Table of contents

- Main points

- Summary publication

- Understanding this release

- Summary of latest net borrowing and debt

- Net debt and borrowing compared with OBR forecast

- Public sector and sub-sector net borrowing

- Net cash requirement

- Public sector net debt

- Central government account

- Recent events and methodological changes

- How provisional outturn progress to final outturn

- Revisions since previous bulletin

- New for the bulletin

- List of tables in this bulletin

- Background notes

- Methodology

1. Main points

Public sector net borrowing excluding public sector banks decreased by £4.4 billion to £38.4 billion (1.9% of Gross Domestic Product) in the current financial year-to-date (April 2015 to August 2015) compared with the same period in 2014

Public sector net borrowing excluding public sector banks increased by £1.4 billion to £12.1 billion (0.6% of Gross Domestic Product) in August 2015 compared with August 2014

Public sector net debt excluding public sector banks at the end of August 2015 was £1,505.5 billion (80.6% of Gross Domestic Product); an increase of £68.9 billion compared with August 2014

Central government net cash requirement decreased by £10.1 billion to £24.3 billion in the current financial year-to-date (April 2015 to August 2015) compared to the same period in 2014

General government gross debt at the end of August 2015 was £1,651.7 billion (88.4% of Gross Domestic Product) and General Government Net Borrowing in the financial year ending 2015 (April 2014 to March 2015) was £93.5 billion (5.2% of Gross Domestic Product)

Due to the volatility of the monthly data, the cumulative financial year-to-date borrowing figures provide a better indication of the progress of the public finances than the individual months

This bulletin reflects a number of methodological changes being made for the 2015 annual national accounts publication (Blue Book 2015). These changes have resulted in an extended period of revisions that have been reflected in this publication

2. Summary publication

A summary version of this publication is available Public Sector Finances, August 2015: A summary of the UK government’s financial position which some users may find helpful.

Back to table of contents3. Understanding this release

This statistical bulletin provides important information on the United Kingdom (UK) government financial position. It enables government, the public, economists and financial analysts to monitor public sector expenditure, receipts, investments, borrowing and debt. By comparing these data with forecasts from The Office for Budget Responsibility (OBR) the current UK fiscal position can be evaluated.

The following table and diagram are intended to provide users with the important terms needed to understand these data and how the statistics relate to each other.

Definition Table: the main terms needed to understand the data

| Term | Description |

| Accruals/accrued recording | financial recording based on when ownership transfers or the service is provided (sometimes different to when cash is paid) |

| Asset Purchase Facility Fund (APF) | an arm of The Bank of England able to purchase financial assets including government securities (gilts). The APF has earnt interest which is periodically transferred back to central government. These payments are public sector borrowing neutral |

| Cash recording | financial recording based on when cash is paid or received. Net cash requirement is recorded on a cash basis and net debt is close to being a cash measure |

| Current budget deficit | the gap between current expenditure and current receipts (having taken account of depreciation) |

| Current expenditure | spending on government activities including: social benefits, interest payments, and other government department spending (excluding spending on capital assets) |

| Current receipts | income mainly from taxes (e.g. VAT, income and corporation taxes) but also includes interest, dividend and rent income |

| ESA 1995 | European System of Accounts 1995 was the European legal requirement for the production of National Accounts prior to September 2014 |

| ESA 2010 | European System of Accounts 2010 is the European legal requirement for the production of National Accounts from September 2014 |

| Maastricht deficit | general government net borrowing as defined within the Maastricht Treaty and Stability and Growth Pact (and as supplied to Eurostat) |

| Maastricht debt | general government gross debt as defined within the Maastricht Treaty and Stability and Growth Pact (and as supplied to Eurostat) |

| Net borrowing | measures the gap between revenue raised (current receipts) and total spending (current expenditure plus net investment). A positive value indicates borrowing while a negative value indicates a surplus |

| Net cash requirement | is a measure of how much cash the government needs to borrow (or lend) to balance its accounts (see cash recording) |

| Net debt | is a measure of how much the government owes at a point in time |

| Net investment | spending on capital assets, e.g. infrastructure projects, property and I.T equipment, both as grants and by public sector bodies themselves minus capital receipts (sale of capital assets) |

Download this table Definition Table: the main terms needed to understand the data

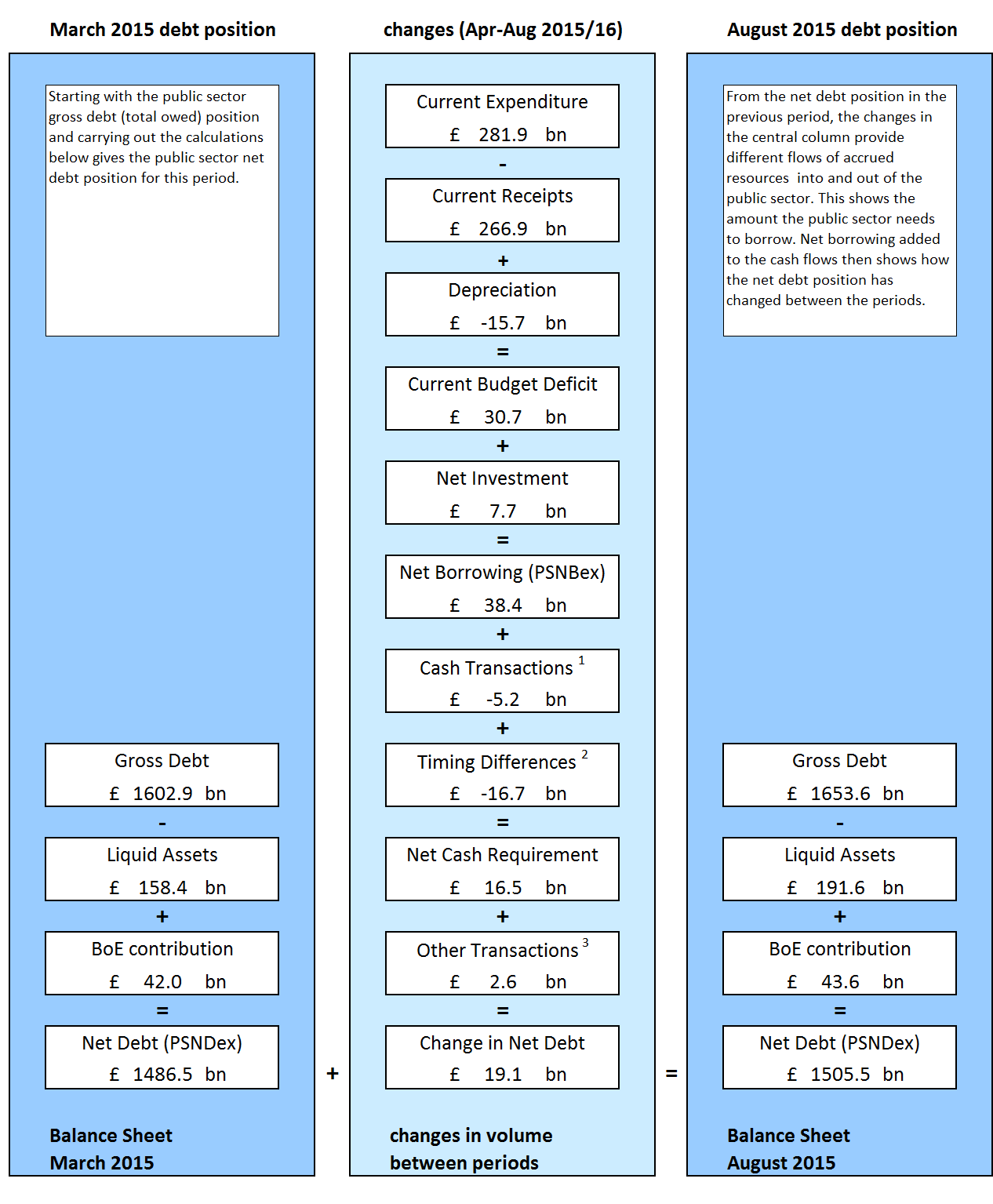

.xls (27.1 kB)Diagram 1 illustrates how debt between periods changes as a result of transaction flows (for example expenditure and receipts) on an accrued and cash basis. The transaction flows are provided for the current financial year-to-date (April 2015 to August 2015). The headline measures of current budget deficit, net borrowing, net cash requirement and net debt are highlighted in the diagram as they provide the important indicators for the performance of the UK public finances. Where possible, reference has been made to the tables attached to the end of this bulletin.

When public sector current expenditure is greater than current receipts (income), the public sector runs a current budget deficit. The sum of net investment (spending on capital less capital receipts) and the current budget deficit constitute net borrowing. The diagram shows how net borrowing relates to the change in net debt.

