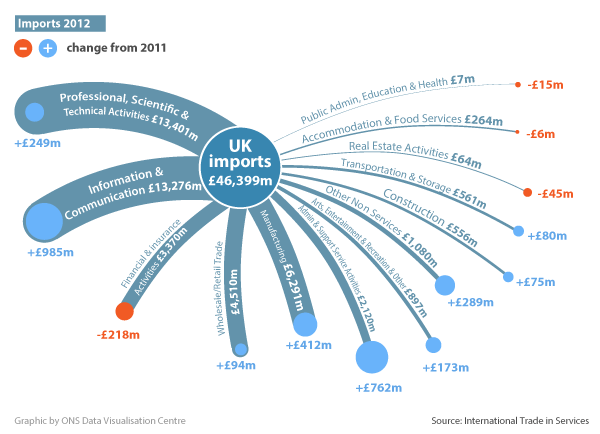

- Total UK imports of services (excluding travel, transportation and banking) in current prices, increased by 7%, rising from £43,564 million in 2011 to £46,399 million in 2012.

- Total UK imports of services from Europe saw an 8% increase between 2011 and 2012, rising from £22,325 million in 2011 to £24,192 million in 2012. This followed marginal growth between 2010 and 2011.

- In 2012, businesses trading within the Professional, scientific and technical activities sector of the economy continued to be the largest contributors of UK exports and imports of services, with £32,724 million and £13,401 million respectively.

2. Overview

This 2012 International Trade in Services statistical bulletin provides a detailed breakdown of UK annual trade in services, by product, industry and country. These estimates are derived from the Office for National Statistics (ONS) International Trade in Services (ITIS) survey.

The ITIS survey is a key source of UK trade data. However, it is important to note that the survey does not cover the transportation, travel and banking industries. As a result, trade in services in these industries are excluded from the estimates reported in this publication and users should be aware of this when interpreting the results. Data for these industries are available from other sources such as the International Passenger Survey and from the Bank of England. These are used alongside data from the ITIS survey by ONS to produce the overall level of trade in services which are published in the ONS Pink Book and UK Trade publication.

Estimates from the ITIS survey are used for a variety of purposes by different users. The strength of the survey is the detail that it provides and the estimates are used by government, business and international organisations for economic assessment, to monitor the competitiveness of UK business, as an input into policy advice and for academic research (see background note 3 for further information).

These statistics are produced according to the agreed international standards set out in the fifth edition of the International Monetary Fund (IMF) Balance of Payments Manual (BPM5). The IMF has recently released new versions of their manuals (BPM6). This revised manual reflects the changes that have occurred in international finance since the previous updates. Along with other countries, the UK is currently working to implement these changes.

For more detail on these changes see the guidance and methodology section of the ONS website.

Back to table of contents3. User engagement

We are constantly aiming to improve this release and its associated commentary. We would welcome any feedback you might have and would be particularly interested in knowing how you make use of these data to inform our work. Please contact us via email: itis@ons.gov.uk or telephone Ciara Williams on +44 (0)1633 456455.

Back to table of contents4. Summary

Total exports of services (excluding travel, transport and banking) from the UK, in current prices, increased from £97,311 million in 2011 to £103,828 million in 2012, an increase of 7%.

As UK exports continue to rise year on year, with 2012 being no exception, the 2012 exports estimate was the highest reported value since the start of the international trade in services survey.

Total imports of services to the UK (excluding travel, transport and banking) increased from £43,564 million in 2011 to £46,399 million in 2012, an increase of 7%.

Prior to 2009, the year on year growth rates in imports of services were larger than those seen more recently. In 2009, the annual gross domestic product (GDP) growth rate fell to a record low of -5.2%, and from this point on, growth in the imports of services to the UK has remained subdued.

Figure 1: Total international trade in services (excluding travel, transport and banking)

Source: Office for National Statistics

Download this chart Figure 1: Total international trade in services (excluding travel, transport and banking)

Image .csv .xlsIn 2012, the UK continued to export more services than it imported. The balance of international trade in services increased from a surplus of £53,746 million in 2011 to a surplus of £57,430 million in 2012, an increase of 7%.

