Table of contents

- Main points for April to June 2015

- Summary of latest labour market statistics

- Understanding and working with labour market statistics

- Detailed commentary

- Employment

- Public and private sector employment (first published on 17 June 2015)

- Employment by nationality and country of birth, not seasonally adjusted

- Actual hours worked

- Workforce jobs (first published on 17 June 2015)

- Average weekly earnings

- Labour disputes (not seasonally adjusted)

- Unemployment

- Claimant Count (experimental statistics)

- Comparison between unemployment and the Claimant Count

- Economic inactivity

- Young people in the labour market

- Redundancies

- Vacancies

- Main out of work benefits, not seasonally adjusted

- Where to find more information about labour market statistics

- Revisions

- Accuracy of the statistics: estimating and reporting uncertainty

- Other quality information

- Background notes

- Methodology

1. Main points for April to June 2015

There were 31.03 million people in work, 63,000 fewer than for January to March 2015 but 354,000 more than for a year earlier

There were 22.76 million people working full-time, 352,000 more than for a year earlier. There were 8.27 million people working part-time, little changed compared with a year earlier

The employment rate (the proportion of people aged from 16 to 64 who were in work) was 73.4%, little changed compared with January to March 2015 but higher than for a year earlier (72.8%)

There were 1.85 million unemployed people (people not in work but seeking and available to work), 25,000 more than for January to March 2015 but 221,000 fewer than for a year earlier

There were 1.01 million unemployed men, 130,000 fewer than for a year earlier. There were 838,000 unemployed women, 92,000 fewer than for a year earlier

The unemployment rate was 5.6%, little changed compared with January to March 2015 but lower than for a year earlier (6.3%). The unemployment rate is the proportion of the labour force (those in work plus those unemployed) who were unemployed

There were 8.99 million people aged from 16 to 64 who were economically inactive (not working and not seeking or available to work), little changed compared with January to March 2015 and with a year earlier

The inactivity rate (the proportion of people aged from 16 to 64 who were economically inactive) was 22.1%, little changed compared with January to March 2015 and with a year earlier

Comparing April to June 2015 with a year earlier, pay for employees in Great Britain increased by 2.4% including bonuses and by 2.8% excluding bonuses

2. Summary of latest labour market statistics

Table A and Figure A show the latest estimates, for April to June 2015, for employment, unemployment and economic inactivity and shows how these estimates compare with the previous quarter (January to March 2015) and the previous year (April to June 2014). Comparing April to June 2015 with January to March 2015 provides the most robust short-term comparison. See Making comparisons with earlier data at Section (ii).

Table A: Summary of latest labour market statistics for April to June 2015, seasonally adjusted

| Number (thousands) | Change on Jan to Mar 2015 | Change on Apr to Jun 2014 | Headline Rate (%) | Change on Jan to Mar 2015 | Change on Apr to Jun 2014 | |

| Employed | 31,035 | -63 | 354 | |||

| Aged 16 to 64 | 29,894 | -7 | 315 | 73.4 | -0.1 | 0.6 |

| Aged 65+ | 1,140 | -56 | 39 | |||

| Unemployed | 1,852 | 25 | -221 | |||

| Aged 16 to 64 | 1,829 | 24 | -218 | 5.6 | 0.1 | -0.7 |

| Aged 65+ | 23 | 2 | -4 | |||

| Inactive | 19,053 | 120 | 200 | |||

| Aged 16 to 64 | 8,990 | 7 | -2 | 22.1 | -0.1 | |

| Aged 65+ | 10,063 | 113 | 202 | |||

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Calculation of headline employment rate: Number of employed people aged from 16 to 64 divided by the population aged from 16 to 64. Population is the sum of employed plus unemployed plus inactive | ||||||

| 2. Calculation of headline unemployment rate: Number of unemployed people aged 16 and over divided by the sum of employed people aged 16 and over plus unemployed people aged 16 and over | ||||||

| 3. Calculation of headline economic inactivity rate: Number of economically inactive people aged from 16 to 64 divided by the population aged from 16 to 64. Population is the sum of employed plus unemployed plus inactive | ||||||

| 4. Components may not sum exactly to totals due to rounding | ||||||

Download this table Table A: Summary of latest labour market statistics for April to June 2015, seasonally adjusted

.xls (56.3 kB)Figure A shows how the latest estimates, for April to June 2015, for employment, unemploymentand economic inactivity compare with the previous quarter (January to March 2015) and theprevious year (April to June 2014).

Figure A: Changes in the number of people in the UK labour market, seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure A: Changes in the number of people in the UK labour market, seasonally adjusted

Image .csv .xls3. Understanding and working with labour market statistics

Where to find explanatory information

Interpreting labour market statistics, available on our website, is designed to help users interpret labour market statistics and highlight some common misunderstandings.

A more detailed Guide to labour market statistics, which expands on “Interpreting labour market statistics” is also available.

A Glossary which gives an explanation of terms used within labour market statistics, is available on our website.

About labour market statuses

Everybody aged 16 or over is either employed, unemployed or economically inactive. The employment estimates include all people in work including those working part-time. People not working are classed as unemployed if they have been looking for work within the last 4 weeks and are able to start work within the next 2 weeks. A common misconception is that the unemployment statistics are a count of people on benefits; this is not the case as they include unemployed people not claiming benefits.

Jobless people who have not been looking for work within the last 4 weeks or who are unable to start work within the next 2 weeks are classed as economically inactive. Examples of economically inactive people include people not looking for work because they are students, looking after the family or home, because of illness or disability or because they have retired.

Making comparisons with earlier data derived from the Labour Force Survey

Estimates of employment, unemployment, economic inactivity, hours worked and redundancies are derived from the Labour Force Survey (LFS), a survey of households. The most robust estimates of short-term movements in these estimates are obtained by comparing the estimates for April to June 2015 with the estimates for January to March 2015, which were first published on 13 May 2015. This provides a more robust estimate than comparing with the estimates for March to May 2015. This is because the April and May data are included within both estimates, so effectively observed differences are those between the individual months of March and June 2015. The LFS is sampled such that it is representative of the UK population over a 3 month period, not for single month periods.

Accuracy and reliability of survey estimates

Most of the figures in this statistical bulletin come from surveys of households or businesses. Surveys gather information from a sample rather than from the whole population. The sample is designed carefully to allow for this, and to be as accurate as possible given practical limitations such as time and cost constraints, but results from sample surveys are always estimates, not precise figures. This means that they are subject to a margin of error which can have an impact on how changes in the numbers should be interpreted, especially in the short-term.

Changes in the numbers reported in this statistical bulletin (and especially the rates) between 3 month periods are usually not greater than the margin of error. In practice, this means that small, short-term movements in reported rates (for example within +/- 0.3 percentage points) should be treated as indicative, and considered alongside medium and long-term patterns in the series and corresponding movements in administrative sources, where available, to give a fuller picture.

