Table of contents

- Main points

- In this bulletin:

- Summary of latest regional labour market statistics

- Understanding and working with labour market statistics

- Employment

- Workforce jobs (first published on 16 September 2015)

- Actual hours worked (first published on 15 July 2015)

- Unemployment

- Claimant Count (experimental statistics)

- Economic inactivity

- Local labour market indicators

- Where to find more information about labour market statistics

- Quality information

- Background notes

- Methodology

1. Main points

The UK employment rate, for the 3 months ending July 2015, was highest in the South West (78.6%) and lowest in Northern Ireland (67.8%). The employment rate estimates showed few large movements for the regions and countries of the UK

The UK unemployment rate, for the 3 months ending July 2015, was highest in the North East (8.5%) and lowest in the South West (4.1%). Generally the pattern is still for gently falling unemployment rates, although those falls may be starting to level off

The UK inactivity rate, for the 3 months ending July 2015, was highest in Northern Ireland (27.5%) and lowest in the South West (17.9%), which is a record low. The largest change in the inactivity rate, compared to the same period last year, was in Wales, which has decreased by 2.5 percentage points

The UK Claimant Count rate, for August 2015, was highest in Northern Ireland (4.7%) and lowest in both the South East and South West (1.3%). Compared with July 2015, the only region to show an increase in the Claimant Count rate was the North West, at 0.1 percentage point

The largest increase in UK workforce jobs, for June 2015, was in Yorkshire and The Humber, at 37,000. The largest decrease was in the North West, at 23,000

The highest proportion of workforce jobs in the service sector was in London, at 91.7%, which has remained unchanged since March 2015. The East Midlands had the highest proportion of jobs in the production sector, at 13.7%

The highest average actual weekly hours worked, for the 12 months ending March 2015, were in London and Northern Ireland, both at 33.3 hours and lowest in the North East, at 31.4 hours. For full-time workers, it was highest in London and the East of England, both at 38.1 hours and for part-time workers it was highest in Northern Ireland, at 17.6 hours

2. In this bulletin:

This bulletin shows the latest main labour market statistics for the regions and countries of the UK, along with statistics for local authorities, travel-to-work areas and parliamentary constituencies.

Data for Northern Ireland, although included in this bulletin, are available separately, in full, in the Northern Ireland Labour Market Report on the NISRA Economic and labour market statistics website.

Updated this month

Labour Force Survey estimates for the period May to July 2015.

Claimant Count for August 2015.

Public and private sector employment for June 2015.

Workforce jobs estimates for June 2015.

Also in this release

Annual Population Survey estimates for the period April 2014 to March 2015.

Back to table of contents3. Summary of latest regional labour market statistics

Table A shows the latest estimates for employment, unemployment and economic inactivity for May to July 2015 and a comparison with the previous quarter (February to April 2015). Comparing non-overlapping periods (May to July 2015 with February to April 2015) provides a more robust short-term comparison. Table B shows the latest Claimant Count rate for August 2015, and shows how these figures compare to the previous month (July 2015) and the previous year (August 2014).

Table A: Summary of latest headline estimates, seasonally adjusted, May to July 2015

| UK regions | Employment rate1 (%) aged 16 to 64 | Change on Feb to Apr 2015 | Unemployment rate2 (%) aged 16 and over | Change on Feb to Apr 2015 | Inactivity rate3 (%) aged 16 to 64 | Change on Feb to Apr 2015 |