Back to table of contents5. Total international trade in services (excluding travel, transport and banking) by continents and countries

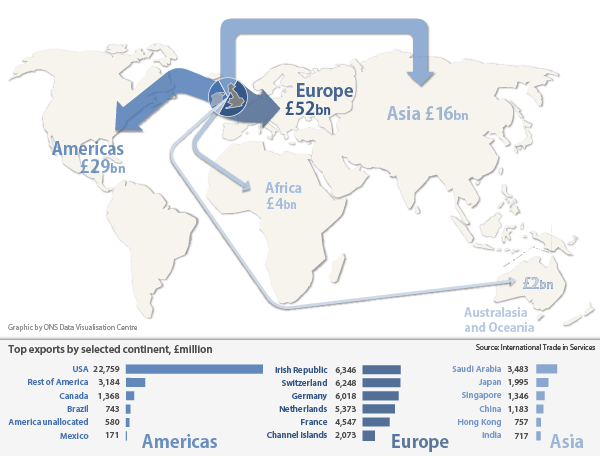

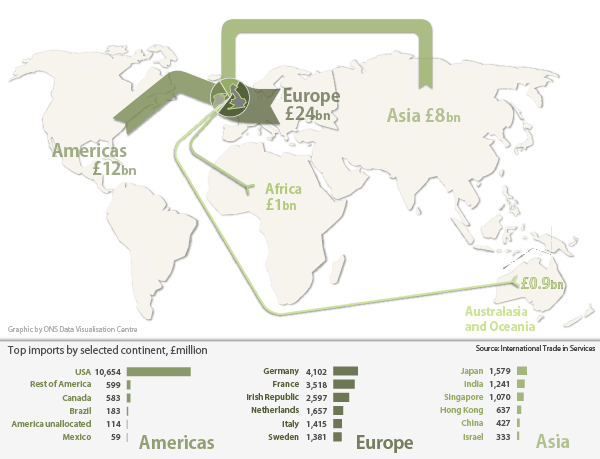

This section shows key geographical findings for the total UK international trade in services (excluding travel, transport and banking). The size of the arrows in Figures 2 and 3 are proportionate to the size of the continental export and import markets for the UK.

For more detailed, geographic information relating to the total exports and imports of services, please refer to data table A0 – Total trade in services (excluding transport, travel and banking) analysed by continents and countries.

Exports

Figure 2: UK International trade in services (excluding travel, transport and banking) exports by continent, 2012

Source: Office for National Statistics

Download this image Figure 2: UK International trade in services (excluding travel, transport and banking) exports by continent, 2012

.png (34.5 kB) .xls (18.9 kB)Europe

In 2012, when looking at exports by continent, Europe remained the dominant customer for UK exports of services with a share of 50% of total service exports. Exports of services from the UK to Europe rose from £48,909 million in 2011 to £51,963 million in 2012, an increase of 6%.

The UK’s top European trading partners with respect of exports of services according to the 2012 International Trade in Services Survey were as follows:

- Irish republic, with a total service exports value of £6,346 million

- Switzerland, with a total service exports value of £6,248 million

- Germany, with a total service exports value of £6,018 million

- The Netherlands, with a total service exports value of £5,373 million

- France, with a total service exports value of £4,547 million

The make up of the UK’s top trading partners in 2012 has remained unchanged from 2011. UK exports to the Irish republic in 2012 contributed the majority share of UK exports to Europe (12%) and remained relatively similar to its contribution in 2011. This marginal growth may have been as a result of Annual Irish GDP, which slowed, although remained positive in 2012.

An interactive map can be found on the ONS website detailing the UK’s European imports and exports of services.

The Americas

Overall, UK exports of services to the Americas accounted for 28% of the total in 2012, increasing from £26,729 million in 2011 to £28,805 million in 2012, an increase of 8%.

The USA continued to be the dominant country within the Americas in receipt of services exported from the UK, accounting for 80% of the total UK exports to the Americas.

UK exports of services to Brazil increased by 34% rising from £556 million in 2011 to £743 million in 2012.