Further information is available towards the end of this statistical bulletin in the section Accuracy of the statistics: estimating and reporting uncertainty.

Seasonal adjustment

All estimates discussed in this statistical bulletin are seasonally adjusted except where otherwise stated. Like many economic indicators, the labour market is affected by factors that tend to occur at around the same time every year; for example school leavers entering the labour market in July and whether Easter falls in March or April. In order to compare movements other than annual changes in labour market statistics, such as since the previous quarter or since the previous month, the data are seasonally adjusted to remove the effects of seasonal factors and the arrangement of the calendar.

Back to table of contents4. Detailed commentary

This section of the statistical bulletin consists of the following parts.

People in work

Employment

Public and private sector employment

Employment by nationality and country of birth

Actual hours worked

Workforce jobs

Average weekly earnings

Labour disputes

People not in work

Unemployment

Claimant Count (experimental statistics)

Comparison between unemployment and the Claimant Count

Economic inactivity

Other labour market statistics

Young people in the labour market

Redundancies

Vacancies

Main out of work benefits

5. Employment

What is employment ?

Employment measures the number of people in work and differs from the number of jobs because some people have more than one job. Further information is available at Notes for Employment at the end of this section.

A comparison between estimates of employment and jobs is available in an article on our website.

Where to find data about employment

Employment estimates are available at Tables 1 and 3 of the pdf version of this statistical bulletin and at data tables A02 SA (497.5 Kb Excel sheet) and EMP01 SA (457 Kb Excel sheet).

Estimates for the number of people in employment and for the number of self-employed people back to 1855 (which do not have National Statistics status) have been published by the Bank of England in the spreadsheet Three centuries of macroeconomic data v2.2 (at columns H and N in worksheet 22).

Commentary

The proportion of people aged from 16 to 64 in work is known as the employment rate. Figure 1.1 shows the employment rate for people aged from 16 to 64 since comparable records began in 1971. The lowest employment rate was 65.6% in 1983, during the economic downturn of the early 1980s. The employment rate has been generally increasing since early 2012 and it reached a record high of 73.5% in January to March 2015.

Figure 1.1: UK Employment rate (aged 16 to 64), seasonally adjusted

January to March 1971 to April to June 2015

Source: Labour Force Survey - Office for National Statistics

Notes:

- Highest: Jan-Mar 2015 (73.5%)

- Lowest: Feb-Apr and May-Jul 1983 (65.6%)

- See figure 1.2 for latest 5 years

Download this chart Figure 1.1: UK Employment rate (aged 16 to 64), seasonally adjusted

Image .csv .xlsFigure 1.2 looks in more detail at the employment rate for the last 5 years.

Figure 1.2: UK Employment rate (aged 16 to 64), seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 1.2: UK Employment rate (aged 16 to 64), seasonally adjusted

Image .csv .xls73.4% of people aged from 16 to 64 were in work for April to June 2015. This was:

little changed compared with the record high of 73.5% recorded for January to March 2015

higher than for a year earlier (72.8%)

higher than the pre-downturn peak recorded for early 2008 (73.0%)

The employment rate of 73.4% for April to June 2015 is slightly higher than the rate for March to May 2014 (73.3%). However the comparison with January to March 2015 provides the most robust short-term comparison.

Looking at employment rates by sex, for April to June 2015:

78.2% of men and 68.7% of women aged from 16 to 64 were in work

these employment rates for men and women were higher than those for a year earlier

the employment rate for men (78.2%) was lower than before the economic downturn of 2008 to 2009, when it peaked at 79.1% in late 2007 to early 2008

the employment rate for women (68.7%) was the joint highest since comparable records began in 1971, partly due to ongoing changes to the state pension age for women resulting in fewer women retiring between the ages of 60 and 65

For April to June 2015, there were 31.03 million people in work, 63,000 fewer than for January to March 2015 but 354,000 more than for a year earlier.

Comparing the estimates for full-time and part-time employment by sex for April to June 2015 with those for a year earlier, the number of:

men working full-time increased by 153,000 to reach 14.36 million

men working part-time increased by 21,000 to reach 2.14 million

women working full-time increased by 198,000 to reach 8.40 million

women working part-time fell by 18,000 to reach 6.13 million

Figure 1.3: Changes in people in employment in the UK between April to June 2014 and April to June 2015, seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 1.3: Changes in people in employment in the UK between April to June 2014 and April to June 2015, seasonally adjusted

Image .csv .xlsComparing the estimates for type of employment for April to June 2015 with those for a year earlier, the number of:

employees increased by 485,000 to reach 26.32 million

self-employed people fell by 95,000 to reach 4.51 million

unpaid family workers fell by 12,000 to reach 102,000 (see Note 2 for an explanation of the coverage of this series)

people on government supported training and employment programmes fell by 23,000 to reach 104,000 (see Note 3 for an explanation of the coverage of this series)

Notes for Employment

Employment consists of employees, self-employed people, unpaid family workers and people on government supported training and employment programmes

Unpaid family workers are people who work in a family business who do not receive a formal wage or salary but benefit from the profits of that business

The government supported training and employment programmes series does not include all people on these programmes; it only includes people engaging in any form of work, work experience or work-related training who are not included in the employees or self-employed series. People on these programmes NOT engaging in any form of work, work experience or work-related training are not included in the employment estimates; they are classified as unemployed or economically inactive

6. Public and private sector employment (first published on 17 June 2015)

What is public and private sector employment ?

Public sector employment measures the number of people in paid work in the public sector. The public sector comprises central government, local government and public corporations. Estimates of public sector employment are obtained from information provided by public sector organisations.

Private sector employment is estimated as the difference between total employment, sourced from the Labour Force Survey, and public sector employment.

Where to find data about public and private sector employment

Public and private sector employment estimates are available at Tables 4 and 4(1) of the pdf version of this statistical bulletin and at data tables EMP02 (47 Kb Excel sheet) and EMP03 (39.5 Kb Excel sheet).

Further information on public sector employment is available in the Public sector employment release.

Commentary

There were 5.37 million people employed in the public sector for March 2015. This was:

down 22,000 from December 2014

down 59,000 from a year earlier

the lowest figure since comparable records began in 1999

There were 25.68 million people employed in the private sector for March 2015. This was 136,000 more than for December 2014 and 483,000 more than for a year earlier.

Welsh Further Education colleges moved from the public sector to the private sector in March 2015. Excluding the effects of this reclassification:

public sector employment fell by 10,000 compared with December 2014 and by 42,000 compared with a year earlier

private sector employment increased by 124,000 compared with December 2014 and by 466,000 compared with a year earlier

For March 2015, 82.7% of people in employment worked in the private sector and the remaining 17.3% worked in the public sector.

Figure 2.1 shows public sector employment as a percentage of all people in employment for the last 5 years.