| North East | 68.1 | -1.2 | 8.5 | 1.1 | 25.5 | 0.6 |

| North West | 71.4 | -0.3 | 5.5 | -0.2 | 24.3 | 0.5 |

| Yorkshire and The Humber | 71.4 | -0.2 | 6.3 | -0.6 | 23.6 | 0.5 |

| East Midlands | 75.0 | 0.6 | 4.7 | -0.2 | 21.2 | -0.4 |

| West Midlands | 70.8 | -0.2 | 5.7 | -0.7 | 24.8 | 0.8 |

| East of England | 77.0 | 0.2 | 4.7 | 0.3 | 19.1 | -0.5 |

| London | 72.2 | 0.3 | 6.4 | 0.2 | 22.7 | -0.5 |

| South East | 76.7 | -0.2 | 4.5 | 0.4 | 19.6 | -0.1 |

| South West | 78.6 | 1.3 | 4.1 | -0.1 | 17.9 | -1.3 |

| England | 73.8 | 0.1 | 5.4 | 0.0 | 21.9 | -0.1 |

| Wales | 71.2 | 1.0 | 6.5 | 0.1 | 23.7 | -1.2 |

| Scotland | 74.0 | -0.4 | 5.9 | 0.0 | 21.3 | 0.4 |

| Great Britain | 73.7 | 0.1 | 5.5 | 0.0 | 21.9 | -0.1 |

| Northern Ireland | 67.8 | -0.5 | 6.2 | 0.1 | 27.5 | 0.5 |

| UK | 73.5 | 0.1 | 5.5 | 0.0 | 22.1 | -0.1 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Calculation of headline employment rate: Number of employed people aged from 16 to 64 divided by the population aged from 16 to 64. Population is the sum of employed plus unemployed plus inactive | ||||||

| 2. Calculation of headline unemployment rate: Number of unemployed people aged 16 and over divided by the sum of employed people aged 16 and over plus unemployed people aged 16 and over | ||||||

| 3. Calculation of headline economic activity rate: Number of economically inactive people aged from 16 to 64 divided by the population aged from 16 to 64. Population is the sum of employed plus unemployed plus inactive | ||||||

Download this table Table A: Summary of latest headline estimates, seasonally adjusted, May to July 2015

.xls (30.7 kB)

Table B: Summary of latest Claimant Count estimates, seasonally adjusted, August 2015 (experimental statistics)

| UK regions | Level (thousands) aged 18 and over | Change on July 2015 | Change on August 2014 | Rate (%) aged 18 and over | Change on July 2015 | Change on August 2014 |

| North East | 46.9 | -0.1 | -11.8 | 3.9 | 0.0 | -1.0 |

| North West | 112.6 | 3.5 | -6.1 | 3.0 | 0.1 | -0.2 |

| Yorkshire and The Humber | 81.1 | -0.7 | -22.9 | 3.0 | 0.0 | -0.9 |

| East Midlands | 48.8 | 0.3 | -14.7 | 2.1 | 0.0 | -0.6 |

| West Midlands | 78.4 | -0.1 | -24.1 | 2.7 | 0.0 | -0.8 |

| East of England | 49.2 | 0.0 | -14.6 | 1.6 | 0.0 | -0.5 |

| London | 112.1 | -0.9 | -29.4 | 2.0 | 0.0 | -0.5 |

| South East | 59.6 | -0.3 | -16.6 | 1.3 | 0.0 | -0.4 |

| South West | 39.1 | 0.4 | -9.7 | 1.3 | 0.0 | -0.3 |

| England | 627.8 | 2.2 | -149.8 | 2.1 | 0.0 | -0.5 |

| Wales | 45.2 | 0.3 | -8.7 | 3.1 | 0.0 | -0.6 |

| Scotland | 76.7 | -0.2 | -14.2 | 2.7 | 0.0 | -0.5 |

| Great Britain | 749.7 | 2.2 | -172.7 | 2.2 | 0.0 | -0.5 |

| Northern Ireland | 42.0 | -1.0 | -10.4 | 4.7 | -0.1 | -1.2 |

| UK | 791.7 | 1.2 | -183.1 | 2.3 | 0.0 | -0.5 |

| Source: Department of Work and Pensions | ||||||

Download this table Table B: Summary of latest Claimant Count estimates, seasonally adjusted, August 2015 (experimental statistics)

.xls (29.7 kB)4. Understanding and working with labour market statistics

Labour market statistics measure many different aspects of work and jobs and provide an insight into the economy. They are also very much about people, including their participation in the labour force, the types of work they do, the earnings and benefits they receive and their working patterns.

We have developed a framework for labour market statistics to describe the concepts within the labour market and their relationship to each other. The framework is based on labour supply and demand.

Labour supply consists of people who are employed, as well as those people defined as unemployed or economically inactive, who are considered to be potential labour supply. Our framework distinguishes between these 3 categories of worker, and also between the different working arrangements of those in employment such as employees, the self-employed and those on government schemes.

Labour demand is represented by employers, who have a need for work to be done, and who offer compensation for this work to the employees who undertake it. Employers group this work to form jobs.

This approach has wide international acceptance, including by the International Labour Organisation (ILO). Users of labour market statistics include central and local government, economists, financial analysts, journalists, businesses, trade unions, employer associations, students, teachers, industrial tribunals, academic researchers and lobby groups.

