Table of contents

- Main points

- What is the producer price index (PPI)?

- Output prices: summary

- Supplementary analysis: Output prices

- Output prices: detailed commentary

- Input prices: summary

- Supplementary analysis: Input prices

- Input prices: detailed commentary

- Producer price index contribution to change in rate

- Output PPI indices by section

- Revisions

- Background notes

- Methodology

1. Main points

The price of goods bought and sold by UK manufacturers, as estimated by the producer price index, continued to fall in the year to July 2015. Crude oil continued to drive down input prices, feeding through to a drop in output prices of petroleum products

Factory gate prices (output prices) for goods produced by UK manufacturers fell 1.6% in the year to July 2015, unchanged since May 2015

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum products, rose 0.3% in the year to July 2015, compared with a 0.1% rise in the year to June 2015

The overall price of materials and fuels bought by UK manufacturers for processing (total input prices) fell 12.4% in the year to July 2015, up from a fall of 13.1% in the year to June 2015

Core input prices, which exclude the more volatile food, beverage, tobacco and petroleum products fell 4.9% in the year to July 2015, compared with a fall of 4.7% in the year to June 2015

2. What is the producer price index (PPI)?

The producer price index (PPI) is a monthly survey that measures the price changes of goods bought and sold by UK manufacturers and provides an important measure of inflation, alongside other indicators such as the consumer price index (CPI) and services producer price index (SPPI). This statistical bulletin contains a comprehensive selection of data on input and output index series and also contains producer price indices of materials and fuels purchased and output of manufacturing industry by broad sector.

The output price indices measure change in the prices of goods produced by UK manufacturers (these are often called “factory gate prices”).

The input price indices measure change in the prices of materials and fuels bought by UK manufacturers for processing. These are not limited to just those materials used in the final product, but also include what is required by the company in its normal day-to-day running.

The factory gate price (the output price) is the price of goods sold by UK manufacturers and is the actual cost of manufacturing goods before any additional charges are added, which would give a profit. It includes costs such as labour, raw materials and energy, as well as interest on loans, site or building maintenance, or rent.

Core factory gate inflation excludes price movements from food, beverage, petroleum, and tobacco and alcohol products, which tend to have volatile price movements. It should give a better indication of the underlying output inflation rates.

The input price is the cost of goods bought by UK manufacturers for the use in manufacturing, such as the actual cost of materials and fuels bought for processing.

Core input inflation strips out purchases from the volatile food, beverage, tobacco and petroleum industries to give an indication of the underlying input inflation pressures facing the UK manufacturing sector.

Back to table of contents3. Output prices: summary

Factory gate inflation fell 1.6% in the year to July 2015, unchanged since May 2015.

The rate of both total output and core inflation has generally been falling since autumn 2011, when output inflation reached its post-economic downturn high of 5.3% in September 2011. During this period, core factory gate inflation has tended to run at a lower rate and show a smaller degree of volatility than total output. However, since January 2014, core output price inflation has been running at a slightly higher rate than total output: a result of the downward pressures from petroleum, which is excluded from the core measure of inflation (Figure A).

Looking at the latest estimates (Table A), movements in factory gate prices over the 12 months to July 2015 were as follows:

factory gate prices fell 1.6%, unchanged since May 2015

core factory gate prices rose 0.3%, compared with a rise of 0.1% last month

factory gate inflation excluding excise duty fell 1.2%, unchanged from last month

Between June and July 2015:

factory gate prices fell 0.1%, unchanged from last month

core factory gate prices rose 0.1%, compared with no movement (0.0%), unchanged since February 2015

Table A: Output prices (home sales)

| Percentage change | ||||||

| All manufactured products | Excluding food, beverage, tobacco and petroleum | All manufactured products excluding duty | ||||

| 1 month | 12 months | 1 month | 12 months | 1 month | 12 months | |

| 2015 Feb | 0.2 | -1.7 | 0.0 | 0.3 | 0.1 | -1.4 |

| 2015 Mar | 0.1 | -1.7 | 0.0 | 0.1 | 0.2 | -1.5 |

| 2015 Apr | 0.1 | -1.7 | 0.0 | 0.1 | 0.1 | -1.4 |

| 2015 May | 0.1 | -1.6 | 0.0 | 0.1 | 0.0 | -1.3 |

| 2015 Jun | -0.1 | -1.6 | 0.0 | 0.1 | -0.1 | -1.2 |

| 2015 Jul | -0.1 | -1.6 | 0.1 | 0.3 | 0.0 | -1.2 |

| Source: Office for National Statistics | ||||||

Download this table Table A: Output prices (home sales)