The net cash requirement is closely related to net debt (the amount owed), which is mainly a cash measure. It is important because it represents the cash needed to be raised from the financial markets. Changes in net debt between 2 points in time are normally similar to the net cash requirement for the intervening period. The relationship is not an exact one because the net cash requirement reflects actual prices paid while the net debt is at nominal prices. For instance, gilts are recorded in net debt at their redemption (or face) value, but they are often issued at a different price due to premia or discounts being applied. The net cash requirement will reflect the actual issuance and redemption prices, but net debt only ever records the face (or nominal) value.

Diagram1: Changes in Public Sector Finances (excluding public sector banks) Financial year-to-date ending 2016 (£ billion)

Notes:

Cash transactions in (non-financing) financial assets which do not impact on net borrowing

Timing differences between cash and accrued data

Revaluation of foreign currency debt (for example foreign currency). Debt issuances or redemptions above/below debt valuation (for example Bond premia/discounts and capital uplifts). Changes in volume of debt not due to transactions (for example Sector reclassification)

Download this image Diagram1: Changes in Public Sector Finances (excluding public sector banks) Financial year-to-date ending 2016 (£ billion)

.png (100.9 kB)We value your feedback

The public sector finances can be complex. To ensure these important statistics are accessible to all, we welcome your feedback on how best to explain concepts and trends in these data. Please contact us at: psa@ons.gov.uk

Back to table of contents4. Summary of latest net borrowing and debt

This release presents the first estimate of August 2015 public sector finances and updates previous financial years’ data.

Public sector finance data are available on a monthly basis, but due to the volatility of the monthly time series, it is often more informative to look at the financial year-to-date or complete financial year data in order to discern underlying patterns. Estimates are revised over time as additional data becomes available.

Table 1 compares the latest month and cumulative totals for the financial year-to-date with the equivalent period in the previous year. Time series for each component are available in Table PSA1.

Table 1: Headline Public Sector Finances data, by month and financial year to date

| £ billion1(not seasonally adjusted) | ||||||

| August | Financial year-to-date7 | |||||

| 2015 | 2014 | Change | 2015/16 | 2014/15 | Change | |

| Current Budget Deficit2 | 10.2 | 9.1 | 1.1 | 30.7 | 36.1 | -5.4 |

| Net Investment3 | 1.9 | 1.7 | 0.3 | 7.7 | 6.7 | 1.0 |

| Net Borrowing4 | 12.1 | 10.7 | 1.4 | 38.4 | 42.8 | -4.4 |

| Net Debt5 | 1505.5 | 1436.6 | 68.9 | 1505.5 | 1436.6 | 68.9 |

| Net Debt as a % of annual GDP6 | 80.6 | 79.7 | 0.9 | 80.6 | 79.7 | 0.9 |

| Notes: | ||||||

| 1. Unless otherwise stated | ||||||

| 2. Current Budget Deficit is the difference between current expenditure (including depreciation) and current receipts | ||||||

| 3. Net Investment is gross investment (net capital formation plus net capital transfers) less depreciation | ||||||

| 4. Net Borrowing is Current Budget Deficit plus Net Investment | ||||||

| 5. Net Debt is financial liabilities (for loans, deposits, currency and debt securities) less liquid assets | ||||||

| 6. GDP = Gross Domestic Product (at current market price) | ||||||

| 7. 2015/16 refers to financial year ending in March 2016 and 2014/15 refers to financial year ending in March 2015 | ||||||

Download this table Table 1: Headline Public Sector Finances data, by month and financial year to date

.xls (32.3 kB)Net borrowing for the financial year-to-date (April 2015 to August 2015)

Due to the volatility of the monthly data, the cumulative financial year-to-date borrowing figures provide a better indication of the progress of the public finances than the individual months.

In the financial year-to-date (April 2015 to August 2015), public sector net borrowing excluding banking groups (PSNB ex) was £38.4 billion; a decrease of £4.4 billion, or 10.3% compared with the same period in 2014.

This decrease in net borrowing was predominantly due to a decrease of £5.5 billion in central government net borrowing, combined with an increase of £1.6 billion in local government net borrowing.

Central government receipts for the financial year-to-date (April 2015 to August 2015) were £252.0 billion, an increase of £8.9 billion, or 3.7%, compared with the same period in 2014. Of which:

income tax-related payments increased by £2.6 billion, or 4.1%, to £65.4 billion

social (national insurance) contributions increased by £2.2 billion, or 4.9%, to £46.1 billion

VAT receipts increased by £1.3 billion, or 2.6%, to £52.2 billion

corporation tax increased by £1.2 billion, or 7.2%, to £17.7 billion

“other” receipts increased by £0.5 billion, or 5.8%, to £9.4 billion; partially due to the receipt of £0.6 billion in financial services fines

Central government expenditure (current and capital) for the financial year-to-date (April 2015 to August 2015) was £289.0 billion, an increase of £3.3 billion, or 1.2%, compared with the same period in 2014. Of which:

central government net investment (capital expenditure) increased by £1.1 billion, or 9.7%, to £12.5 billion; largely as a result of an increase in gross capital formation

other current expenditure (mainly departmental spending) increased by £1.1 billion, or 0.7%, to £169.9 billion; largely as a result of increases in departmental spending on goods and services, partially offset by decreases in transfers to local government

net social benefits (mainly pension payments) increased by £1.0 billion, or 1.2%, to £84.7 billion; largely as a result of increases in state pension payments (within National Insurance Fund benefits)

debt interest increased by £0.1 billion, or 0.5%, to £22.0 billion; of this £22.0 billion, £5.9 billion is the interest payable to the Bank of England Asset Purchase Facility on its gilt holdings (see Table PSA9) which are PSNB ex neutral

Local government net borrowing for the financial year-to-date (April 2015 to August 2015) was estimated to be in surplus by £4.4 billion, a decrease in surplus of £1.6 billion on the same period in the previous year, mainly due to decreases in grants received from central government, particularly in April. Local government data for the current financial year-to-date are provisional estimates mainly based on budget figures received from the Department for Communities and Local Government (DCLG) and the devolved administrations.

Public corporations’ net borrowing for the financial year-to-date (April 2015 to August 2015) was estimated to be in surplus by £0.9 billion, an increase in surplus of £0.3 billion compared with the same period in 2014, mainly due to decreases in grants received from the public sector. Public corporation data for the current financial year-to-date are mainly provisional estimates.

Net borrowing in August 2015

In August 2015, public sector net borrowing excluding public sector banks (PSNB ex) was £12.1 billion; an increase in borrowing of £1.4 billion, or 12.6% compared with August 2014.

This increase in net borrowing was largely due to an increase of £1.6 billion in central government net borrowing, combined with a decrease of £0.1 billion in local government net borrowing.

Central government receipts in August 2015 were £45.7 billion, a decrease of £0.3 billion, or 0.6% compared with August 2014. Of this:

VAT receipts increased by £0.3 billion, or 3.1%, to £10.4 billion

social (national insurance) contributions increased by £0.3 billion, or 3.5%, to £9.1 billion

corporation tax decreased by £0.2 billion, or 14.1%, to £1.4 billion

income tax-related payments decreased by £0.4 billion, or 3.5%, to £11.9 billion

Central government expenditure (current and capital) in August 2015 was £55.7 billion, an increase of £1.3 billion, or 2.4%, compared with August 2014. Of this:

other current expenditure (mainly departmental spending) increased by £1.0 billion, or 3.2%, to £32.6 billion; largely as a result of increases in expenditure on goods and services

net social benefits (mainly pension payments) in August 2015 were at the same level as in August 2014 as a result of increases in state pension payments (within National Insurance Fund benefits) offset by falls in social assistance payments and public sector pension contributions

central government net investment (capital expenditure) increased by £0.4 billion, or 24.4%, to £2.3 billion; largely as a result of increases in capital transfers to the other sectors and gross capital formation

debt interest decreased by £0.1 billion, or 3.5%, to £4.1 billion; of this £4.1 billion, £1.2 billion is the interest paid to the Asset Purchase Facility Fund (APF) on its gilt holdings (see Table PSA9) which are PSNB ex neutral

In August 2015, local government net borrowing (LGNB) was estimated at £1.8 billion, a decrease of £0.1 billion on the previous year, mainly due to decreases in expenditure on goods and services. Local government data for August 2015 are provisional estimates mainly based on budget figures received from the Department for Communities and Local Government (DCLG) and the devolved administrations.

In August 2015, public corporations’ net borrowing (PCNB) was estimated to be in surplus by £0.3 billion, an increase in surplus of £0.1 billion on the previous year. Public corporation data for August 2015 are mainly provisional estimates.