They use them for the analysis, evaluation, monitoring and planning of the labour market and economy. Labour market statistics are also used for social analysis and help inform a wide range of government policies towards population groups of particular concern (women, young people, older people and jobless households).

Labour market statuses

Everybody aged 16 or over is either employed, unemployed or economically inactive. The employment estimates include all people in work including those working part-time. People not working are classed as unemployed if they have been looking for work within the last 4 weeks and are able to start work within the next 2 weeks. A common misconception is that the unemployment statistics are a count of people on benefits; this is not the case as they include unemployed people not claiming benefits.

Jobless people who have not been looking for work within the last 4 weeks or who are unable to start work within the next 2 weeks are classed as economically inactive. Examples of economically inactive people include people not looking for work because they are students, looking after the family or home, because of illness or disability, or because they have retired.

What is the relationship between the Annual Population Survey (APS) and the Labour Force Survey (LFS)?

The Labour Force Survey (LFS) is a household survey using international definitions of employment, unemployment and economic inactivity and compiles a wide range of related topics such as occupation, training, hours of work and personal characteristics of household members aged 16 years and over. Estimates are produced every month for a rolling 3 monthly period, for example, January to March data in a release will be followed by data for February to April in the next release.

The Annual Population Survey (APS), which began in 2004, is compiled from interviews for the LFS, along with additional regional samples. The APS comprises the main variables from the LFS, with a much larger sample size. Consequently the APS supports more detailed breakdowns than can be reliably produced from the LFS. Estimates are produced every quarter for a rolling annual period, for example, January to December data will be followed by data for April to March when they are next updated.

This bulletin includes labour market estimates at a regional level from the LFS on total employment, unemployment and economic inactivity. More detailed regional estimates for employment by age, full-time and part-time working, economic activity and inactivity by age, and reasons for inactivity are provided using the APS. Any estimates for geographic areas below regional level are provided using the APS. In tables where APS estimates are provided for detailed geographic areas, regional and national estimates are also provided from APS for comparability.

Making comparisons with earlier data

The most robust estimates of short-term movements in estimates derived from the Labour Force Survey (LFS) are obtained by comparing the estimates for May to July 2015 with the estimates for February to April 2015, which were first published on 17 June 2015. This provides a more robust estimate than comparing with the estimates for April to June 2015. This is because the May and June data are included within both estimates, so observed differences are only between April and July 2015. The LFS is representative of the UK population over a 3 month period, not for single month periods.

Accuracy and reliability of survey estimates

Most of the figures in this statistical bulletin come from surveys of households or businesses. Surveys gather information from a sample rather than from the whole population. The sample is designed carefully to allow for this, and to be as accurate as possible given practical limitations such as time and cost constraints, but results from sample surveys are always estimates, not precise figures. This means that they are subject to a margin of error which can have an impact on how changes in the numbers should be interpreted, especially in the short-term.

Changes in the numbers reported in this statistical bulletin (and especially the rates) between 3 month periods are usually not greater than the margin of error. In practice, this means that small, short-term movements in reported rates (for example, within plus or minus 0.3 percentage points) should be treated as indicative, and considered alongside medium and long-term patterns in the series and corresponding movements in administrative sources, where available, to give a fuller picture.

Further information is available in Quality information in the background notes section.

Seasonal adjustment

All estimates discussed in this statistical bulletin are seasonally adjusted except where otherwise stated. Like many economic indicators, the labour market is affected by factors that tend to occur at around the same time every year; for example, school leavers entering the labour market in July and whether Easter falls in March or April. In order to compare movements other than annual changes in labour market statistics the data are seasonally adjusted to remove the effects of seasonal factors and the arrangement of the calendar.

A glossary is also available to explain the main labour market terms.

Where to find explanatory information

We have produced a number of items to help aid understanding and highlight common misunderstandings of labour market statistics, all of which are available on our website:

Get all the tables for this publication in the data section of this publication .

Back to table of contents5. Employment

Employment measures the number of people in work; it differs from the number of jobs because some people have more than one job.

Employment consists of employees, self-employed people, unpaid family workers and people on government supported training and employment programmes. Unpaid family workers are people who work in a family business who do not receive a formal wage or salary but benefit from the profits of that business. The government supported training and employment programmes series does not include all people on these programmes; it only includes people engaging in any form of work, work experience or work-related training who are not included in the employees or self-employed series. People on these programmes NOT engaging in any form of work, work experience or work-related training are not included in the employment estimates; they are classified as unemployed or economically inactive.