Asia

Asian countries held a 16% share of total UK exports of services in 2012.

UK exports of trade in services to Asian businesses increased from £15,445 million in 2011 to £16,284 million in 2012, an increase of 5%. This compares with stronger growth between 2009 and 2010 (10%) and between 2010 and 2011 (9%).

UK exports of services to Saudi Arabia increased from £1,525 million in 2011 to £3,483 million in 2012. This fits with the strong economic growth in Saudi Arabia in 2012.

Offsetting the growth seen in Saudi Arabia, UK exports of services to Singapore experienced a notable decrease in 2012, falling from £2,547 million in 2011 to £1,346 million in 2012. Incidentally, Singapore’s domestic exports with the rest of the world also experienced a decline, triggered by a drop in electronic services exports. With their own exports falling, Singapore may have compensated by reducing its expenditure on imports in 2012 until their exports levels recovered.

In 2012, UK exports of services to India returned to 2010 levels, falling from £1,087 million in 2011 to £717 million in 2012.

Imports

Figure 3: UK International trade in services (excluding transport, travel and banking) imports by continent, 2012

Source: Office for National Statistics

Download this image Figure 3: UK International trade in services (excluding transport, travel and banking) imports by continent, 2012

.png (33.4 kB) .xls (18.9 kB)Europe

Europe continued to be the prime supplier of UK imports of services with a share of 52% of the total ITIS imports value. Total UK imports from Europe increased from £22,325 million in 2011 to £24,192 million in 2012, an increase of 8%. This followed a marginal decline in growth in European imports to the UK between 2010 and 2011.

The UK’s top trading partners in 2012, with respect to imports of services, according to the 2012 International Trade in Services Survey were as follows:

- Germany, with a total service imports value of £4,102 million

- France, with a total service imports value of £3,518 million

- Irish Republic, with a total service imports value of £2,597 million

- The Netherlands, with a total service imports value of £1,657 million

- Italy, with a total service imports value of £1,415 million

There was a slight shift in the composition of the UK’s top trading partners in relation to imports of services. The 2012 results showed that there was an increase in the amount of trade with Italy compared with 2011, moving from sixth into fifth position. UK imports of services from Italy decreased between 2010 and 2011.

An interactive map can be found on the ONS website detailing the UK’s European. imports and exports of services.

The Americas

The Americas continued to be the second largest supplier of imports of services to the UK with a 26% share of total UK imports of services, increasing from £11,217 million in 2011 to £12,193 million in 2012. The 9% increase followed broadly flat growth between 2010 and 2011. The USA continued to be the primary provider of services imported into the UK, accounting for 87% of the total imports from the Americas to the UK.

Asia

UK imports of services from Asia experienced a decline, falling from £8,250 million in 2011 to £7,807 million in 2012, a decrease of 5%. This was in contrast to a year on year increase of 25% between 2010 and 2011.

This decrease in UK imports from Asia during 2012 was mainly driven by lower imports from Japan, which fell from £2,793 million in 2011 to £1,579 million in 2012, a decrease of 43%. The reduction in imports of services from Japan to UK may have been as a result of the natural disasters Japan faced during 2011. Japan has needed time to recover and only in late spring 2012 did the country show signs of recovery, with a rise in Japanese domestic exports.

Back to table of contents6. Trade in service products: geographical analysis

This section illustrates UK trade in services exports and imports broken down by prominent product groups. Each group is analysed by continent, making comparisons between 2011 to 2012.

Technical, trade related, operational leasing and other business services group

The products which have been used to compile the data contained within this service group are as follows:

- Total agricultural, mining and on-site processing

- Total construction goods and services

- Total technical services

- Operational leasing

Exports

The total value of UK exports (excluding transport, travel and banking) of technical, trade related, operational leasing and other business services increased by 6%, rising from £10,263 million in 2011 to £10,885 million in 2012.

Figure 4: Exports (excluding travel, transport and banking) of technical, trade related, operational leasing and other business services, by continent

Source: Office for National Statistics

Download this chart Figure 4: Exports (excluding travel, transport and banking) of technical, trade related, operational leasing and other business services, by continent

Image .csv .xlsEurope

UK exports of technical, trade related, operational leasing and other business services was dominated by trade with Europe, with a 31% share of total exports within this service group.