Public sector net debt

Public sector net debt excluding public sector banks (PSND ex) was £1,505.5 billion (80.6% GDP) at the end of August 2015, which was £68.9 billion, or 4.8% higher than in August 2014. This increase was a result of:

£85.6 billion of public sector net borrowing

less £0.4 billion in timing differences between cash flows for gilt interest payments and the accrued gilt interest flows

less £16.3 billion in net cash transactions related to acquisition or disposal of financial assets of equivalent value (for example loans) and timing of recording

5. Net debt and borrowing compared with OBR forecast

The Office for Budget Responsibility (OBR) normally produces forecasts of the public finances twice a year (normally in March and December). The latest OBR forecast was published on 8 July 2015.

Figure 1 and Table 2 enable users to compare emerging data against the OBR forecasts. Caution should be taken when comparing public finance data with OBR figures for the full financial year, as data are not finalised until after the financial year ends. Initial estimates soon after the end of the financial year can be subject to sizeable revisions in later months. In addition, in-year timing effects on spending and receipts can affect year-to-date comparisons with previous years.

There can also be some methodological differences between OBR forecasts and outturn data. In its latest publication, OBR published a table within their Economic and fiscal outlook supplementary fiscal tables July 2015 annex titled ‘Table: 2.42 Items included in OBR forecasts that ONS have not yet included in outturn’.

Figure 1 illustrates the public sector net borrowing excluding public sector banks (PSNB ex) for the financial year ending 2015 (April 2014 to March 2015), along with the first 5 month’s borrowing of the financial year ending 2016 (April to August 2015).

Figure 1: Cumulative public sector net borrowing by month

All data excluding public sector banks, United Kingdom

Notes:

- For the financial year ending 2015 (April 2014 to March 2015) and the financial year ending 2016 (April 2015 to March 2016)

- OBR illustrative forecast for PSNB ex from March 2015 Economic & Fiscal Outlook (EFO)

- OBR illustrative forecast for PSNB ex from July 2015 Economic & Fiscal Outlook (EFO).

Download this chart Figure 1: Cumulative public sector net borrowing by month

Image .csv .xlsIn the financial year-to-date (April to August 2015), borrowing fell by £4.4 billion to £38.4 billion compared with the same period in 2014.

The OBR forecast for the financial year ending 2015 (April 2014 to March 2015) was £89.2 billion which was £0.9 billion below the outturn in financial year ending 2015 (April 2014 to March 2015) presented in this bulletin.

The OBR forecast for the financial year ending 2016 (April 2015 to March 2016) is £69.5 billion which is £20.6 billion below the outturn in financial year ending 2015 (April 2014 to March 2015) presented in this bulletin.

Table 2 summarises the percentage change between the latest data for the financial year-to-date (April to August 2015) and in the previous financial year (April to August 2014). It contrasts these data with the percentage change between the latest full year outturn data for the financial year ending 2015 (April 2014 to March 2015) and the OBR forecast for the financial year ending 2016 (April 2015 to March 2016) (as published in July 2015).

Table 2: Public Sector Latest Outturn Estimates vs Office for Budget Responsibility (OBR) Forecasts

| United Kingdom, excluding public sector banks | ||||||

| £ billion1 (not seasonally adjusted) | ||||||

| Financial year-to-date, April-August | Financial Year7 | |||||

| 2015/16 | 2014/15 | Increase/ Decrease % | 2015/16 OBR Forecast6 | 2014/15 Outturn | Forecast Increase/Decrease % | |

| Current Budget Deficit2 | 30.7 | 36.1 | -15.1 | 40.8 | 59.8 | -31.8 |

| Net Investment3 | 7.7 | 6.7 | 15.2 | 28.7 | 30.3 | -5.2 |

| Net Borrowing 4 | 38.4 | 42.8 | -10.3 | 69.5 | 90.1 | -22.8 |

| Net Debt 5 | 1,505.5 | 1,436.6 | 4.8 | 1,532.0 | 1,486.5 | 3.1 |

| Net Debt as a % of GDP | 80.6 | 79.7 | 1.1 | 80.3 | 80.8 | -0.6 |

| Notes: | ||||||

| 1. Unless otherwise stated | ||||||

| 2. Current Budget Deficit is the difference between current expenditure (including depreciation) and current receipts | ||||||

| 3. Net Investment is gross investment (net capital formation plus net capital transfers) less depreciation | ||||||

| 4. Net Borrowing is Current Budget Deficit plus Net Investment | ||||||

| 5. Net Debt is financial liabilities (for loans, deposits, currency and debt securities) less liquid assets | ||||||

| 6. All OBR figures are from the OBR Economic and Fiscal Outlook published on 08 July 2015 | ||||||

| 7. Full financial year ending 2015 (April 2014 to March 2015) and full financial year ending 2016 (April 2015 to March 2016) | ||||||

Download this table Table 2: Public Sector Latest Outturn Estimates vs Office for Budget Responsibility (OBR) Forecasts

.xls (35.3 kB)On the same day as this bulletin is released, the OBR publishes a commentary on the latest figures and how these reflect on its forecasts. The OBR provides this commentary to help users interpret the differences between the latest outturn data and the OBR forecasts by providing contextual information about assumptions made during the OBR’s forecasting process.

Back to table of contents6. Public sector and sub-sector net borrowing

Public sector net borrowing excluding public sector banks (PSNB ex) in financial year-to-date (April 2015 to August 2015) was £38.4 billion, or 1.9% of GDP. A time series of PSNB ex as a percentage of GDP can be found in Table PSA5a.

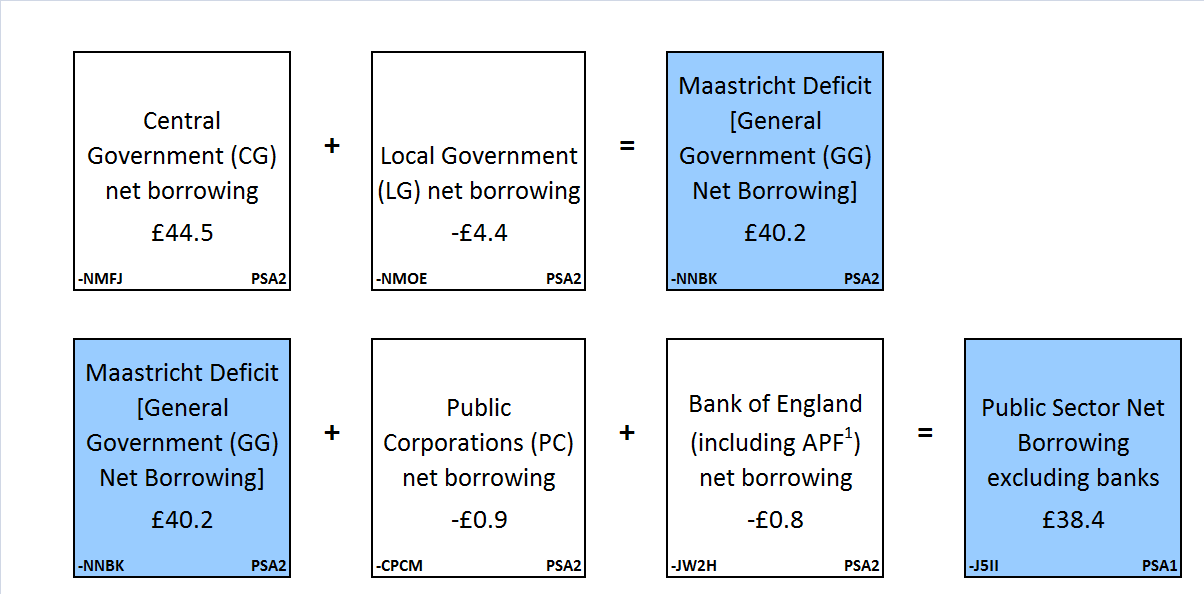

Diagram 2 presents public sector net borrowing by sector for the current financial year-to-date (April 2015 to August 2015).

Diagram 2: Sub-sector split of public sector net borrowing excluding public sector banks (PSNB ex), financial year-to-date ending 2016 (£ billion)

Notes:

Sub-sector totals are added in calculating public sector net borrowing and current budget deficit

- APF - Bank of England Asset Purchase Facility

Download this image Diagram 2: Sub-sector split of public sector net borrowing excluding public sector banks (PSNB ex), financial year-to-date ending 2016 (£ billion)

.png (55.3 kB)Figure 2 illustrates public sector net borrowing excluding public sector banks (PSNB ex) for the last 22 financial years and highlights that between the financial year ending 1999 (April 1998 to March 1999) and the financial year ending 2001 (April 2000 to March 2001), borrowing was in surplus, that is the public sector was a net lender.