Figure 2.1: UK public sector employment as a percentage of total UK employment, seasonally adjusted

Source: Quarterly Public Sector Employment Survey - Office for National Statistics

Notes:

- In June 2012 some educational bodies were reclassified to the private sector

- In December 2013 Royal Mail plc was reclassified to the private sector

- In March 2014 Lloyds Banking Group plc was reclassified to the private sector

Download this chart Figure 2.1: UK public sector employment as a percentage of total UK employment, seasonally adjusted

Image .csv .xlsThe number of people employed in the public sector has been generally falling since March 2010. Quarterly estimates of public and private sector employment are available back to 1999. Comparisons of public and private sector employment over time are complicated by a number of changes to the composition of these sectors over this period with several large employers moving between the public and private sectors. We therefore publish estimates of public and private sector employment excluding the effects of major reclassifications alongside estimates of total public and private sector employment at Table 4 of the pdf version of this statistical bulletin and at data table EMP02 (47 Kb Excel sheet).

Back to table of contents7. Employment by nationality and country of birth, not seasonally adjusted

What is employment by nationality and country of birth?

The estimates of employment by both nationality and country of birth relate to the number of people in employment rather than the number of jobs. Changes in the series therefore show net changes in the number of people in employment, not the proportion of new jobs that have been filled by UK and non-UK workers. These estimates should not be used as a proxy for flows of foreign migrants into the UK.

The estimates are not seasonally adjusted and it is therefore best practice to compare the estimates for April to June 2015 with those for a year earlier rather than with those for January to March 2015.

Where to find data about employment by nationality and country of birth

Estimates of employment by nationality and country of birth are available at Table 8 of the pdf version of this statistical bulletin and at data table EMP06 (137 Kb Excel sheet).

Commentary

Looking at the estimates by nationality, between April to June 2014 and April to June 2015, the number of:

UK nationals working in the UK increased by 84,000 to reach 27.76 million

non-UK nationals working in the UK increased by 257,000 to reach 3.18 million

Looking at changes in non-UK nationals working in the UK between April to June 1997 and April to June 2015:

the number of non-UK nationals working in the UK increased from 966,000 to 3.18 million

the proportion of all people working in the UK accounted for by non-UK nationals increased from 3.7% to 10.3%

this increase in non-UK nationals working in the UK reflects the admission of several new member states to the European Union

Looking in more detail at non-UK nationals working in the UK, between April to June 2014 and April to June 2015, the number of:

non-UK nationals from the European Union (EU) working in the UK increased by 250,000 to reach 1.98 million

non-UK nationals from outside the EU working in the UK was little changed at 1.20 million

Figure 3.1 shows the number of non-UK nationals from EU and non-EU countries working in the UK from April to June 1997 to April to June 2015.

Figure 3.1: Non-UK nationals working in the UK, not seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 3.1: Non-UK nationals working in the UK, not seasonally adjusted

Image .csv .xlsAs shown in Figure 3.1, since January to March 2009, the number of non-UK nationals from outside the EU working in the UK has been broadly flat but the number of non-UK nationals from EU countries working in the UK has continued to increase.

For April to June 2015, there were 4.99 million people born abroad working in the UK, but the number of non-UK nationals working in the UK was much lower at 3.18 million. This is because the estimates for people born abroad working in the UK include some UK nationals. Looking at the estimates by country of birth, between April to June 2014 and April to June 2015, the number of:

UK born people working in the UK increased by 126,000 to reach 25.94 million

non-UK born people working in the UK increased by 207,000 to reach 4.99 million

8. Actual hours worked

What is actual hours worked ?

Actual hours worked measures the number of hours worked in the economy. Changes in actual hours worked reflect changes in the number of people in employment and the average hours worked by those people.

Where to find data about hours worked

Hours worked estimates are available at Tables 7 and 7(1) of the pdf version of this statistical bulletin and at data tables HOUR01 SA (222.5 Kb Excel sheet) and HOUR02 SA (574 Kb Excel sheet).

Estimates for average weekly hours worked back to 1855 (which do not have National Statistics status) have been published by the Bank of England in the spreadsheet Three centuries of macroeconomic data v2.2 (at column Q in worksheet 22).

Commentary

Total hours worked per week were 996.4 million for April to June 2015. This was:

2.2 million (0.2%) fewer than for January to March 2015

9.6 million (1.0%) more than for a year earlier

74.2 million (8.0%) more than 5 years previously

Figure 4.1 shows total hours worked for the last 5 years

Figure 4.1: Total hours worked per week in the UK, seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 4.1: Total hours worked per week in the UK, seasonally adjusted

Image .csv .xlsFor April to June 2015:

people worked, on average, 32.1 hours per week in their main job, little changed compared with a year earlier

people working full-time worked, on average, 37.4 hours per week in their main job, 0.2 hours fewer than for a year earlier

people working part-time worked, on average, 16.2 hours per week in their main job, 0.2 hours more than for a year earlier

9. Workforce jobs (first published on 17 June 2015)

What is workforce jobs ?

Workforce jobs measures the number of filled jobs in the economy. The estimates are mainly sourced from employer surveys. Workforce jobs is a different concept from employment, which is sourced from the Labour Force Survey, as employment is an estimate of people and some people have more than one job.

A comparison between estimates of employment and jobs is available in an article published on our website.

Where to find data about workforce jobs

Jobs estimates are available at Tables 5 and 6 of the pdf version of this statistical bulletin and at data tables JOBS01 (55.5 Kb Excel sheet) and JOBS02 (326 Kb Excel sheet).

Commentary

There were 33.67 million workforce jobs in the UK in March 2015, 160,000 more than for December 2014 and 613,000 more than for a year earlier. Figure 5.1 shows changes in the number of jobs by industrial sector between March 2014 and March 2015.

Figure 5.1: Changes in the number of jobs in the UK between March 2014 and March 2015, seasonally adjusted

Source: Office for National Statistics

Download this chart Figure 5.1: Changes in the number of jobs in the UK between March 2014 and March 2015, seasonally adjusted

Image .csv .xlsSince comparable records began in 1978, the number of jobs in the manufacturing and mining and quarrying sectors has declined, but jobs in the service sectors have increased substantially. Between June 1978 and March 2015:

the proportion of jobs accounted for by the manufacturing and mining and quarrying sectors fell from 26.4% to 8.1%

the proportion of jobs accounted for by the services sector increased from 63.2% to 83.4%

Comparable estimates for workforce jobs by industry begin in 1978 and are available at data table JOBS02 (326 Kb Excel sheet). Historical information back to 1841, not comparable with the latest estimates, are available from 2011 Census Analysis, 170 years of industry published on our website.

Back to table of contents10. Average weekly earnings

What is average weekly earnings ?