A comparison between estimates of employment and jobs is available in an article on our website.

Regional employment

The employment rate for people aged from 16 to 64 for the UK was 73.5%, for the period May to July 2015. This is an increase of 0.1 percentage point from the previous period (February to April 2015).

The UK region with the highest employment rate was the South West, at 78.6%, a record high for the region, followed by the East of England, at 77.0% and the South East, at 76.7%. The highest rate for the same period last year was in the South East and the East of England, both at 76.6%. Along with the record high employment rate for the South West, mentioned earlier, the employment levels for the South West, East of England and East Midlands are also at record highs.

The region with the lowest rate was Northern Ireland, at 67.8%, followed by the North East, at 68.1% and the West Midlands, at 70.8%. The lowest rate for the same period last year was also in Northern Ireland, at 67.9%.

The region with the largest increase in the employment rate on the previous period (February to April 2015), was the South West, with an increase of 1.3 percentage points, followed by Wales with an increase of 1.0 percentage point and the East Midlands, with an increase of 0.6 percentage points. Recent increases in Wales have followed just over a year of lower rate estimates, returning to levels in line with those seen before that dip.

The North East had the largest decrease in the employment rate, with a decrease of 1.2 percentage points, followed by Northern Ireland, with a decrease of 0.5 percentage points and Scotland, with a decrease of 0.4 percentage points. For the North East, the pattern prior to the latest estimates has been for gently increasing employment rates to record highs in late 2014 and early 2015. It is too early to tell whether these estimates are the start of a longer trend in falling employment rates in the North East.

Figure 1: Employment rates by region and comparison year on year, seasonally adjusted, May to July 2014 and May to July 2015

UK regions

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 1: Employment rates by region and comparison year on year, seasonally adjusted, May to July 2014 and May to July 2015

Image .csv .xlsOver the year, the region with the largest increase in the employment rate was Wales, with an increase of 2.5 percentage points, followed by the South West, with an increase of 2.4 percentage points and the North West and the East Midlands, both with an increase of 1.4 percentage points.

There were only 2 regions that had a decrease in the employment rate: the North East, at 0.6 percentage points, and Northern Ireland, at 0.1 percentage points. Yorkshire and The Humber remained unchanged, compared to the same period last year.

Where to find data about employment

Employment estimates are available for each region at Tables HI00 – Headline LFS indicators for all UK regions and HI01 to HI12 – Headline indicators for individual UK regions (Tables 1 and 2), and Tables LI01 to LI05 - Local indicators for sub-regional areas of Great Britain, for this and further estimate breakdowns by age or geographies.

These tables contain data produced from the Labour Force Survey (LFS) and Annual Population Survey (APS). A note in the section "Understanding and working with labour market statistics" on the relationship between the LFS and APS entitled "What is the relationship between the APS and the LFS?" is included in this bulletin.

Back to table of contents6. Workforce jobs (first published on 16 September 2015)

Workforce jobs measures the number of filled jobs in the economy. The estimates are mainly sourced from employer surveys such as the Short-Term Employment Surveys (STES) and the Quarterly Public Sector Employment Survey (QPSES). Workforce jobs is a different concept from employment, which is sourced from the Labour Force Survey (LFS), as employment is an estimate of people and some people have more than one job.

A comparison between estimates of employment and jobs is available in an article published on our website.

The service sector consists of the following industries:

wholesale and retail trade

repair of motor vehicles and motor cycles, transport and storage

accommodation and food service activities

information and communication

financial and insurance activities

real estate activities

professional, scientific and technical activities

administrative and support service activities

public admin and defence

compulsory social security

education

human health and social work activities

arts, entertainment and recreation

other service activities

people employed by households, etc

The production sector consists of the following industries:

mining and quarrying

manufacturing

electricity, gas, steam and air conditioning supply

water supply, sewerage, waste and remediation activities

"Other" consists of the following industries: agriculture, forestry, and fishing and construction.

The Northern Ireland self-employed component of the workforce jobs are published by NISRA − Economic and Labour Market Statistics.

Regional workforce jobs

Workforce jobs increased in 8 of the 12 regions of the UK between March and June 2015. The largest increase of 37,000 was in Yorkshire and The Humber, followed by London, which increased by 35,000.

The largest decrease of 23,000 was in the North West, followed by the South West, which decreased by 15,000.