Figure 2: Public sector net borrowing, the financial year ending 1994 to the financial year ending 2015, excluding public sector banks [1]

All data excluding public sector banks, United Kingdom

Notes:

- Full financial year ending 1994 (April 1993 to March 1994) and full financial year ending 2015 (April 2014 to March 2015)

Download this chart Figure 2: Public sector net borrowing, the financial year ending 1994 to the financial year ending 2015, excluding public sector banks [1]

Image .csv .xlsPSNB ex peaked in the financial year ending 2010 (April 2009 to March 2010) as the effects of the economic downturn impacted on the public finances (reducing tax receipts while expenditure continued to increase). PSNB ex has reduced since then, although remained higher than before the financial year ending 2008 (April 2007 to March 2008) and the 2007 global financial market shock. PSNB ex in the financial year ending 2013 (April 2012 to March 2013) was higher than PSNB ex in the financial year ending 2012 (April 2011 to March 2012). One of the reasons behind this was the recording in April 2012 of an £8.9 billion payable capital grant in recognition that the liabilities transferred from the Royal Mail Pension Plan exceeded the assets transferred.

In the UK, the public sector consists of 5 sub-sectors: central government, local government, public non-financial corporations, Bank of England and public financial corporations (that is public sector banks). Table 3 summarises the current monthly and year-to-date borrowing position of each of these sub-sectors along with the public sector aggregates. Full time series for these data can be found in Table PSA2.

Table 3: Sub-sector Breakdown of Public Sector Net Borrowing

| United Kingdom | ||||||

| August | Financial year-to-date1 | |||||

| 2015 | 2014 | Change | 2015/16 | 2014/15 | Change | |

| General Government | 13.4 | 11.9 | 1.5 | 40.2 | 44.0 | -3.9 |

| of which | ||||||

| Central Government | 11.5 | 10.0 | 1.6 | 44.5 | 50.0 | -5.5 |

| Local Government | 1.8 | 2.0 | -0.1 | -4.4 | -6.0 | 1.6 |

| Public Non-Financial Corporations | -0.3 | -0.1 | -0.1 | -0.9 | -0.6 | -0.3 |

| Bank of England | -1.0 | -1.1 | 0.0 | -0.8 | -0.6 | -0.2 |

| Public Sector ex (PSNB ex) | 12.1 | 10.7 | 1.4 | 38.4 | 42.8 | -4.4 |

| Public Financial Corporations | -0.8 | -0.8 | 0.0 | -3.9 | -3.5 | -0.4 |

| Public Sector (PSNB) | 11.3 | 9.9 | 1.4 | 34.5 | 39.3 | -4.8 |

| Notes: | ||||||

| 1. 2015/16 refers to financial year ending in March 2016 and 2014/15 refers to financial year ending in March 2015 | ||||||

Download this table Table 3: Sub-sector Breakdown of Public Sector Net Borrowing

.xls (34.3 kB)7. Net cash requirement

Net cash requirement is a measure of how much cash the government needs to borrow (or lend) to balance its accounts. In very broad terms, net cash requirement equates to the change in the level of debt.

Central government net cash requirement is reconciled against the change in central government net debt in Table REC3 attached to this bulletin.

The public sector net cash requirement excluding public sector banks (PSNCR ex) follows a similar trend to that of public sector net borrowing: peaking in the financial year ending 2010, though in recent years transfers from the Asset Purchase Facility have had a substantial impact on PSNCR ex but are PSNB ex neutral.

Public sector net cash requirement excluding public sector banks (PSNCR ex) in the financial year-to-date (April 2015 to August 2015) was £16.5 billion; £7.7 billion, or 31.8% less than in the same period in 2014. A time series for PSNCR ex is included in Table PSA7A.

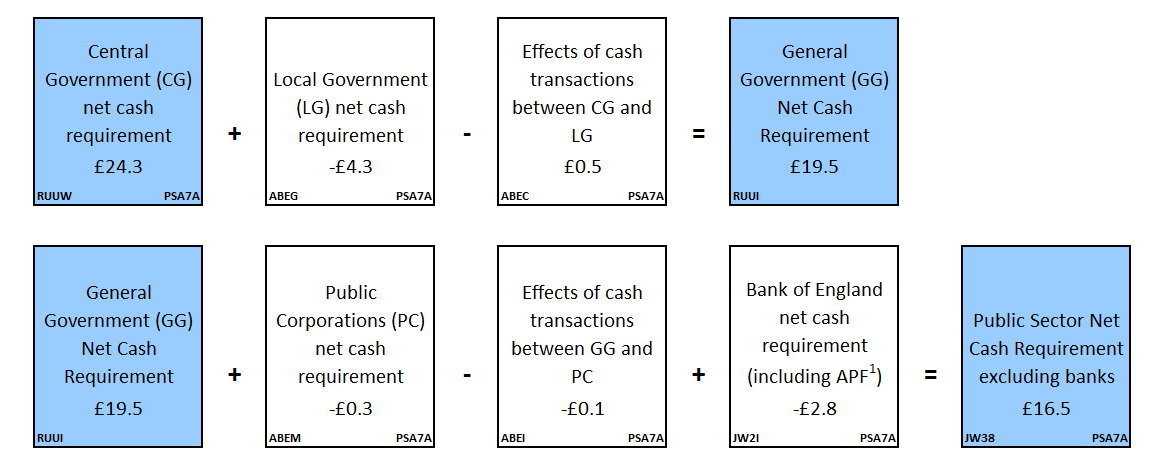

Diagram 3 presents public sector cash requirement by sub-sector for the current financial year-to-date (April 2015 to August 2015).

Diagram 3: Sub-sector split of public sector net cash requirement excluding public sector banks, financial year-to-date ending 2016 (£ billion)

Notes:

Effects of cash transactions between sub-sectors are removed in calculating public sector total net cash requirement (and consolidated expenditure and income totals)

- APF - Bank of England Asset Purchase Facility

Download this image Diagram 3: Sub-sector split of public sector net cash requirement excluding public sector banks, financial year-to-date ending 2016 (£ billion)

.png (46.4 kB)Central government net cash requirement (CGNCR) is a focus for some users, as it provides an indication of how many gilts (government bonds) the Debt Management Office may issue to meet the government’s borrowing requirements.

CGNCR was in surplus by £0.5 billion in August 2015; £3.1 billion, or 120.8% lower than in August 2014.

In the current financial year-to-date (April 2015 to August 2015), CGNCR was £24.3 billion; a decrease of £10.1 billion, or 29.4%, compared to the same period in 2014.

Cash transfers from the Asset Purchase Facility (APF) were £0.3 billion lower in the current financial year-to-date (April 2015 to August 2015), than the previous financial year. Without the impact of these transfers, CGNCR would have been £10.5 billion lower in the current financial year-to-date (April 2015 to August 2015) than the same period in 2014.

Events impacting on CGNCR

In the financial year ending 2016 (April 2015 to March 2016) the following events reduced the CGNCR:

the transfers between the APF and central government

the sale of shares in Lloyds Banking Group

the sale of shares in Eurostar

the sale of shares in Royal Mail

the sale of shares in Royal Bank of Scotland

In the financial year ending 2015 (April 2014 to March 2015) the following events reduced the CGNCR:

the transfers between the APF and central government

the sale of shares in Lloyds Banking Group

In the financial year ending 2014 (April 2013 to March 2014) the following events reduced the CGNCR:

the transfers between the APF and central government

the sale of shares in Lloyds Banking Group

the sale of shares in Royal Mail

In the financial year ending 2013 (April 2012 to March 2013) the following events reduced the CGNCR:

the Royal Mail Pension Plan transfer and subsequent sale of assets

the transfer of the Special Liquidity Scheme final profits

the 4G Spectrum sale

the transfers between the APF and central government

Public sector net cash requirement

Although the central government net cash requirement is the largest part of the public sector net cash requirement excluding public sector banks (PSNCR ex), the total public sector net cash requirement (PSNCR) can be very different. The reason is that the PSNCR includes the net cash requirement of the public sector banking groups. In recent years, the public sector banking groups have recorded large cash surpluses which have had a substantial impact on the public sector net cash requirement.

Back to table of contents8. Public sector net debt

Public sector net debt ex (PSND ex) represents the amount of money the public sector owes to UK private sector organisations and overseas institutions, largely as a result of government liabilities on the bonds (gilts) and Treasury bills it has issued.

The debt is built up by successive government administrations over many years. When the government borrows, this adds to the debt total.

At the end of August 2015, public sector net debt excluding public sector banks (PSND ex) was £1,505.5 billion (80.6% of GDP).