Average Weekly Earnings measures money paid to employees in Great Britain in return for work done, before tax and other deductions from pay. The estimates do not include earnings of self-employed people. Estimates are available for both total pay (which includes bonuses) and for regular pay (which excludes bonus payments). The estimates are not just a measure of pay settlements as they also reflect compositional changes within the workforce. Further information is available at Notes for Earnings at the end of this section.

Where to find data on average weekly earnings

Estimates of average weekly earnings in nominal terms (that is, not adjusted for consumer price inflation) are available at Tables 15, 16 and 17 of the pdf version of this statistical bulletin and at data tables EARN01 (611 Kb Excel sheet), EARN02 (542.5 Kb Excel sheet) and EARN03 (616 Kb Excel sheet).

While comparable records for average weekly earnings start in 2000, modelled estimates back to 1963 (which do not have National Statistics status) are available at data table EARN02 (542.5 Kb Excel sheet).

Estimates back to 1750 (which do not have National Statistics status) have been published by the Bank of England in the spreadsheet Three centuries of macroeconomic data v2.2 (at column G in worksheet 21).

Where to find more information about earnings

A supplementary analysis of Average Weekly Earnings which includes estimates of real earnings (that is, adjusted for consumer price inflation) is available in an article on our website.

An article looking at bonus payments was published on 29 August 2014. The next annual article on bonus payments will be published on 26 August 2015.

The Annual Survey of Hours and Earnings (ASHE), published on 19 November 2014, provides more detailed data.

Commentary

For June 2015:

average regular pay (excluding bonuses) for employees in Great Britain was £463 per week before tax and other deductions from pay

average total pay (including bonuses) for employees in Great Britain was £488 per week before tax and other deductions from pay

Between April to June 2014 and April to June 2015 in nominal terms (that is, not adjusted for consumer price inflation):

regular pay for employees in Great Britain increased by 2.8%, the same as the growth rate between March to May 2014 and March to May 2015

total pay for employees in Great Britain increased by 2.4%, lower than the growth rate between March to May 2014 and March to May 2015 (3.2%)

This fall in the total pay annual growth rate, from 3.2% for March to May 2015 to 2.4% for April to June 2015, reflected a high single month growth rate (4.4%) for March 2015 falling out of the latest 3 month average time period and being replaced by a lower single month growth rate (1.9%) for June 2015. Lower bonuses were recorded in June 2015 compared with June 2014 across the private sector, particularly for financial and business services.

Figure 6.1 compares the annual growth rates for both regular and total pay in nominal terms for the last 5 years.

Figure 6.1: Great Britain average earnings annual growth rates, seasonally adjusted

Source: Monthly Wages and Salaries Survey - Office for National Statistics

Download this chart Figure 6.1: Great Britain average earnings annual growth rates, seasonally adjusted

Image .csv .xlsLooking at longer term movements since comparable records began in 2000, average total pay for employees in Great Britain in nominal terms (that is, not adjusted for consumer price inflation) increased from £311 a week in January 2000 to £488 a week in June 2015; an increase of 56.6%. Over the same period the Consumer Prices Index increased by 39.2%.

Between April to June 2014 and April to June 2015 in real terms (that is, adjusted for consumer price inflation):

regular pay for employees in Great Britain increased by 2.8%

total pay for employees in Great Britain increased by 2.4%

These growth rates are the same as those for earnings in nominal terms because consumer price inflation was close to zero. A more detailed analysis of earnings growth in real terms is available at Supplementary Analysis of Average Weekly Earnings.

Notes for Average Weekly Earnings

The estimates relate to Great Britain and include salaries but not unearned income, benefits in kind or arrears of pay

As well as pay settlements, the estimates reflect bonuses, changes in the number of paid hours worked and the impact of employees paid at different rates joining and leaving individual businesses. The estimates also reflect changes in the overall structure of the workforce; for example, fewer low paid jobs in the economy would have an upward effect on the earnings growth rate

Lloyds Banking Group plc is reclassified to the private sector from April 2014 following the sale of some government owned shares to private sector investors. It is classified to the public sector between July 2009 and March 2014. We estimate that, if the April 2014 reclassification had not occurred, the public sector single month growth rates between April 2014 and March 2015 would have been around 0.3 percentage points higher and the corresponding private sector growth rates would have been around 0.1 percentage points lower

11. Labour disputes (not seasonally adjusted)

What is labour disputes ?

The labour disputes estimates measure strikes connected with terms and conditions of employment.

Where to find data about labour disputes

Labour disputes estimates are available at Table 20 of the pdf version of this statistical bulletin and at data table LABD01 (115.5 Kb Excel sheet).

Where to find more information about labour disputes

An article providing more detailed information was published on 16 July 2015.

Commentary

In June 2015, there were 7,000 working days lost from 19 stoppages. For the 12 months ending June 2015, there were 670,000 working days lost from 156 stoppages.

Since monthly records began in December 1931:

the highest cumulative 12 month estimate for working days lost was 32.2 million for the 12 months to April 1980

the lowest cumulative 12 month estimate for working days lost was 143,000 for the 12 months to March 2011

Working days lost are at historically low levels when looking at the longer run time series back to the 1930s, available at data table LABD01 (115.5 Kb Excel sheet).

Figure 7.1 shows cumulative 12 month totals for working days lost for the last 5 years.

Figure 7.1: Working days lost in the UK cumulative 12 months totals, not seasonally adjusted

Source: Labour Disputes Statistics - Office for National Statistics

Notes:

- The figures from November 2011 to October 2012 and from July 2014 are affected by one day strikes on 30 November 2011 and 10 July 2014 relating to changes to pension schemes and pay for some public sector workers

Download this chart Figure 7.1: Working days lost in the UK cumulative 12 months totals, not seasonally adjusted

Image .csv .xls12. Unemployment

What is unemployment ?

Unemployment measures people without a job who have been actively seeking work within the last 4 weeks and are available to start work within the next 2 weeks.

Where to find data about unemployment

Unemployment estimates for the UK are available at Table 9 of the pdf version of this statistical bulletin and at data table UNEM01 SA (692 Kb Excel sheet).

Estimates for the unemployment level and rate back to 1870 (which do not have National Statistics status) have been published by the Bank of England in the spreadsheet Three centuries of macroeconomic data v2.2 (at columns P and U in worksheet 22).

International comparisons of unemployment rates are available at Table 19 of the pdf version of this statistical bulletin and at data table A10 (291.5 Kb Excel sheet).

European Union (EU) unemployment rates were published in a Eurostat News Release on 31 July 2015.

Commentary

The unemployment rate is not the proportion of the total population who are unemployed. It is the proportion of the economically active population (those in work plus those seeking and available to work) who are unemployed. This follows guidelines specified by the International Labour Organisation and it ensures that UK unemployment rates are broadly comparable with those published by other countries.

Figure 8.1 shows that the lowest unemployment rate recorded since comparable records began in 1971 was 3.4% in late 1973 to early 1974 and the highest rate, of 11.9%, was recorded in 1984 during the downturn of the early 1980s. The unemployment rate for the latest time period, April to June 2015, was 5.6%.