.xls (55.8 kB)

Figure A: Output prices

United Kingdom, July 2011 to July 2015

Source: Office for National Statistics

Download this chart Figure A: Output prices

Image .csv .xls4. Supplementary analysis: Output prices

Table B shows the annual percentage change in price across all product groups and Figure B shows their contribution to the annual factory gate inflation rate.

Table B: 12 months change to July 2015

| United Kingdom | |

| Product group | Percentage change |

| Food products | -3.2 |

| Tobacco and alcohol (incl. duty) | 0.9 |

| Clothing, textile and leather | 0.0 |

| Paper and printing | -0.2 |

| Petroleum products (incl. duty) | -15.8 |

| Chemical and pharmaceutical | -1.4 |

| Metal, machinery and equipment | 0.9 |

| Computer, electrical and optical | 0.6 |

| Transport equipment | -0.9 |

| Other manufactured products | 1.8 |

| All manufacturing | -1.6 |

| Source: Office for National Statistics | |

Download this table Table B: 12 months change to July 2015

.xls (26.1 kB)Figure B: Output prices: Contribution to 12 months growth rate, July 2015

United Kingdom

Source: Office for National Statistics

Download this chart Figure B: Output prices: Contribution to 12 months growth rate, July 2015

Image .csv .xlsTable C: 1 month change to July 2015

| United Kingdom | |

| Product group | Percentage change |

| Food products | -0.2 |

| Tobacco and alcohol (incl. duty) | 0.1 |

| Clothing, textile and leather | 0.1 |

| Paper and printing | 0.0 |

| Petroleum products (incl. duty) | -1.7 |

| Chemical and pharmaceutical | -0.1 |

| Metal, machinery and equipment | 0.1 |

| Computer, electrical and optical | 0.0 |

| Transport equipment | -0.1 |

| Other manufactured products | 0.5 |

| All manufacturing | -0.1 |

| Source: Office for National Statistics | |

Download this table Table C: 1 month change to July 2015

.xls (26.1 kB)Figure C: Output prices: Contribution to 1 month growth rate, July 2015

United Kingdom

Source: Office for National Statistics

Download this chart Figure C: Output prices: Contribution to 1 month growth rate, July 2015

Image .csv .xls5. Output prices: detailed commentary

Factory gate prices fell 1.6% in the year to July 2015, unchanged since May 2015. Prior to July 2014, there had been no fall in the annual rate since October 2009, when it fell 0.1%. The main contribution to the annual rate for July 2015 came mainly from a fall in the price of petroleum and food products (Figure B).

The price index between June and July 2015 fell 0.1%, unchanged from last month. The majority of product groups showed very small movements except for petroleum, which provided the main contribution to the fall in the monthly rate. Other manufactured product prices increased which slightly offset the drop in petroleum products (Figure C).

Petroleum product prices fell 15.8% in the year to July 2015, compared with a fall of 14.5% in the year to June 2015. The largest decrease seen in this index was in July 2009, when it fell by 21.3%. The main contributions to the fall in the latest annual rate came from diesel and gas oil, which fell 15.1%.

Petroleum prices between June and July 2015 fell 1.7%, down from a fall of 0.5% between May and June 2015. The main contribution to the fall in the monthly index was due to the prices of diesel and gas oil products, which fell 2.5%.

Petroleum prices are usually affected by changes in the price of crude oil. This month crude oil prices continued to fall, pushing down the price of petroleum product output prices. The most notable impact on the price of Diesel came from refineries in Saudi Arabia coming on-stream and providing an increased suppy.