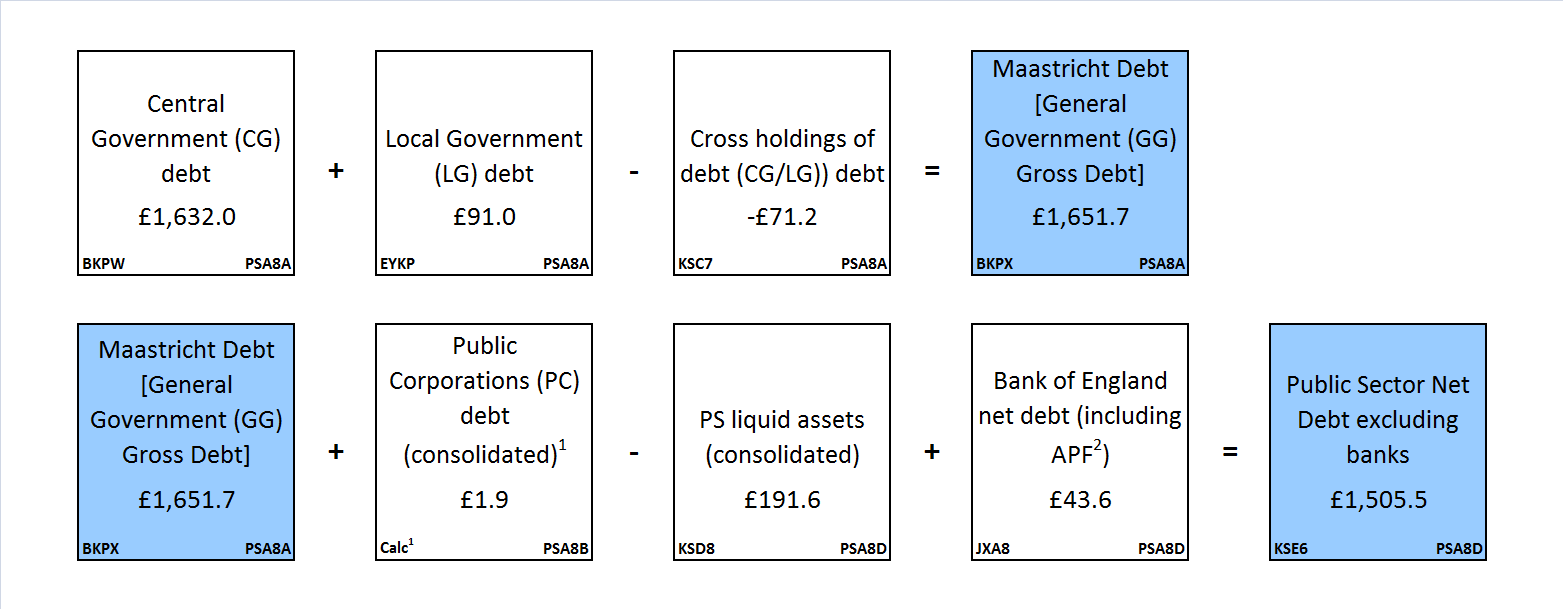

Diagram 4 presents public sector debt by sub-sector.

Diagram 4: Sub-sector split of public sector net debt excluding public sector banks at August 2015 (£ billion)

Notes:

Cross holdings between sub-sectors are removed in calculating public sector net debt, gross debt and liquid assets.

PC Corporations' debt (consolidated) = non-financial PC gross debt (EYYD) + Less CG/NFPCs' gross debt (KSC8) + Less LG/NFPCs' cross holdings of debt (KSC9)

APF - Bank of England Asset Purchase Facility

Download this image Diagram 4: Sub-sector split of public sector net debt excluding public sector banks at August 2015 (£ billion)

.png (66.4 kB)Figure 3 illustrates public sector net debt excluding banking groups (PSND ex) between the financial year ending 1998 (April 1997 to March 1998) and the financial year ending 2015 (April 2014 to March 2015). PSND ex represents the amount of money the public sector owes to UK private sector organisations and overseas institutions, largely as a result of government liabilities on the bonds (gilts) and Treasury bills it has issued.

The increases in debt between the financial year ending 2009 (April 2008 to March 2009) and the financial year ending 2011 (April 2010 to March 2011) were larger than in the early part of the decade, as the economic downturn meant public sector net borrowing excluding public sector banks (PSNB ex) increased. Since then it has continued to increase but at a slower rate.

Figure 3: Public sector net debt, the financial year ending 1998 to the financial year ending 2015 [1]

All data excluding public sector banks, United Kingdom

Notes:

- Financial year ending 1998 (April 1997 to March 1998) to the financial year ending 2015 (April 2014 to March 2015)

Download this chart Figure 3: Public sector net debt, the financial year ending 1998 to the financial year ending 2015 [1]

Image .csv .xlsNet debt, for the purposes of UK fiscal policy, is defined as total gross financial liabilities less liquid financial assets, where liquid assets are cash and short-term assets which can be released for cash at short notice and without significant loss. These liquid assets mainly comprise foreign exchange reserves and bank deposits. The net debt is a cash measure which is priced at nominal value (that is the cost to the issuer at redemption) and consolidated (that is intra-sector holdings of liabilities and assets are removed).

Back to table of contents9. Central government account

Figure 4 illustrates that the central government current budget deficit has reduced since the financial year ending 2010 (April 2009 to March 2010), but is still larger than before the global financial shock.

Figure 4: Central government receipts, expenditure and current budget deficit by financial year [1]

All data excluding public sector banks, United Kingdom

Notes:

- The financial year ending 1998 (April 1997 to March 1998) to the financial year ending 2015 (April 2014 to March 2015)

- Current budget deficit is receipts minus expenditure but also includes the effects of depreciation

Download this chart Figure 4: Central government receipts, expenditure and current budget deficit by financial year [1]

Image .csv .xlsIn August 2015, the central government current budget deficit was £9.3 billion, an increase of £1.1 billion, or 14.1% compared with August 2014.

In recent years the current budget has been in deficit in most months. January and July tend to be surplus months as these are the 2 months with the highest receipts.

a) Current receipts

As cash receipts are generally accrued back to earlier periods when the economic activity took place, the first monthly estimate for receipts is by nature provisional, and must include a substantial amount of forecast data.

Central government receipts follow a strong cyclical pattern over the year, with high receipts in April, July, October and January due to quarterly corporation tax returns being accrued to these months.

In both January and July (to a lesser extent) accrued receipts are particularly high due to receipts from quarterly corporation tax combining with those from income tax self-assessment. The revenue raised through income tax self-assessment, as well as primarily affecting January and July receipts, also tends to lead to high receipts in the following month (February and August respectively), although to a lesser degree.

Pay as you earn (PAYE) tends to vary little throughout the financial year on a monthly basis (excluding bonus months).

Events impacting on current receipts

In the financial year ending 2016 (April 2015 to March 2016) the following events increased current receipts:

- the transfers between the APF and central government by £4.3 billion (so far)

In the financial year ending 2015 (April 2014 to March 2015) the following events increased current receipts:

- the transfers between the APF and central government by £10.7 billion

In the financial year ending 2014 (April 2013 to March 2014) the following events increased current receipts:

- the transfers between the APF and central government by £12.2 billion

In the financial year ending 2013 (April 2012 to March 2013) the following events increased current receipts:

the transfer of the Special Liquidity Scheme final profits by £2.3 billion

the transfers between the APF and central government by £6.4 billion

The receipt of APF and SLS transfers by central government have no impact on public sector borrowing due to the central government receipts being offset by the payments from the Bank of England.

b) Current expenditure

Trends in central government current expenditure can be affected by monthly changes in debt interest payments which can be volatile as they depend on the monthly path of the Retail Prices Index. It can therefore be informative to consider the total central government current expenditure excluding debt interest payments.

The profile of accrued central government current expenditure excluding debt interest is generally less volatile through the year. However, one regular peak is in net social benefits, which are higher in November than in other months because this is when the winter fuel allowance is paid.

Growth in net social benefits is affected by inflation. Benefits were uprated by 5.2% in the financial year ending 2013 (April 2012 to March 2013) in line with the Consumer Prices Index (CPI). This contrasts with an equivalent figure of 2.2% in the financial year ending 2014 (April 2013 to March 2014), 2.7% in the financial year ending 2015 (April 2014 to March 2015) and 1.2% in the financial year ending 2016. However for State Pensions there is a "triple guranatee" that mean that they are uprated by the highest of the CPI, increases in earnings or 2.5%, which is the rise for the financial year ending 2016 (April 2015 to March 2016). Since the financial year ending 2014 (April 2013 to March 2014), the uprating only applies to benefits received by disabled people and pensioners - benefits for people of working age have only been increased by 1% in these 3 years.

It is difficult to compare the profile of monthly central government expenditure excluding debt interest and net social benefits since the financial year ending 2014 (April 2013 to March 2014) with earlier years because of a number of changes to central government funding for local authorities (in particular the timing of grants).

In the financial year ending 2012 (April 2011 to March 2012) and earlier years, the funds were distributed in multiple, similar-sized, payments throughout the year. In the financial year ending 2013 (April 2012 to March 2013), local authorities received almost all their funding from the Department for Communities and Local Government (DCLG) through redistributed business rates, rather than the Revenue Support Grant (RSG). In addition, in the financial year ending 2013 (April 2012 to March 2013), as in previous years, the bulk of the RSG was paid in April, with a smaller balance paid in February.