Figure 8.1: UK Unemployment rate (aged 16 and over), seasonally adjusted

January to March 1971 to April to June 2015

Source: Labour Force Survey - Office for National Statistics

Notes:

- Highest: Feb-Apr to Apr-Jun 1984 (11.9%)

- Lowest: Oct-Dec 1973 and Nov-Jan 1974 (3.4%)

- Latest: Apr-Jun 2015 (5.6%)

- See figure 8.2 for latest 5 years

Download this chart Figure 8.1: UK Unemployment rate (aged 16 and over), seasonally adjusted

Image .csv .xlsFigure 8.2 looks in more detail at the unemployment rate for the last 5 years.

Figure 8.2: UK Unemployment rate (aged 16 and over), seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 8.2: UK Unemployment rate (aged 16 and over), seasonally adjusted

Image .csv .xlsThe unemployment rate for those aged 16 and over for April to June 2015 was 5.6%. This was:

little changed from January to March 2015 (5.5%)

down from 6.3% for a year earlier

higher than the pre-downturn trough of 5.2% for late 2007 to early 2008

For April to June 2015, there were 1.85 million unemployed people. This was 25,000 more than for January to March 2015 but 221,000 fewer than for a year earlier.

Looking at unemployment for men and women for April to June 2015, there were:

1.01 million unemployed men, little changed compared with January to March 2015 but 130,000 fewer than for a year earlier

838,000 unemployed women, 17,000 more than for January to March 2015 but 92,000 fewer than for a year earlier

Looking at unemployment by how long people have been out of work and seeking work, for April to June 2015 there were:

971,000 people who had been unemployed for up to 6 months, 17,000 more than for January to March 2015 but 28,000 fewer than for a year earlier

305,000 people who had been unemployed for between 6 and 12 months, 21,000 more than for January to March 2015 but 28,000 fewer than for a year earlier

575,000 people who had been unemployed for over 12 months, 13,000 fewer than for January to March 2015 and 166,000 fewer than for a year earlier

Looking at international comparisons, the unemployment rate for the European Union (EU) was 9.6% of the economically active population for June 2015. Within the EU:

the highest unemployment rates were for Greece (25.6% for April 2015) and Spain (22.5% for June 2015)

the lowest unemployment rates were for Germany (4.7% for June 2015) and the Czech Republic (4.9% for June 2015)

The unemployment rate for the United States was 5.3% for both June and July 2015.

Figure 8.3 shows the unemployment rates for the UK, the EU and the United States (US) for the last 5 years. It shows that the unemployment rate for the UK has been substantially lower than that for the whole of the EU. The unemployment rate for the US has moved in a downward direction since early 2010 and the UK unemployment rate has been generally falling since early 2012. For the most recent time periods the unemployment rates for the UK and the US have been very similar. However, for April to June 2015, the employment rate for those aged from 16 to 64 for the UK (73.4%) was higher than that for the US (68.7%).

Figure 8.3: Unemployment rates for the United Kingdom, European Union and United States, seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Notes:

- The unemployment rates for the UK and the United States are for those aged 16 and over. The unemployment rate for the EU is for those aged from 15 to 74

- Figure 8.3 shows monthly estimates for the EU and for the United States from June 2010 to June 2015 and 3 month average estimates for the UK from April to June 2010 to April to June 2015

Download this chart Figure 8.3: Unemployment rates for the United Kingdom, European Union and United States, seasonally adjusted

Image .csv .xls13. Claimant Count (experimental statistics)

What is the Claimant Count ?

The Claimant Count measures the number of people claiming unemployment related benefits:

between January 1971 (when comparable estimates start) and September 1996 it is an estimate of the number of people who would have claimed unemployment related benefits if the current benefit system had existed at that time

between October 1996 and April 2013 the Claimant Count is a count of the number of people claiming Jobseeker’s Allowance (JSA)

between May 2013 and October 2013 the Claimant Count includes all claimants of Universal Credit (including those who were in work) as well as all JSA claimants

from November 2013 the Claimant Count includes all out of work Universal Credit claimants as well as all JSA claimants

Ideally only those Universal Credit claimants who are out of work and required to seek work should be included in the Claimant Count but it is not currently possible to produce estimates on this basis. The Claimant Count therefore currently includes some out of work claimants of Universal Credit who are not required to look for work; for example, due to illness or disability.

The Claimant Count estimates are currently designated as experimental statistics because the Universal Credit estimates are still being developed by the Department for Work and Pensions. However the Claimant Count estimates do provide the best available estimates of the number of people claiming unemployment related benefits in the UK.

The Claimant Count includes people who claim unemployment related benefits but who do not receive payment. For example some claimants will have had their benefits stopped for a limited period of time by Jobcentre Plus. Some people claim JSA in order to receive National Insurance Credits.

Where to find data about the Claimant Count

Claimant Count estimates are available at Table 10 of the pdf version of this statistical bulletin and at data table CLA01 (276 Kb Excel sheet).

While comparable records start in 1971, some data back to 1881 (which do not have National Statistics status) are available from the “Historic Data” worksheet within data table CLA01 (276 Kb Excel sheet).

Commentary

Figure 9.1 shows the Claimant Count since comparable records began in 1971. It shows that the lowest number of people claiming unemployment related benefits was 422,600 in December 1973 and the highest figure was 3.09 million in July 1986. For the latest month, July 2015, there were 792,400 people claiming unemployment related benefits.

Figure 9.1: UK Claimant Count, seasonally adjusted

January 1971 to July 2015

Source: Office for National Statistics, Department for Work and Pensions

Notes:

- Highest: 3.09 million (July 1986)

- Lowest: 422,600 (December 1973)

- Latest 792,400 (July 2015)

- See figure 9.2 for latest 5 years

Download this chart Figure 9.1: UK Claimant Count, seasonally adjusted

Image .csv .xlsLooking in more detail at the most recent 5 years, Figure 9.2 shows the Claimant Count from July 2010 to July 2015.

Figure 9.2: UK Claimant Count, seasonally adjusted

Source: Office for National Statistics, Department for Work and Pensions

Download this chart Figure 9.2: UK Claimant Count, seasonally adjusted

Image .csv .xlsFor July 2015 there were 792,400 people claiming unemployment related benefits. The number of people claiming unemployment related benefits is:

down 4,900 from June 2015

down 217,700 from a year earlier

14,000 higher than the pre-downturn trough of 778,400 for February 2008

For July 2015 there were:

512,500 men claiming unemployment related benefits, 700 fewer than for June 2015 and 136,100 fewer than for a year earlier

279,900 women claiming unemployment related benefits, 4,200 fewer than for June 2015 and 81,600 fewer than for a year earlier

14. Comparison between unemployment and the Claimant Count

Unemployment is measured according to internationally accepted guidelines specified by the International Labour Organisation (ILO). Unemployed people in the UK are:

without a job, have actively sought work in the last 4 weeks and are available to start work in the next 2 weeks

out of work, have found a job and are waiting to start it in the next 2 weeks

People who meet these criteria are classified as unemployed irrespective of whether or not they claim Jobseeker’s Allowance (JSA) or other benefits. The estimates are derived from the Labour Force Survey and are published for 3 month average time periods.