Food products fell 3.2% in the year to July 2015, unchanged from last month. Dairy products were the main contribution to the decrease in the year to July 2015, falling by 12.3%.

Core factory gate inflation

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum product prices, giving a measure of the underlying factory gate inflation, rose 0.3% in the year to July 2015, compared with a rise of 0.1% in the year to June 2015. On the monthly index, there was a rise of 0.1% between June and July 2015, compared with no movement (0.0%) since February 2015.

Back to table of contents6. Input prices: summary

Since autumn 2011 when input prices rose by around 16%, the price inflation of materials and fuels purchased by UK manufacturing industry, as measured by input prices, has been falling (Figure D). Input price inflation showed a steady but fairly slow increase from October 2012 to July 2013, when it reached 4.7%. From November 2013, prices started to decrease rapidly. The largest fall was seen in January 2015 (14.1%) and input prices are currently falling by 12.4%. The core measure of inflation has also decreased through this period but at a significantly slower rate of 4.9%.

Looking at the latest data (Table D), the main movements in the year to July 2015 were as follows:

the total input price index fell 12.4%, compared with a fall of 13.1% in the year to June 2015

the core input price index saw a fall of 4.9%, compared with a fall of 4.7% last month

the price of imported materials as a whole (including crude oil) fell 12.6%, up from a fall of 12.9% last month (reference Table 7 (230 Kb Excel sheet))

Between June and July 2015:

the total input price index fell 0.9%, compared with a fall of 1.8% last month (Table D)

in seasonally adjusted terms (see Table D), the input price index for the manufacturing industry excluding the food, beverage, tobacco and petroleum industries fell 0.5%, unchanged from last month

Table D: Input prices

| Percentage change | |||||

| Materials and fuels purchased | Excluding food, beverage, tobacco and petroleum industries | ||||

| 1 month (NSA)1 | 12 months(NSA)1 | 1 month (NSA)1 | 12 months (NSA)1 | 1 month(SA)2 | |

| 2015 Feb | 0.2 | -13.5 | -1.3 | -4.0 | -1.6 |

| 2015 Mar | 0.1 | -13.1 | -0.2 | -4.4 | -0.7 |

| 2015 Apr | 1.3 | -11.1 | -0.4 | -3.8 | 0.1 |

| 2015 May | -1.2 | -12.4 | -0.7 | -4.0 | -0.3 |

| 2015 june | -1.8 | -13.1 | -1.1 | -4.7 | -0.5 |

| 2015 Jul | -0.9 | -12.4 | -1.0 | -4.9 | -0.5 |

| Source: Office for National Statistics | |||||

| Notes: | |||||

| 1.NSA: Not Seasonally Adjusted | |||||

| 2.SA: Seasonally Adjusted | |||||

Download this table Table D: Input prices

.xls (56.3 kB)Figure D: Input prices (materials and fuel) manufacturing industry

United Kingdom, July 2011 to July 2015

Source: Office for National Statistics

Download this chart Figure D: Input prices (materials and fuel) manufacturing industry

Image .csv .xlsNotes for Input prices: summary

Input price indices include the Climate Change Levy which was introduced in April 2001

Input price indices include the Aggregate Levy (13.9 Kb Pdf) which was introduced in April 2002

7. Supplementary analysis: Input prices

Table E and Figure E show the percentage change in the price of the main commodities groups over the year and their contributions to the total input index.

Table E: 12 months change to July 2015

| United Kingdom | |

| Product group | Percentage change |

| Fuel including Climate Change Levy | -1.2 |

| Crude oil | -39.9 |

| Home food materials | -8.7 |

| Imported food materials | -3.3 |

| Other home-produced materials | 3.7 |

| Imported metals | -13.1 |

| Imported chemicals | -5.4 |

| Imported parts and equipment | -1.2 |

| Other imported materials | -1.3 |

| All manufacturing | -12.4 |

| Source: Office for National Statistics | |

Download this table Table E: 12 months change to July 2015

.xls (16.4 kB)Figure E: Input prices: Contribution to 12 months growth rate, July 2015

United Kingdom

Source: Office for National Statistics

Download this chart Figure E: Input prices: Contribution to 12 months growth rate, July 2015

Image .csv .xlsTable F and Figure F show the percentage change in the price of the main commodities groups over the month and their contributions to the total input index.