From the start of the financial year ending 2014 (April 2013 to March 2014), local authorities retained half of the business rates they collect, with the remainder redistributed through the RSG. The retained business rates are still classified as a central government tax (see background note on business rates). Furthermore, the RSG in the financial year ending 2014 (April 2013 to March 2014) (and in the financial year ending 2015 (April 2014 to March 2015)) included a number of grants that were paid by other departments in the financial year ending 2013 (April 2012 to March 2013), including one to fund council tax benefit localisation and was again paid mainly in April with a smaller balance in February. This means that central government current expenditure year-on-year growth for April and February for the financial year ending 2014 (April 2013 to March 2014) was high, while year-on-year growth in other months was generally lower.

In the financial year ending 2016 (April 2015 to March 2016) the RSG has been paid to local authorities with a different profile with a third of the total being paid in April and the remainder in equal instalments in all the other months. This means that for this financial year current expenditure growth in April and February will be lower while year on year growth in other months will generally be higher.

c) Net investment

Central government net investment is difficult to predict in terms of its monthly profile as it includes some large capital grants (such as those to local authorities and education institutions), and can include some large capital acquisitions or disposals, all of which vary from year to year. Net investment in the last quarter of the financial year is usually markedly higher than that in the previous 3 quarters.

Central government net investment includes the direct acquisition minus disposal of capital assets (such as buildings, vehicles, computing infrastructure) by central government. It also includes capital grants to and from the private sector and other parts of the public sector. Capital grants are varied in nature and cover payments made to assist in the acquisition of a capital asset, payments made as a result of the disposal of a capital asset, transfers in ownership of a capital asset and the unreciprocated cancellation of a liability.

Back to table of contents10. Recent events and methodological changes

Classification decisions

Each quarter we publish a Forward Workplan outlining the classification assessments we expect to undertake over the coming 12 months. To supplement this, each month a Classifications Update is published which includes expected implementation points (for different statistics) where possible.

Classification decisions are reflected in the public sector finances at the first available opportunity and where necessary outlined in this section of the statistical bulletin.

Share Sales

In recent years the government has entered a program of selling shares in publically owned organisations. For most share sales, the proceeds will reduce the central government net cash requirement (CGNCR) and public sector net debt (PSND) but have no impact on public sector net borrowing.

This section outlines the recent central government share sale program. In addition OBR discuss state-owned asset sales in their Economic and Fiscal Outlook July 2015 indicating expected future share sales in Chart 4.14.

Royal Bank of Scotland

In August 2015, the government announced the sale of approximately 5.4% of its shareholding in Royal Bank of Scotland. The £2.1 billion raised from this sale reduced central government net cash requirement and net debt in August 2015 by a corresponding amount.

Lloyds Banking Group

On 17 September 2013, the UK government began selling part of its share holdings in Lloyds Banking Group (LBG). A further share sale on 23 and 24 March 2014 meant that the UK government surrendered in total a 13.5% stake in the institution, a quantity sufficient to lead to LBG being re-classified from a public sector body to a private sector body.

Since December 2014, the government has continued reducing its shareholding in LBG via a pre-arranged trading plan, raising an estimated total of £14.4 billion to date. In June 2015 the government announced that it will launch a LBG share sale to the public "in the next 12 months".

In August 2015, an estimated £600 million raised from these sales reduced central government net cash requirement and net debt in May 2015 by a corresponding amount.

Royal Mail

In June 2015, the government announced the sale of half of its retained shareholding in Royal Mail. The £750 million raised from this sale of a 15% stake reduced central government net cash requirement and net debt in June 2015 by a corresponding amount.

Eurostar

In March 2015, the government announced the sale of its 40% stake in the cross-Channel train operator Eurostar. The £757 million raised from this sale reduced central government net cash requirement and net debt in May 2015 by a corresponding amount.

Bank of England Asset Purchase Facility Fund

The Chancellor announced on 9 November 2012 that it had been agreed with the Bank of England to transfer the excess cash in the Asset Purchase Facility Fund (APF) to the Exchequer. The 2013 PSF Review consultation (129.2 Kb Pdf) concluded that transactions between the APF and central government net out and have no impact on PSNB ex while the net liabilities of the APF increase PSND ex, which is reflected in this bulletin.

In August 2015, there were no transfers from the Bank of England Asset Purchase Facility Fund (BEAPFF) to HM Treasury, while in the current financial year-to-date (April 2015 to August 2015), £4.3 billion has been transferred.

The next expected transfer will occur in October 2015.

The Bank of England entrepreneurial income for the financial year ending 2015 (April 2014 to March 2015) was calculated as £12.5 billion. This is the total amount of dividend transfers that can impact on central government net borrowing in the financial year ending 2016 (April 2015 to March 2016).

Between April 2012 to March 2013, there were £11.3 billion of transfers from the BEAPFF to HM Treasury, while in the same period in financial year ending 2014 and 2015 the transfers were £31.1 billion and £10.7 billion respectively.

All cash transferred from the Asset Purchase Facility to HM Treasury is fully reflected in central government net cash requirement and net debt. For more detail of transactions relating to the Asset Purchase Facility, see Table PSA9.

New VAT rules for electronic services

On 1 January 2015, VAT rules relating to the supply of telecommunications, radio and television broadcasting and electronically supplied services changed.

Prior to 1 January 2015, supplies made by EU businesses to EU resident customers were subject to VAT in the country where the suppliers were established; from 1 January 2015, the supplies will be subject to VAT in the country where the customer is resident. The tax changes are as a result of European legislation.

The legislation provides for a transition period of 4 years during which the tax authority in the country where the supplier is located can retain a part of the VAT collected prior to passing on the remainder of the collected tax to the country where the customer is resident. From 1 January 2019, all collected tax must be transferred to the tax authority in the appropriate country.

We are currently considering how the transferred and retained tax should be treated in the public sector finances and will provide more detail over the coming months.

Diverted Profit Tax

The government has introduced a new tax – the Diverted Profits Tax – to counter the use of aggressive tax planning techniques used by multinational enterprises to divert profits from the UK. The legislation is included in the Finance Act 2015, and applies from 1 April 2015.

In public sector finances, Diverted Profit Tax will be treated as a tax on income and wealth and so reduce central government net borrowing.

EU contributions

Every year the European Commission (EC) reports retrospective adjustments to the EC budget contributions by EU member states based on the latest Value Added Tax (VAT) and gross national income (GNI) data.

In December 2014, the public sector finances recorded £2.9 billion of current expenditure in that month that related to increases in the UK contribution due to revised GNI data over a long historical period (as far back as 2002 for most member states). The gross liability of £2.9 billion for the UK arose in December 2014 and so has been recorded, then even though the cash will not be paid by the UK government until 2015. The first cash payment of £0.4 billion was made in July 2015.

Previous month's bulletins have noted the existence of 2 transactions which would offset this £2.9 billion:

a repayment (estimated by OBR as £1.2 billion) as the Commission returns all the member states’ additional contributions related to the data revisions

an increase in the UK rebate (estimated by the OBR as £0.8 billion) as a result of the UK's additional payment

The rebate is a regular transfer made by the EC to the UK. These transactions are reflected in the public sector finances when they occur (and are recorded as part of "Current transfers received from abroad" in Table PSA6E).

The latest guidance received from Eurostat makes it clear that the £1.2 billion repayment should be recorded in 2014 in the same way that the £2.9 billion payment has been. This has resulted in the December 2014 current expenditure for that month being revised down by £1.2 billion to reflect the repayment from the EC to the UK, which is accrued to December 2014 although the cash transactions take place in 2015. This is consistent with the approach taken by the OBR.

Of the £1.2 billion repayment, £0.5 billion was received in February 2015, so the accrued impact on borrowing in February 2015 is £0.5 billion higher than the cash impact on the net cash requirement to account for the fact that the £1.2 billion repayment has already been recorded within the net borrowing of December 2014.

More details of these EU budget contributions can be found on the EU Commission website.

Grants to Local Government

The Revenue Support Grant (RSG) is the main revenue funding grant paid by central government to local government in England.

In the financial year ending 2015 (March 2014 to April 2015), more than half of the RSG was paid in April with the remaining balance paid in February and March. The payment profile has changed for the financial year ending 2016 (March 2015 to April 2016), with one-third of the grant paid in April and the rest expected to be paid evenly through the year.

This change in profile explains almost all of the fall in central government current transfers to local government and central government other current spending in April 2015 compared to April last year. The impact of this change is offset in local government net borrowing.

Summer Budget 2015

In their July 2015 Economic and Fiscal Outlook, the Office for Budget Responsibility referred to uncertainty around the statistical implementation of 2 policy changes. These were the social sector rent measure which starts in the financial year ending 2017 and the movement of corporation tax payment dates which will be implemented in the financial year ending 2018. We will consider how transactions related to these, and any other Budget policies, will be recorded in the public finances and inform users in due course.