The Claimant Count measures the number of people claiming unemployment related benefits. As explained at Section 9 of this statistical bulletin, the Claimant Count estimates are designated as experimental statistics. In this section of the bulletin, quarterly movements in unemployment are compared with quarterly movements in the Claimant Count. Some claimants will not be classified as unemployed. For example, people in employment working fewer than 16 hours a week can be eligible to claim JSA depending on their income.

Figure 10.1 and the associated spreadsheet compare quarterly movements in unemployment and the Claimant Count for the same 3 month average time periods. The unemployment estimates shown in this comparison exclude unemployed people in the 16 to 17 and 65 and over age groups as well as unemployed people aged from 18 to 24 in full-time education. This provides a more meaningful comparison with the Claimant Count than total unemployment because people in these population groups are not usually eligible to claim JSA.

When 3 month average estimates for the Claimant Count are compared with unemployment estimates for the same time periods and for the same population groups (people aged from 18 to 64 excluding 18 to 24 year olds in full-time education), between January to March 2015 and April to June 2015:

unemployment increased by 20,000

the Claimant Count fell by 27,000

Figure 10.1: Quarterly changes in Unemployment and the Claimant Count for the UK (aged 18 to 64), seasonally adjusted

Source: Office for National Statistics, Department for Work and Pensions

Notes:

- Unemployment estimates are sourced from the Labour Force Survey (a survey of households). The unemployment figures in this chart, and the associated spreadsheet, exclude unemployed people aged from 18 to 24 in full-time education

- Claimant Count estimates are sourced from administrative data from Jobcentre Plus (part of the Department for Work and Pensions)

Download this chart Figure 10.1: Quarterly changes in Unemployment and the Claimant Count for the UK (aged 18 to 64), seasonally adjusted

Image .csv .xls15. Economic inactivity

What is economic inactivity ?

Economically inactive people are not in employment but do not meet the internationally accepted definition of unemployment because they have not been seeking work within the last 4 weeks and/or they are unable to start work within the next 2 weeks.

Where to find data on economic inactivity

Economic inactivity estimates are available at Tables 1 and 13 of the pdf version of this statistical bulletin and at data tables A02 SA (497.5 Kb Excel sheet) and INAC01 SA (783.5 Kb Excel sheet).

Commentary

The proportion of people, aged from 16 to 64, not in work and neither seeking nor available to work is known as the economic inactivity rate. Figure 11.1 shows the economic inactivity rate for people aged from 16 to 64 since comparable records began in 1971.

Figure 11.1 shows that the economic inactivity rate increased during the downturn of the early 1980s reaching a record high of 25.9% in 1983. As the economy improved in the late 1980s, the economic inactivity rate resumed its downward path, reaching a record low of 21.7% in late 1989 and 1990, before the economic downturn of the early 1990s drove it back up again. Following an increase in the economic inactivity rate during the economic downturn of 2008 to 2009, it resumed its generally downward path although it has been broadly flat for the last year.

Figure 11.1: UK Economic inactivity rate (aged 16 to 64), seasonally adjusted

January to March 1971 to April to June 2015

Source: Labour Force Survey - Office for National Statistics

Notes:

- Highest: Feb-Apr to Apr-Jun 1983 (25.9%)

- Lowest: Late 1989 and 1990 (21.7%)

- Latest: Apr-Jun 2015 (22.1%)

- See figure 11.2 for latest 5 years

Download this chart Figure 11.1: UK Economic inactivity rate (aged 16 to 64), seasonally adjusted

Image .csv .xlsSince comparable records began in 1971, the economic inactivity rate for men has been gradually rising while the rate for women has been gradually falling. For the latest time period, April to June 2015, the rate for women reached a record low of 27.2% while the rate for men was 16.9%.

Figure 11.2 shows the economic inactivity rate for people for the last 5 years.

Figure 11.2: UK Economic inactivity rate (aged 16 to 64), seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 11.2: UK Economic inactivity rate (aged 16 to 64), seasonally adjusted

Image .csv .xlsThe economic inactivity rate for those aged from 16 to 64 for April to June 2015 was 22.1%. This was little changed compared with January to March 2015 and with a year earlier.

For April to June 2015, there were 8.99 million people aged from 16 to 64 not in work and neither seeking nor available to work (known as economically inactive). This was little changed compared with January to March 2015 and with a year earlier. Comparing April to June 2015 with a year earlier, falls in most categories of economic inactivity were largely offset by an increase of 86,000 in the number of people in the long-term sick category.

Looking in more detail at the 8.99 million people aged from 16 to 64 who were economically inactive for April to June 2015, the 2 largest categories were students and people looking after the family or home (each of which accounted for just over a quarter of the total):

there were 2.30 million people who were not looking for work because they were studying, 15,000 fewer than for January to March 2015 and 46,000 fewer than for a year earlier

there were 2.26 million people (of which 2.01 million were women) who were not looking for work because they were looking after the family or home, 23,000 fewer than for January to March 2015 and 42,000 fewer than for a year earlier

The third and fourth largest categories were long-term sick (around 23% of the total) and retired (around 14% of the total):

there were 2.08 million people who were not looking for work due to long-term sickness, 75,000 more than for January to March 2015 and 86,000 more than for a year earlier

there were 1.25 million people who were not looking for work because they had retired, 28,000 fewer than for January to March 2015 and 70,000 fewer than for a year earlier, partly due to ongoing changes to the state pension age for women resulting in fewer women retiring between the ages of 60 and 65

A more detailed breakdown of economic inactivity by reason is available at Table 13 of the pdf version of this statistical bulletin and at data table INAC01 SA (783.5 Kb Excel sheet).

Back to table of contents16. Young people in the labour market

Where to find data on young people in the labour market

Estimates for young people in the labour market are available at Table 14 of the pdf version of this statistical bulletin and at data table A06 SA (1.02 Mb Excel sheet).

Where to find more information about young people in the labour market

Estimates for young people who were Not in Education, Employment or Training (NEET) for January to March 2015 were published on 21 May 2015. Estimates for April to June 2015 will be published on 20 August 2015.