Total UK exports to Europe declined at a steady rate between 2009 and 2011 with year on year growth rates falling by 8% between 2009 and 2010 and 9% between 2010 and 2011. In contrast, between 2011 and 2012, UK exports to Europe within this service group rose by 12%, rising from £3,026 million in 2011 to £3,397 million in 2012.

Overall, UK exports to countries within Europe experienced relatively stable growth from 2009 onwards, with the exception of Norway. Norway showed a decline of 15% between 2009 and 2010 and a further decline of 46% between 2010 and 2011. Estimates for UK exports of services to Norway in 2012 increased by 50% since 2011, with a total exports figure of £493 million. This was 15% of total UK exports to Europe within this service group. Engineering and other technical services were the main products within this cluster which showed notable increases. Norwegian investments in carbon capture projects may have resulted in Norway looking to the UK for the provision of services within this group to assist with ongoing work.

Asia

In 2012, UK exports of technical, trade related, operational leasing and other business services to Asia increased by 12%, rising from £2,799 million in 2011 to £3,140 million in 2012.

Within this service group, UK exports to Saudi Arabia were the main driver for this increase, rising from £339 million in 2011 to £699 million in 2012. In particular, UK exports of technical services, such as engineering and surveying services, were the largest contributor.

Saudi Arabia seemed to weather the global financial crisis well, with its economic growth rebounding back to pre-crisis levels in 2010. The countries population has also been increasing, resulting in the country’s need to expand. In 2012, it was announced that the construction industry in Saudi Arabia was investing heavily in multi billion pound projects. This may explain in part why the UK has seen an increase in exports to Saudi Arabia in this service group.

The Americas

The Americas saw a small decline in UK exports of services in 2012 within this service group, falling from £2,651 million in 2011 to £2,573 million in 2012, a decrease of 3%. This decrease was primarily attributed to the USA, which showed an 11% decline, falling from £1,853 million in 2011 to £1,657 million in 2012.

Imports

The total value of imports of technical, trade related, operational leasing and other business services to the UK increased by 29%, rising from £3,341 million in 2011 to £4,326 million in 2012.

Figure 5: Imports (excluding travel, transport and banking) of technical, trade related, operational leasing and other business services by continent

Source: Office for National Statistics

Download this chart Figure 5: Imports (excluding travel, transport and banking) of technical, trade related, operational leasing and other business services by continent

Image .csv .xlsEurope

Europe continued to be the primary supplier of services into the UK within this service group. Imports of services to the UK from Europe increased by 26% in 2012, rising from £1,736 million in 2011 to £2,194 million in 2012. This increase was predominantly driven by three countries within Europe, these being:

- Germany, increasing from £259 million in 2011 to £420 million in 2012

- Italy, increasing from £178 million in 2011 to £330 million in 2012

- The Irish Republic, increasing from £139 million in 2011 to £249 million in 2012

Asia

Imports of services to the UK from Asia rose from £842 million in 2011 to £1,102 million in 2012, an increase of 31%. Imports of these services from Saudi Arabia, Singapore and the rest of Asia made up the majority of the 2012 total.

The Americas

UK imports of these services from The America’s also experienced an increase in 2012, rising from £393 million in 2011 to £706 million in 2012. This increase was fairly evenly distributed between the USA and the Rest of the America's, with the USA now having a 60% share of imports of this service group to the UK and a share of 19% from the Rest of the America's.

The increase seen in UK imports from the Americas may be linked with the rise seen in imports of engineering services. This service product covers a wide spectrum of services, For example aircraft maintenance. UK based companies who rely on air transport and have aircraft overseas requiring maintenance would need to have this work carried out before the aircraft can re-enter service. Having this work completed outside of the UK would be classed as an import to the UK from the country the aircraft is located in.