Back to table of contents11. How provisional outturn progress to final outturn

In publishing monthly estimates, it is necessary that a range of different types of data sources are used. This section provides a summary of the different sources used and the implications that has for data revisions.

Latest month

Central government: departmental expenditure data are provisional outturns for the most recent month and in some cases data are based on forecasts. Adjustments are made to these forecasts for some departments to account for likely under or over spending. For central government income, the data are again a mixture of provisional outturn data and forecasts.

Local government: while some income data are available monthly, the majority of expenditure and income data are based on previously forecasted levels from the most recent quarter. There is an adjustment based on data from previous periods to account for likely under or over spending.

All data for public corporations for the latest month are based on our forecasts.

Earlier months

Central government: for the 2 to 3 months before the latest month a mixture of outturn data and budget estimates (forecasts) are used but it increasingly becomes outturn.

Local government: since the financial year ending 2012 (April 2011 to March 2012), for English local authorities, data from the Quarterly Revenue Outturn and Quarterly Capital Payments and Receipts forms collected by the Department of Communities and Local Government (DCLG) have been used to provide provisional outturn figures. These figures are included within the public sector finance statistics around 3 to 4 months after the end of the quarter.

For local authorities outside of England and all local authorities before the financial year ending 2012 (April 2011 to March 2012), in year expenditure data were based on the expected level of spending from local authority forecasts. This included estimates of likely under or over spending. However, quarterly data was used for capital expenditure in England.

Public corporations: We conduct a quarterly survey of the 8 largest public corporations. These figures are used around 3 to 4 months after the end of the quarter. Data for the remaining public corporations are based on our estimates until the audited accounts are available.

Even after all audited data for the public sector are available, there may still be revisions to reflect, for example, the implementation of classification decisions and other methodological changes.

Assessing the end year position

The implication is that the earliest estimates of outturn for the financial year ending 2015 (April 2014 to March 2015) will be subject to revision as revised data are provided to us by data suppliers. Depending upon the timing of the updated data from suppliers, this means that some months the revised estimates can be higher than the initial estimate and some months lower.

Back to table of contents12. Revisions since previous bulletin

In publishing monthly estimates, it is necessary that a range of different types of data sources are used. A summary of the different sources used and the implications this has for data revisions is provided in the document Sources summary and their timing (22.8 Kb Pdf). More detail of the methodology and sources employed can be found in the Public Sector Finances Methodological Guide (360.3 Kb Pdf) .

The Public Sector Finance Revision Policy provides information of when users of the statistics published in the Public Sector Finances and Government Deficit and Debt under the Maastricht Treaty statistical bulletins should expect to see methodological and data related revisions.

This bulletin reflects a number of methodological changes being made for the 2015 annual national accounts publication (Blue Book 2015). These changes have resulted in an extended period of revisions that have been reflected in this publication.

Each quarter PSF data are aligned to the data reported in the EU Government Deficit and Debt return to take advantage of the more detailed quarterly data underpinning the latter publication.

In order to ensure this coherence between the EU Government Deficit and Debt Return output and the PSF statistical bulletin the quarterly compilation approach taken in the PSF bulletin is to:

align the PSF data with the data in the EU Government Deficit and Debt output for all published quarters (for example, the PSF published in December will include data that are aligned up until the end of Q3, i.e. September)

use the latest PSF data sources for the estimates for the month immediately prior to publication (for example, the PSF published in December will include the latest available data for November)

calculate estimates for the penultimate month by taking the latest data for the cumulative financial year-to-date and subtracting both the cumulative totals for those aligned quarters in the financial year and the latest month estimates (for example, the PSF published in December will derive October figures from the financial year-to-date total less the sum of the estimates for Q2, Q3 and November)

The impact of aligning to the quarterly data while using the latest monthly data to inform the year-to-date total is that the monthly path of revisions may not reflect the latest data.

Table 4 summarises revisions between the data contained in this bulletin and the previous publication.

Borrowing

This month’s bulletin includes revisions to public sector net borrowing (excluding public sector banks) (PSNB ex) back to financial year ending 1998 in line with some of the methodological revisions included in Blue Book 2015.

An article Methodological Improvements to National Accounts for Blue Book 2015: Classifications outlines the National Accounts changes and presents the estimated revisions (Annex A). Most of the improvements have already been implemented in public sector finances but two changes are reflected in this month’s public sector finces.

The two main revisions are to central government and local government depreciation, from a change in the estimated life length of roads (from 75 to 55 years) used in the ONS’s model that produces estimates of capital consumption (depreciation) and the re-classification of some of the subsidiaries Transport for London between local government and public corporations. Both of these are largely neutral for PSNB.

The more substantial revisions (in excess of £1 billion) are limited to the financial years ending 2014 and 2015, along with the current financial year-to-date (April to July 2015) and as a result of the combination of the methodological improvements and updated data.

Over the financial year ending 2015, (April 2014 to March 2015), PSNB ex was revised up by £2.0 billion, while in the current financial year-to-date to (April to July 2015) PSNB ex was revised up by £2.2 billion.

Central government borrowing

Changes to estimates of central government depreciation resulting from the change in methodology (mentioned above) range from £104 million in the financial year ending 1998 to £684 million in the financial year ending 2015. These changes are public sector borrowing neutral, increasing the current budget deficit and decreasing net investment by an equal but offsetting amount.

In the current financial year-to-date (April to July 2015), the estimate of central government net borrowing (CGNB) has been revised up by £0.1 billion.

Current receipts in the current year-to-date were revised up by £0.8 billion, largely due to increases in the estimates of taxes on production (other than VAT), income tax and national insurance contributions of £0.3 billion, £0.4 billion and £0.2 billion respectively.

This increase in current receipts were offset by a similar increase in current expenditure of £0.9 billion, resulting in a £0.1 billion increase to the estimate of net borrowing in the current financial year-to-date. The revisions in current expenditure were mainly driven by ‘other’ current expenditure, which includes departmental expenditure on staff and goods & services, as well as transfers.

In the financial year ending 2015 CGNB revised down by £0.2bn due to initial estimates of departmental spending data being replaced by resource accounts. Similarly there were smaller revisions to CGNB in earlier years due to new data received from suppliers.

Local government borrowing

The revisions to local government net borrowing (LGNB) since the last publication (summarised in Table 4) are partially due to the re-classification of some of the subsidiaries of Transport for London (TfL) between the public corporation and local government sectors.

Revisions to estimates of depreciation, also mentioned above, as a result to the change in methodology in the road life length of roads are of the same magnitude as those for central government and have been omitted from the analysis below as they are public sector borrowing neutral.

In addition to the methodological changes in the current financial year-to-date (April to July 2015), provisional estimates based on the June 2015 OBR forecast have been replaced by budget forecast figures received from the Department for Communities and Local Government (DCLG) and the devolved administrations. These data changes have resulted in the estimate of borrowing increasing by £2.4 billion.

In the financial year ending 2015, the estimate of LGNB has been revised up by £0.9 billion due to budget forecast figures being replaced by provisional outturn figures received from DCLG.

In the financial year ending 2014, the estimate of LGNB has been revised up by £1.5 billion due to a £1.3 billion upward revision to current spending, of which £0.8 billion was due to changes to TfL and £0.5 billion was due to updated data sources.

In the financial year ending 2013, the estimate of LGNB has been revised up by £0.5 billion largely due to a £0.7 billion upward revision to current spending due to TfL.

In the financial year ending 2012, the estimate of LGNB has been revised up by £0.5 billion due to a £0.5 billion upward revision to current spending, of which £0.7 billion was due to changes to TfL, partially offset by a reduction in the spending estimate of £0.2 billion due to updated data sources.

In the financial year ending 2011, the estimate of LGNB has been revised down by £0.1 billion.

In the financial years ending 2009 and 2010, the estimate of LGNB has been revised down by £0.8 billion and £0.2 billion respectively. Both of these revisions were largely due to corrections to Capital grants from Local Government to the private sector of £0.9 billion and £0.3 billion respectively.

Public corporations borrowing

The revisions to public corporation net borrowing (PCNB) since the last publication (summarised in Table 4) are almost entirely due to the re-classification of some of the subsidiaries of Transport for London between the public corporation and local government sectors.

Public sector net debt (excluding public sector banks)

The revisions to public sector net debt (excluding public sector banks) (PSND ex) in this publication (summarised in Table 4) are related to the re-classification of some of the subsidiaries of Transport for London between the public corporation and local government sectors.

These methodological changes are described in the article Methodological Improvements to National Accounts for Blue Book 2015: Classifications.

Public sector cash requirement (excluding public sector banks)

Public sector net cash requirement (excluding public sector banks) (PSNCR ex) has remained unchanged over the current financial year-to-date (April and July 2015), however there have been a number of offsetting revisions between sectors due to updated source data.