Commentary

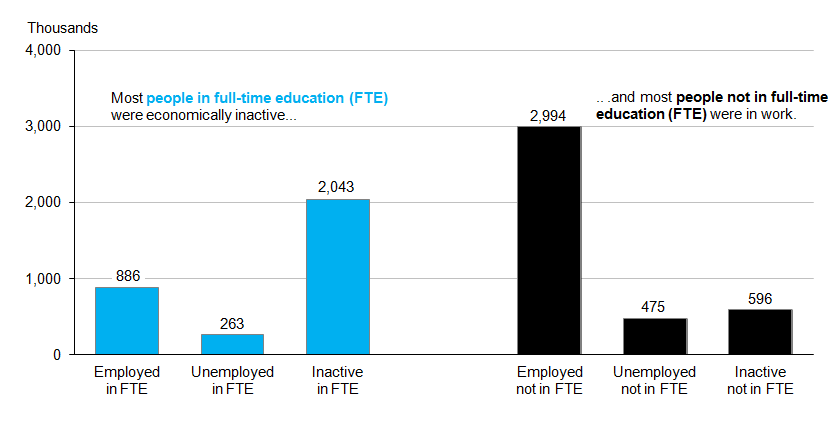

For April to June 2015, for people aged from 16 to 24, there were:

3.88 million people in work (including 886,000 full-time students with part-time jobs)

738,000 unemployed people (including 263,000 full-time students looking for part-time work)

2.64 million economically inactive people, most of whom (2.04 million) were full-time students

It is a common misconception that all people in full-time education are classified as economically inactive. This is not the case as people in full-time education are included in the employment estimates if they have a part-time job and are included in the unemployment estimates if they are seeking part-time work.

Figure 12.1: Young people (aged 16 to 24) in the UK labour market for April to June 2015, seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Notes:

- FTE = Full-time education

- The “Not in full-time education” series includes people in part-time education and/or some form of training

Download this image Figure 12.1: Young people (aged 16 to 24) in the UK labour market for April to June 2015, seasonally adjusted

.png (16.6 kB)Figure 12.2 shows how the latest estimates, for April to June 2015, for employment, unemployment and economic inactivity for people aged from 16 to 24 compare with the previous quarter (January to March 2015) and the previous year (April to June 2014).

Figure 12.2: Changes in the number of young people (aged 16 to 24) in the UK labour market, seasonally adjusted

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 12.2: Changes in the number of young people (aged 16 to 24) in the UK labour market, seasonally adjusted

Image .csv .xlsFor April to June 2015, the unemployment rate for 16 to 24 year olds was 16.0%. This was:

little changed compared with January to March 2015 (15.9%)

lower than for a year earlier (16.9%)

higher than the pre-downturn trough of 13.8% for the 3 months ending February 2008

The unemployment rate for those aged from 16 to 24 has been consistently higher than that for older age groups. Since comparable records began in 1992:

the lowest youth unemployment rate was 11.6% for March to May 2001

the highest youth unemployment rate was 22.5% for late 2011

Comparisons of youth unemployment rates over time are complicated by the fact that, since comparable records began in 1992, the proportion of people aged from 16 to 24 in full-time education has increased substantially from 26.2% for March to May 1992 to 44.0% for April to June 2015. This long-term increase in the proportion of young people going into full-time education reduces the size of the economically active population (those in work plus those seeking and available to work). The reduction in the economically active population increases the unemployment rate, because the unemployment rate is the proportion of the economically active population who are unemployed.

Looking at international comparisons, the youth unemployment rate (for those aged from 15 to 24) for the European Union (EU) was 20.7% for June 2015. Within the EU, the highest youth unemployment rates were for Greece (53.2% for April 2015) and for Spain (49.2% for June 2015). The lowest youth unemployment rates were for Germany (7.1% for June 2015) and Malta (10.0% for June 2015). These EU youth unemployment rates were published in a Eurostat news release on 31 July 2015.

Back to table of contents17. Redundancies

What are redundancies ?

The redundancies estimates measure the number of people who have been made redundant or have taken voluntary redundancy.

Where to find data on redundancies

Redundancies estimates are available at Tables 23 and 24 of the pdf version of this statistical bulletin and at data tables RED01 SA (68.5 Kb Excel sheet) and RED02 (2.36 Mb Excel sheet).

Commentary

For April to June 2015, 112,000 people had become redundant in the 3 months before the Labour Force Survey interviews. This was little changed compared with January to March 2015 and with a year earlier, but 199,000 fewer than the peak of 311,000 recorded for February to April 2009.

Figure 13.1 shows the number of people who had become redundant since comparable records began in March to May 1995.

Figure 13.1: Number of redundancies in the UK, seasonally adjusted

March to May 1995 to April to June 2015

Source: Labour Force Survey - Office for National Statistics

Notes:

- Highest: Feb-Apr 2009 (311,000)

- Lowest: Jul-Sept 2014 (91,000)

Download this chart Figure 13.1: Number of redundancies in the UK, seasonally adjusted

Image .csv .xls18. Vacancies

What are vacancies ?

Vacancies are defined as positions for which employers are actively seeking to recruit outside their business or organisation.

Where to find data about vacancies

Vacancies estimates are available at Tables 21, 21(1) and 22 of the pdf version of this statistical bulletin and at data tables VACS01 (66 Kb Excel sheet), VACS02 (148.5 Kb Excel sheet) and VACS03 (79.5 Kb Excel sheet).

Commentary

There were 735,000 job vacancies for May to July 2015. This was:

little changed compared with February to April 2015

69,000 more than for a year earlier

Figure 14.1 shows the number of job vacancies since comparable records began in 2001.

Figure 14.1: Number of vacancies in the UK, seasonally adjusted

April to June 2001 to May to July 2015

Source: Vacancy Survey - Office for National Statistics

Notes:

- Highest: Jan-Mar 2015 (744,000)

- Lowest: Apr-Jun and May-Jul 2009 (429,000)

Download this chart Figure 14.1: Number of vacancies in the UK, seasonally adjusted

Image .csv .xls19. Main out of work benefits, not seasonally adjusted

What are main out of work benefits?

Main out of work benefits includes claimants of unemployment related benefits and Employment and Support Allowance and other incapacity benefits. It also includes claimants of Income Support and Pension Credit. While most people claiming these benefits are out of work a small number are in employment. These estimates exclude claimants in Northern Ireland.

The estimates are not seasonally adjusted and it is therefore best practice to compare the estimates for February 2015 with those for a year earlier rather than with those for November 2014.

Where to find data about main out of work benefits

Estimates of claimants of main out of work benefits are available at Table 11 of the pdf version of this statistical bulletin and at data table BEN01 (59.5 Kb Excel sheet).

Commentary

For February 2015 there were 3.94 million people claiming main out of work benefits. This was:

329,700 fewer than for February 2014

1.16 million fewer than the peak of 5.10 million recorded for February 2010

For February 2015, 9.9% of the population aged from 16 to 64 were claiming main out of work benefits. This was down from 10.7% for a year earlier.

Figure 15.1 shows, for the last 5 years, the proportion of the population aged from 16 to 64 claiming main out of work benefits.