Professional, management consulting and research and development

The service products which have been used to compile the data contained within this category are as follows:

- Accountancy, auditing and bookkeeping

- Public relations services

- Legal Services

- Property management

- Advertising

- Recruitment

- Market research and public opinion polling

- Research and development

- Management Consulting

- Procurement

- Other business and professional services

Exports

The total value of UK exports of professional, management consulting and research and development services increased by 10%, rising from £22,146 million in 2011 to £24,452 million in 2012.

Figure 6: Exports (excluding travel, transport and banking) of professional, management consulting and reseach and development services by continent

Source: Office for National Statistics

Download this chart Figure 6: Exports (excluding travel, transport and banking) of professional, management consulting and reseach and development services by continent

Image .csv .xlsEurope

UK exports of professional, management consulting and research and development services continue to be dominated by Europe which has an overall share of 56% of total exports of this product group.

UK exports of these services to Europe increased by 16% in 2012, rising from £11,841 million in 2011 to £13,702 million in 2012. This was in contrast to recent years which saw moderate growth of 6% between 2010 and 2011.

The growth in UK exports of these services to Europe was primarily driven by Switzerland (increasing from £1,599 million in 2011 to £2,220 million in 2012) and Germany (increasing from £1,354 million in 2011 to £1,787 million in 2012).

The demand for management consultancy services has been increasing in Switzerland in recent years, as a result of growth in large consulting businesses as well as very small firms. These have been able to take advantage of the recovering economy by increasing their rates surpassing medium sized consultancy firms. This may be an indication as to why UK exports to Switzerland within this service group have increased in 2012.

The Americas

The Americas remained the UK’s second largest customer of exports of professional, management consulting and research and development services in 2012 with a value of £7,089 million. This occurred despite marginal growth since 2011. The USA continued to be the dominant customer for UK exports of these services, holding an 82% share of the Americas total in 2012.

Asia

Between 2009 to 2011, growth in UK exports to Asia has remained broadly flat. However, between 2011 and 2012, UK exports to Asia within this service group grew by 15%, rising from £2,457 million in 2011 to £2,821 million in 2012. This growth was predominantly driven by an increase in exports to Japan (increasing from £660 million in 2011 to £768 million in 2012) and Rest of Asia (increasing from £710 million in 2011 to £804 million in 2012).

The increase to Japan in respect of these services may have been in part due to the environmental disasters that Japan has experienced in recent years, with signs of recovery becoming apparent in 2012. Japan may have sought help from the UK in terms of technical assistance and legal services exports in order to help the economy recover from such devastation.

Imports

The total value of imports of services to the UK of professional, management consulting and research and development services increased by 6%, rising from £11,675 million in 2011 to £12,349 million in 2012.

Figure 7: Imports (excluding travel, transport and banking) of professional, management consulting and reseach and development services

Source: Office for National Statistics

Download this chart Figure 7: Imports (excluding travel, transport and banking) of professional, management consulting and reseach and development services

Image .csv .xlsEurope

UK imports of professional, management consulting and research and development services continued to be dominated by European supply, having an overall share of 55% of total UK imports within this service group. Imports of services from Europe to the UK remained relatively static falling from £6,841 million in 2011 to £6,800 million in 2012.

The Americas

UK imports of these services from the Americas showed a return to 2009 levels, rising from £2,711 million in 2011 to £2,905 million in 2012. This growth was predominantly driven by the USA, which rose from £2,390 million in 2011 to £2,539 million in 2012. This is in contrast to the marginal growth seen in UK exports of these services to the Americas.

Asia

UK imports of professional, management consulting and research and development services from Asia showed strong growth between 2011 and 2012 (22%) rising from £1,655 million in 2011 to £2,017 million in 2012. UK imports of these services from Hong Kong saw the largest increase, rising from £106 million in 2011 to £274 million in 2012.

Hong Kong has a skilled labour force coupled with Western business methods and enhanced technology. Increasing its imports to the UK within this service group may have enabled Hong Kong to maximise on the diversity of services it can deliver to the rest of the world.

Merchanting, other trade-related and services between related enterprises

The service products which have been used to compile the data contained within this category are as follows:

- Merchanting

- Other Trade related

- Services between related enterprises

Exports

The total value of UK exports of merchanting, other trade-related and services between related enterprises decreased from £22,356 million in 2011 to £21,308 million in 2012, a fall of 5%. This was in stark contrast to the 2011 estimates which showed 30% growth for UK exports of services for this service group between 2010 and 2011.