Central government and public corporation net cash requirement fell by £0.2 billion and £0.1 billion respectively in July, with the remaining year-to-date revisions almost entirely attributable to revised local government data.

Table 4: Revisions between this bulletin and the previous bulletin

| United Kingdom, previous bulletin refers to the PSF bulletin published on 21 August 2015 | ||||||||

| £ billion1 (not seasonally adjusted) | ||||||||

| Period | Net Borrowing | Net Debt | PSNCR ex9 | |||||

| CG2 | LG3 | NFPCs4 | BoE5 | PSNB ex6 | PSND ex7 | PSND % of GDP8 | ||

| 2000/01 | 0.0 | 0.0 | -0.1 | 0.0 | -0.1 | 0.0 | 0.0 | 0.0 |

| 2001/02 | 0.0 | 0.0 | -0.1 | 0.0 | -0.1 | 0.2 | 0.1 | 0.0 |

| 2002/03 | 0.0 | 0.0 | -0.1 | 0.0 | 0.0 | 0.3 | 0.1 | 0.0 |

| 2003/04 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.6 | 0.1 | 0.0 |

| 2004/05 | 0.0 | 0.0 | 0.3 | 0.0 | 0.3 | 1.1 | 0.1 | 0.0 |

| 2005/06 | 0.0 | 0.0 | 0.3 | 0.0 | 0.3 | 1.8 | 0.1 | 0.0 |

| 2006/07 | 0.0 | 0.0 | 0.3 | 0.0 | 0.3 | 2.6 | 0.2 | 0.0 |

| 2007/08 | 0.0 | 0.0 | 0.2 | 0.0 | 0.2 | 3.3 | 0.2 | 0.0 |

| 2008/09 | 0.0 | -0.8 | 1.7 | 0.0 | 0.9 | 3.3 | 0.2 | 0.0 |

| 2009/10 | 0.0 | -0.2 | 0.2 | 0.0 | -0.1 | 3.4 | 0.2 | 0.0 |

| 2010/11 | 0.1 | -0.1 | 0.0 | 0.0 | 0.0 | 1.4 | 0.1 | 0.0 |

| 2011/12 | 0.0 | 0.5 | -0.4 | 0.0 | 0.2 | 1.0 | 0.0 | 0.0 |

| 2012/13 | -0.1 | 0.5 | -0.4 | 0.0 | 0.0 | 0.9 | 0.1 | 0.0 |

| 2013/14 | -0.1 | 1.5 | -0.2 | 0.0 | 1.3 | 0.8 | 0.0 | 0.0 |

| 2014/1510 | -0.2 | 0.9 | 1.3 | 0.0 | 2.0 | 0.3 | 0.1 | -0.1 |

| 2015/16 ytd11 | 0.1 | 2.4 | -0.2 | 0.0 | 2.2 | 0.5 | 0.0 | 0.0 |

| 2015 April12 | -0.7 | 0.6 | -0.1 | 0.0 | -0.2 | 0.8 | 0.0 | 0.1 |

| 2015 May12 | -0.3 | 0.5 | -0.1 | 0.0 | 0.1 | 2.0 | 0.1 | 0.2 |

| 2015 June12 | -0.2 | 0.6 | -0.1 | 0.0 | 0.3 | 2.3 | 0.1 | 0.2 |

| 2015 July12 | 1.4 | 0.6 | 0.0 | 0.0 | 2.0 | 0.5 | 0.0 | -0.5 |

| Notes: | ||||||||

| 1. Unless otherwise stated | ||||||||

| 2. Central Government | ||||||||

| 3. Local Government | ||||||||

| 4. Non-Financial public corporations | ||||||||

| 5. Bank of England | ||||||||

| 6. Public sector net borrowing excluding public sector banks | ||||||||

| 7. Public sector net debt excluding public sector banks | ||||||||

| 8. GDP = Gross Domestic Product | ||||||||

| 9. Public sector cash requirement excluding public sector banks | ||||||||

| 10. 2014/15 represents financial year ending 2015 (April 2014 to March 2015) | ||||||||

| 11. ytd = Year-to-date | ||||||||

| 12. Monthly revisions are in part due to the quarterly practice of aligning the monthly public sector finances with the quarterly datasets. The alignment process and its impact on the monthly profile is set out in the public sector finance revisions policy. Year-to-date figures are unaffected | ||||||||

Download this table Table 4: Revisions between this bulletin and the previous bulletin

.xls (37.9 kB)To provide users with an insight into the drivers of the historical revisions between publications, this bulletin presents 3 revisions tables;

table PSA1R complements PSA1 and provides a revisions summary (between the current and previous publication) to headline statistics in this release

table PSA2R complements PSA2 and provides the revisions (between the current and previous publication) to net borrowing by sector

table PSA6R complements PSA6B and provides the revisions (between the current and previous publication) to the components of central government net borrowing

Tables PSA1R and PSA6R are published in excel format only in appendix A to this release.

In addition, appendix C to this bulletin presents a statistical analysis on several key components of the central government account (current receipts, current expenditure, net borrowing and net cash requirement) to determine whether their average revisions are statistically significant.

Back to table of contents13. New for the bulletin

Recent public sector finance articles

We are currently in the process of updating public sector finance guidance and methodology articles published on our website. This month we have updated the Public Sector Finances Revision Policy and recently we have updated articles covering:

The reconciliation of net cash requirement to debt

The issues and subsequent revisions to CGNCR reported in October 2014 were identified through work undertaken to reconcile the 3 different fiscal measures (that is net cash requirement, net borrowing and net debt) and to reconcile the central government net cash requirement with cash reported in audited resource accounts.

We are currently building these reconciliation processes into the monthly production systems. The first of these new reconciliations, Table REC3, attempts to reconcile central government net cash requirement and net debt.

Table REC3 is not currently designated a National Statistic and should be considered as a work-in-progress, with plans to introduced further refinements in the coming months.

Back to table of contents14. List of tables in this bulletin

PSA1 Public Sector Summary

PSA2 Public Sector Net Borrowing: by sector

PSA3 Public Sector Current Budget Deficit, Net Borrowing and Net Cash Requirement (excluding public sector banks)

PSA4 Public Sector Net Debt (excluding public sector banks)

PSA5A Long Run of Fiscal Indicators as a percentage of GDP on a financial year basis

PSA5B Long Run of Fiscal Indicators as a percentage of GDP on a quarterly basis*

PSA6A Net Borrowing: month and year-to-date comparisions

PSA6B Central Government Account: Overview

PSA6C Central Government Account: Total Revenue,Total Expenditure and Net Borrowing

PSA6D Central Government Account: Current Receipts

PSA6E Central Government Account: Current Expenditure

PSA6F Central Government Account: Net Investment

PSA6G Local Government Account: Overview*

PSA6H Local Government Account: Total Revenue, Total Expenditure and Net Borrowing*

PSA6I Local Government Account: Current Receipts*

PSA6J Local Government Account: Current Expenditure*

PSA6K Local Government Account: Net Investment*

REC1 Reconciliation of Public Sector Net Borrowing and Net Cash Requirement (excluding banking groups)

REC2 Reconciliation of Central Government Net Borrowing and Net Cash Requirement

PSA7A Public Sector Net Cash Requirement

PSA7B Public Sector Net Cash Requirement*

PSA7C Central Government Net Cash Requirement

PSA7D Central Government Net Cash Requirement on own account (receipts and outlays on a cash basis)

REC3 Reconciliation of Central Government Net Cash Requirement and Debt (Experimental Statistic)

PSA8A General Government Consolidated Gross Debt nominal values at end of period

PSA8B Public Sector Consolidated Gross Debt nominal values at end of period

PSA8C General Government Net Debt nominal values at end of period

PSA8D Public Sector Net Debt nominal values at end of period

PSA9 Bank of England Asset Purchase Facility Fund (APF)

PSA10 Public Sector transactions by sub-sector and economic category

PSA1R Public Sector Statistics: Revisions since last publication*

PSA2R Public Sector Net Borrowing: by sector; Revisions since last publication

PSA6R Central Government Account: overview; Revisions since last publication*

These tables are published in Excel format only.

Appendices – Data in this release

Appendix A Public Sector Finances Tables 1 to 10

Appendix B Large impacts on public sector fiscal measures excluding financial intervention (one off events).

Appendix C Revisions Analysis on several main components of the central government account (current receipts, current expenditure, net borrowing and net cash requirement).

The following guidance documents aim to help users gain a detailed understanding of the public sector finances: Monthly statistics on Public Sector Finances: a methodological guide (360.3 Kb Pdf) ; Developments to Public Sector Finances Statistics (255.2 Kb Pdf) and Quality and Methodology Information (201.4 Kb Pdf) .

Back to table of contents