Table F: 1 month change to July 2015

| United Kingdom | |

| Product group | Percentage change |

| Fuel including Climate Change Levy | -0.5 |

| Crude oil | -3.2 |

| Home food materials | -0.7 |

| Imported food materials | 3.1 |

| Other home-produced materials | 0.3 |

| Imported metals | -3.8 |

| Imported chemicals | -0.5 |

| Imported parts and equipment | -0.7 |

| Other imported materials | 0.1 |

| All manufacturing | -0.9 |

| Source: Office for National Statistics | |

Download this table Table F: 1 month change to July 2015

.xls (16.9 kB)Figure F: Input prices: Contribution to 1 month growth rate, July 2015

United Kingdom

Source: Office for National Statistics

Download this chart Figure F: Input prices: Contribution to 1 month growth rate, July 2015

Image .csv .xls8. Input prices: detailed commentary

The overall input index for all manufacturing, which measures changes in the price of materials and fuels purchased by manufacturers, fell 12.4% in the year to July 2015, compared with a fall of 13.1% in the year to June 2015. The main downward contributions to the index came from crude oil, home-produced food and imported metals (down 39.9%, 8.7% and 13.1% respectively in the year to July 2015).

The monthly input index fell 0.9% between June and July 2015, compared with a fall of 1.8% last month. This fall was driven by a decrease in the price of crude oil and imported metals, which fell by 3.2% and 3.8% respectively between June and July 2015 (see Table F and Figure F).

Crude oil annual prices have been falling overall since October 2013. The annual index fell 39.9% in the year to July 2015, down from a fall of 40.3% last month. The monthly index, which had shown increases since February 2015, fell between June and July 2015 by 3.2%, compared with a fall of 4.2% between May and June 2015. The lowest fall on the monthly index was between November and December 2008, when it fell by 22.3%. In recent years, factors such as supply disruptions, concerns over the global economic recovery, instability in eurozone countries and the expectation of reduced demand, have all affected prices.

Recent PPI publications have included short stories relating to crude oil. The latest was released this month, Petrol prices – Are consumers getting a fair deal?

Home-produced food prices fell by 8.7% in the year to July 2015, up from a fall of 11.2% in the year to June 2015. Home-produced food prices between June and July 2015 fell 0.7%, compared with a fall of 3.3% between May and June 2015. The main contribution to both the annual and monthly rates came from crop and animal production, and hunting and related services, which fell 8.8% and 0.7% respectively.

Imported metal prices fell 13.1% in the year to July 2015, compared with a fall of 9.0% in the year to June 2015. The biggest decrease to the annual rate was in June 2009 when it fell by 16.2%. The monthly rate for imported metal fell 3.8% between June and July 2015, compared with a fall of 2.9% between May and June 2015. This is the biggest decrease since 2011, when it fell 5.5% between September and October.

Core input price index (excluding purchases from the food, beverage, tobacco and petroleum industries)

The core input price index, in seasonally adjusted terms, fell 0.5% between June and July 2015, unchanged from last month. The unadjusted index fell 1.0% between June and July 2015, compared with a fall of 1.1% last month.

Back to table of contents9. Producer price index contribution to change in rate

This additional section of the PPI statistical bulletin introduces some new charts to explain contributions to the change in the PPI rate of inflation. They are currently being published in a separate section for clarity and as an opportunity for users to provide feedback. Please email ppi@ons.gov.uk with your comments.

Output Prices

The annual percentage growth rate for the output PPI in July 2015 was –1.6%, unchanged from last month, resulting in no increase in the annual rate between June and July 2015. This was mostly due to drops in the contribution from refined petroleum products, and alcohol and tobacco, being offset by increases in contributions from other manufactured products and chemicals (Figure G).