Exports of merchanting services fell by 60% from £7,635 million in 2011 to £3,025 million in 2012. This decrease was offset by an increase in exports of services between related enterprises which increased by 26% rising from £13,758 million in 2011 to £17,308 million in 2012.

The decline in UK exports of merchanting services in 2012 may have been caused by the types of goods being merchanted. These can be very high in value, for example oil. Oil is traded in extremely large quantities all over the world and the cost of such a commodity can run into billions of pounds. Fluctuations in both interest and exchange rates can have a large impact on the resale costs of oil narrowing the profit margins of the merchant. Oil is traded worldwide which could also be an indicator as to why almost all countries are experiencing a decline in this service group.

Figure 8: Exports (excluding travel, transport and banking) of merchanted, other trade-related and services between related enterprises by continent

Source: Office for National Statistics

Download this chart Figure 8: Exports (excluding travel, transport and banking) of merchanted, other trade-related and services between related enterprises by continent

Image .csv .xlsEurope

Europe continued to be main UK export market for UK exports of merchanting, other-trade related and services between related enterprises with a 54% share of the total UK exports of these services. However, the decline in the level of UK exports of these services to Europe was the driver behind the overall drop in the value of total UK exports within this service group, a 5% decrease.

The largest declines in Europe within this service group were:

- the Rest of Europe falling from £606 million in 2011 to £98 million in 2012

- Switzerland falling from £1,996 million in 2011 to £1,685 million in 2012

The Americas

UK exports of merchanting, other trade-related and services between related enterprises increased during 2012 rising from £5,614 million in 2011 to £6,005 million in 2012 and increase of 7%. This was as a result of an increase in UK exports to the USA which rose 24% between 2011 and 2012.

Asia

Asia also experienced a decline in UK exports of merchanting, other trade-related and services between related enterprises falling from £2,894 million in 2011 to £2,463 million in 2012 a decrease of 15%. UK exports to India showed the largest decline falling by 68%.

Imports

The total value of imports of merchanting, other trade related and services between related enterprises to the UK rose from £8,960 million in 2011 to £9,902 million in 2012, an increase of 11%. The rate of growth has slowed between 2011 and 2012, compared with a 19% increase between 2010 and 2011.

The increase seen in UK imports of merchanting, other trade related and services between related enterprises in 2012 was driven by supply from Europe but closely followed by the Americas.

Figure 9: Imports (excluding travel, transport and banking) of merchanted, other trade-related and services between related enterprises by continent

Source: Office for National Statistics

Download this chart Figure 9: Imports (excluding travel, transport and banking) of merchanted, other trade-related and services between related enterprises by continent

Image .csv .xlsEurope

The total value of imports of these services to the UK from Europe increased from £4,817 million in 2011 to £5,407 million in 2012, an increase of 12%. A large proportion of this increase came from within the European Union, specifically France, which showed growth of 25% between 2011 and 2012.

In contrast to the UK exports data for the same product service group, UK imports of these services showed relatively strong growth and were driven by imports of services between related enterprises. This may suggest that companies were moving funds between subsidiaries outside of the UK. For example, France witnessed a 25% increase in this area rising from £997 million in 2011 to £1,250 million in 2012. These fund transfers may have taken place in order to cover ongoing projects here in the UK.

The Americas

UK imports of merchanting, other trade related and services between related enterprises from the America’s continued to grow at a similar rate to that seen between 2010 and 2011. UK imports of these services rose from £2,004 million in 2011 to £2,409 million in 2012, an increase of 20%. This increase was mainly driven by the USA, who witnessed a growth of 25%, rising from £1,789 million in 2011 to £2,230 million in 2012.

Back to table of contents7. Trade in services by products: industry analysis

This section illustrates UK trade in services exports and imports detailed by industry and product classification.

Exports

Figure 10: UK exports of service products, by industry, 2012

Source: Office for National Statistics

Download this image Figure 10: UK exports of service products, by industry, 2012

.png (28.7 kB) .xls (21.5 kB)An interactive bar chart detailing UK exports by product can be found on the ONS website.