Figure 15.1: Proportion of Great Britain population (aged 16 to 64) claiming main out of work benefits, not seasonally adjusted

Source: Department for Work and Pensions, Office for National Statistics

Download this chart Figure 15.1: Proportion of Great Britain population (aged 16 to 64) claiming main out of work benefits, not seasonally adjusted

Image .csv .xls20. Where to find more information about labour market statistics

Other regularly published labour market releases

Regional Labour Market statistics(*)

Young People who were Not in Employment, Education or Training (NEET)

Annual Survey of Hours and Earnings (ASHE)

Business Register and Employment Survey (BRES)

Index of Labour Costs per Hour (ILCH) - Experimental Statistics

(*) Regional and local area statistics are available at NOMIS®.

Recently published reports on labour market topics

Understanding average earnings for the “continuously employed” (18 May 2015)

Workers aged 65 and over in the 2011 Census (25 March 2015)

Participation rates in the UK Labour Market (19 March 2015)

Contracts with no guaranteed hours (25 February 2015)

Families in the Labour Market (9 December 2014)

Underemployment and overemployment in the UK (25 November 2014)

Public and Private Sector Earnings (19 November 2014)

Working and workless households (29 October 2014)

Employment in tourism industries (26 September 2014)

Bonus payments in Great Britain (29 August 2014)

Self-employed workers in the UK (20 August 2014)

Historic articles published in Economic and Labour Market Review and Labour Market Trends

Articles about labour market statistics were published in Labour Market Trends (up until 2006) and in Economic and Labour Market Review (from 2007 to 2011). Editions of Labour Market Trends are available on our website from July 2001 until December 2006 when the publication was discontinued. Editions of Economic and Labour Market Review are available on our website from the first edition, published in January 2007, up until the last edition published in May 2011.

Published ad hoc data and analysis

Additional statistical data and analyses for labour market statistics that have not been included in our standard publications are available on our website.

Methodological articles

A number of methodological articles about labour market statistics are available on our website.

Back to table of contents21. Revisions

Estimates for the most recent time periods are subject to revision due to the receipt of late and corrected responses to business surveys and revisions to seasonal adjustment factors which are re-estimated every month. Estimates are subject to longer run revisions, on an annual basis, resulting from reviews of the seasonal adjustment process. Estimates derived from the Labour Force Survey (a survey of households) are usually only revised once a year. Revisions to estimates derived from other sources are usually minor and are commented on in the statistical bulletin if this is not the case. Further information is available in the labour market statistics revisions policy (36.7 Kb Pdf).

One indication of the reliability of the key indicators in this statistical bulletin can be obtained by monitoring the size of revisions. Data tables EMP05 (1.32 Mb Excel sheet), UNEM04 (2.11 Mb Excel sheet), JOBS06 (370.5 Kb Excel sheet) and CLA02 (2.09 Mb Excel sheet) record the size and pattern of revisions over the last five years. These indicators only report summary measures for revisions. The revised data itself may be subject to sampling or other sources of error. Our standard presentation is to show 5 years worth of revisions (60 observations for a monthly series, 20 for a quarterly series).

Back to table of contents22. Accuracy of the statistics: estimating and reporting uncertainty

Most of the figures in this statistical bulletin come from surveys of households or businesses. Surveys gather information from a sample rather than from the whole population. The sample is designed carefully to allow for this, and to be as accurate as possible given practical limitations like time and cost constraints, but results from sample surveys are always estimates, not precise figures. This means that they are subject to some uncertainty. This can have an impact on how changes in the estimates should be interpreted, especially for short-term comparisons.

We can calculate the level of uncertainty (also called “sampling variability”) around a survey estimate by exploring how that estimate would change if we were to draw many survey samples for the same time period instead of just one. This allows us to define a range around the estimate (known as a “confidence interval”) and to state how likely it is in practice that the real value that the survey is trying to measure lies within that range. Confidence intervals are typically set up so that we can be 95% sure that the true value lies within the range – in which case we refer to a “95% confidence interval”.

For example, the unemployment rate for April to June 2015 was estimated to be 5.6%. This figure had a stated 95% confidence interval of +/- 0.2 percentage points. This means that we can be 95% certain that the true unemployment rate for April to June 2015 was between 5.4% and 5.8%. However, the best estimate from the survey was that the unemployment rate was 5.6%.

The number of people unemployed for the same period was estimated at 1,852,000, with a stated 95% confidence interval of +/- 76,000. This means that we can be 95% sure that the true number of unemployed people was between 1,776,000 and 1,928,000. Again, the best estimate from the survey was that the number of unemployed people was 1,852,000.

As well as calculating precision measures around the numbers and rates obtained from the survey, we can also calculate them for changes in the numbers. For example, for April to June 2015, the estimated change in the number of unemployed people since January to March 2015 was an increase of 25,000, with a 95% confidence interval of +/- 81,000. This means that we can be 95% certain the actual change in unemployment was somewhere between an increase of 106,000 and a fall of 56,000, with the best estimate being an increase of 25,000. As the estimated increase in unemployment of 25,000 is smaller than the confidence interval of 81,000, the estimated increase in unemployment is said to be “not statistically significant”.

Working with uncertain estimates

In general, changes in the numbers (and especially the rates) reported in this statistical bulletin between 3 month periods are small, and are not usually greater than the level that is explainable by sampling variability. In practice, this means that small, short-term movements in reported rates (for example within +/- 0.3 percentage points) should be treated as indicative, and considered alongside medium and long-term patterns in the series and corresponding movements in administrative sources, where available, to give a fuller picture.

Seasonal adjustment and uncertainty

Like many economic indicators, the labour market is affected by factors that tend to occur at around the same time every year; for example school leavers entering the labour market in July and whether Easter falls in March or April. In order to compare movements other than annual changes in labour market statistics, such as since the previous quarter or since the previous month, the data are seasonally adjusted to remove the effects of seasonal factors and the arrangement of the calendar. All estimates discussed in this statistical bulletin are seasonally adjusted except where otherwise stated. While seasonal adjustment is essential to allow for robust comparisons through time, it is not possible to estimate uncertainty measures for the seasonally adjusted series.

Where to find data about uncertainty and reliability

Data table A11 (48 Kb Excel sheet) shows sampling variabilities for estimates derived from the Labour Force Survey.

Data table JOBS07 (44.5 Kb Excel sheet) shows sampling variabilities for estimates of workforce jobs.

The sampling variability of the 3 month average vacancies level is around +/- 1.5% of that level.

Sampling variability information for Average Weekly Earnings growth rates are available from the (616 Kb Excel sheet)“Sampling Variability” worksheets within data tables EARN01 (611 Kb Excel sheet) and EARN03 (616 Kb Excel sheet).

Back to table of contents23. Other quality information

Quality and methodology information papers for labour market statistics are available on our website.

Further information about the Labour Force Survey (LFS) is available from:

Back to table of contents