Figure G: Output 12 month contribution to change in rate between June and July 2015

United Kingdom

Source: Office for National Statistics

Download this chart Figure G: Output 12 month contribution to change in rate between June and July 2015

Image .csv .xlsInput prices

The annual percentage growth rate for the input PPI in July 2015 was –12.4%, up from –13.1% last month, resulting in a rise in the annual rate of 0.7% between June and July 2015. This rise resulted mainly from an increase in contribution from home food materials, crude oil, fuel, and imported food materials. This was slightly offset by a fall in the contribution from imported metals (Figure H).

Figure H: Input 12 month contribution to change in rate between June and July 2015

United Kingdom

Source: Office for National Statistics

Download this chart Figure H: Input 12 month contribution to change in rate between June and July 2015

Image .csv .xls10. Output PPI indices by section

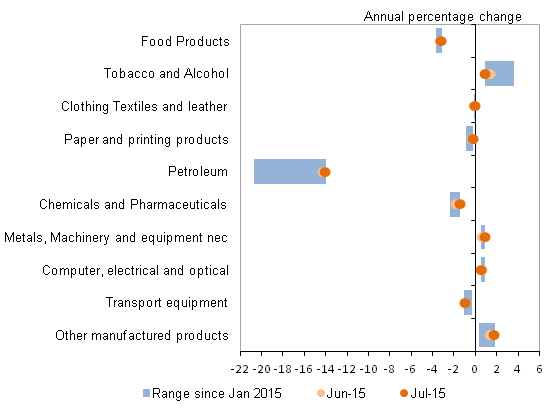

Figure I shows the year on year growth in Output PPI by section for the latest two months and the range of the price changes that have been seen in these sections since January 2015. It can be seen that the majority of output PPI indices have experienced little variance in inflation during 2015. Petroleum shows the biggest decreases since January, ranging from drops of 20.7% in January to 14.0% in July. Tobacco and alcohol shows the biggest increases, ranging from rises of 3.6% in January to 0.9% in July.

Figure I: Output PPI by section, January to July 2015

United Kingdom

Source: Office for National Statistics

Download this image Figure I: Output PPI by section, January to July 2015

.png (16.3 kB)11. Revisions

For this bulletin reference tables 8R and 9R (230 Kb Excel sheet) highlight revisions to movements in price indices previously published in last month’s statistical bulletin. These are mainly caused by changes to the most recent estimates, as more price quotes are received, and revisions to seasonal adjustment factors, which are re-estimated every month.

Some notable revisions appear in the all manufacturing input index. These are due to revised prices for Gas and Electricity. For more information about our revisions policy, see our website.

Table G: Revisions between first publication and estimates 12 months later

| Percentages | |||||

| Value in latest period | Revisions between first publication and estimates 12 months later | ||||

| Average over the last 5 years | Average over the last 5 years without regard to sign (average absolute revision) | ||||

| Total output (JVZ7) - 12 months | -1.60 | -0.15 | 0.21 | ||

| Total output (JVZ7) - 1 month | -0.10 | 0.00 | 0.07 | ||

| Total input (K646) - 12 months | -12.40 | 0.07 | 0.35 | ||

| Total input (K646) - 1 month | -0.90 | 0.09 | 0.27 | ||

| Source: Office for National Statistics | |||||

| Notes: | |||||

| 1. *Statistically significant | |||||

Download this table Table G: Revisions between first publication and estimates 12 months later

.xls (55.8 kB)Revisions to data provide one indication of the reliability of main indicators. Table G shows summary information on the size and direction of the revisions which have been made to the data covering a 5-year period. A statistical test has been applied to the average revision to find out if it is statistically significantly different from zero. An asterisk (*) shows that the test is significant.

Table G presents a summary of the differences between the first estimates published between 2007 and 2015 and the estimates published 12 months later. These numbers include the effect of the reclassification onto Standard Industrial Classification (SIC) 2007.

Spreadsheets giving revisions triangles of estimates for all months from January 1998 through to June 2015 and the calculations behind the averages in the table are available in the reference table area of our website:

revision triangle for total output (12 months) (2.37 Mb Excel sheet"

revision triangle for total output (1 month) (2.37 Mb Excel sheet)

revision triangle for total input (12 months) (2.42 Mb Excel sheet)

revision triangle for total input (1 month) ( 2.41 Mb Excel sheet)

Back to table of contents