Professional, scientific and technical activities

Professional, scientific and technical services was the largest industry sector contributing to total service exports (excluding transport, travel and banking) rising from £28,772 million in 2011 to £32,724 million in 2012, an increase of 14%.

The increase in this industry sector was predominantly driven by the product grouping business and professional services, specifically services between related enterprises (rising from £5,647 million in 2011 to £6,622 million in 2012, an increase of 17%) and management consulting (rising from £974 million in 2011 to £1,434 million in 2012, an increase of 47%).

Information and communication

Information and communication was the second largest industry component of total service exports (excluding transport, travel and banking) and showed growth of 11%, rising from £21,779 million in 2011 to £24,220 million in 2012.

The dominant products exported from this industry were telecommunication services (15% increase) and computer services (3% increase) in 2012.

Business and professional services saw the largest increase rising from £3,902 million in 2011 to £5,213 million in 2012. Within this service group, services between related enterprises showed the largest rise, increasing from £2,120 million in 2011 to £3,150 million in 2012 (49% increase).

Financial and insurance activities

The financial and insurance sector continued to grow in 2012, with UK exports of services increasing from £13,238 million in 2011 to £14,664 million in 2012, an increase of 11%.

The UK’s annual GDP growth fell from 1.1% in 2011 to 0.3% in 2012 signaling a slow in the UK economy, this however did not seem to have an immediate impact on the amount of financial services exported from the UK.

Wholesale / Retail trade

A decline in UK exports from the Wholesale/Retail sector partially offset the growth seen in the total UK exports of services estimates. Exports fell from £14,176 million in 2011 to £10,869 million in 2012, a decrease of 23%. This was driven by decreases seen in the exports of merchanting which decreased by 64% between 2011 and 2012.

Imports

Figure 11: UK imports of service products, by industry, 2012

Source: Office for National Statistics

Download this image Figure 11: UK imports of service products, by industry, 2012

.png (29.6 kB) .xls (21.5 kB)An interactive bar chart detailing UK imports by product can be found on the ONS website.

Professional, scientific and technical activities

Professional, scientific and technical service activities were the largest industry components contributing to total UK services imports (excluding transport, travel and banking), increasing from £13,152 million in 2011 to £13,401 million in 2012, an increase of 2%.

Similarly with exports, the imports of business and professional services dominated this industry sector, with imports increasing by 5% between 2011 and 2012. Within this service group, services between related enterprises drove this growth, increasing from £1,393 million in 2011 to £1,830 million in 2012, an increase of 31%. However, this was offset by the imports of research and development services, which fell from £3,424 million in 2011 to £2,948 million in 2012, a decrease of 14%.

UK imports within this industry of technical services during 2012 showed a return to pre-2010 levels, rising from £735 million in 2011 to £1,170 million in 2012. This was driven by increases seen in engineering services imports to the UK, which increased from £522 million in 2011 to £861 million in 2012.

Offsetting the growth in the professional, scientific and technical activities industry sector was UK imports of services associated with royalties and licenses in 2012. These fell from £2,116 million in 2011 to £1,015 million in 2012.

Information and communication

UK imports within the information and communication industry sector remained the second largest contributor to the total UK imports estimate (excluding transport, travel and banking). Information and communication imports to the UK saw year on year increases of 8%, rising from £12,292 million in 2011 to £13,276 million in 2012.

The growth in UK imports with this sector was driven by the business and professional services product group, which increased from £2,647 million in 2011 to £3,187 million in 2012. This increase was as a result of increased imports of services between related enterprises. Information services also showed a notable increase rising from £2,750 million in 2011 to £3,131 million in 2012. Of these, imports of computer services drove this change.

Manufacturing

Manufacturing was the third largest industry sector contributing to total UK imports of services (excluding transport, travel and banking), increasing from £5,878 million in 2011 to £6,291 million in 2012. Increases were seen in most product groups with the notable exception of merchanting and other trade related services, which saw a decline of 7%.

Back to table of contents