Compared to the same month last year (June 2014), the largest increase in workforce jobs was in London, with an increase of 66,000. This was also the largest overall change. The only decrease was in Scotland, at 8,000.

Figure 2: Change in workforce jobs, by region, seasonally adjusted, June 2014 and June 2015

UK regions

Source: Short Term Employment Survey (GAPS) - Office for National Statistics

Download this chart Figure 2: Change in workforce jobs, by region, seasonally adjusted, June 2014 and June 2015

Image .csv .xlsThe East Midlands had the highest proportion of jobs in the production sector, at 13.7%, whilst London had the lowest proportion, at 2.9%. This is due to London having primarily service-based industries within its region, such as financial and administrative sectors.

For the service sector, London had the highest proportion, at 91.7% whilst Wales had the lowest proportion, at 78.1%. The service sector currently accounts for 83.5% of the total workforce jobs in the UK.

Figure 3: Proportion of workforce jobs by broad industry group, by region, June 2015

UK regions

Source: Short Term Employment Survey (GAPS) - Office for National Statistics

Download this chart Figure 3: Proportion of workforce jobs by broad industry group, by region, June 2015

Image .csv .xlsWhere to find data about workforce jobs

Workforce jobs estimates are available for each region at Tables HI01 to HI12 – Headline indicators for individual UK regions (Tables 4 and 5).

While comparable estimates for workforce jobs by industry begin in 1978, some information back to 1841, based on census data, not comparable with the latest estimates, are available from 2011 Census Analysis, 170 years of industry published on our website.

Back to table of contents7. Actual hours worked (first published on 15 July 2015)

Actual hours worked measures the number of hours worked in the economy. Changes in actual hours worked reflect changes in the number of people in employment and the average hours worked by those people.

Regional actual hours worked

For the period April 2014 to March 2015, the UK regions with the highest average actual weekly hours worked, for all workers, were in London and Northern Ireland, both at 33.3 hours, followed by the North West and the East of England, both at 32.4 hours. The lowest was in the North East, at 31.4 hours, followed by Wales and the South West, both at 31.5 hours.

The UK region with the largest increase in the average hours worked, compared to the same period last year (April 2013 to March 2014) was the North West, with an increase of 0.4 hours (1.1%), followed by the West Midlands, with an increase of 0.2 hours (0.6%). The only decreases in the average hours worked, were in London, with a decrease of 0.6 hours (1.8%) and Yorkshire and The Humber, with a decrease of 0.2 hours (0.5%).

The regions with the highest average actual weekly hours worked in full-time jobs, were London and the East of England, both at 38.1 hours, a decrease of 1.1% and an increase of 0.3% respectively, compared to the same period last year. The lowest was the North East, at 36.6 hours, which has decreased by 0.3%. For part-time jobs, the region with the highest average hours worked was Northern Ireland, at 17.6 hours and the lowest was the South East, at 15.6 hours.

For men the region with the highest average hours worked was in Northern Ireland, at 39.1 hours and for women it was in London, at 28.6 hours. The largest difference in average hours worked between men and women was in Northern Ireland, where men worked on average 12.4 more hours a week than women. The largest change compared to the same period last year (April 2013 to March 2014), was seen for women in Northern Ireland, where the average hours worked decreased by 3.5%; a decrease from 27.2 hours to 26.7 hours per week.

The region with the largest difference in total hours worked between men and women was in London, where men worked a total of 32.0 million more hours than women. The regions with the smallest difference were in the North East and Northern Ireland, where men worked only 7.0 million more hours than women.

Figure 4: Average (mean) actual weekly hours of work, by region and by sex, April 2014 to March 2015

UK regions

Source: Annual Population Survey (APS) - Office for National Statistics

Download this chart Figure 4: Average (mean) actual weekly hours of work, by region and by sex, April 2014 to March 2015

Image .csv .xlsWhere to find data about hours worked

Hours worked estimates are available for each region at Tables HI01 to HI12 – Headline indicators for individual UK regions (Table 6). These estimates are based on data from the Annual Population Survey (APS)

The national data is also available at Tables 7 and 7(1) of the UK labour market statistical bulletin at Tables Hour1 - Actual weekly hours worked (seasonally adjusted) and Hour2 – Usual weekly hours worked (seasonally adjusted). These estimates are based on data from the Labour Force Survey (LFS).

Back to table of contents8. Unemployment

Unemployment measures people without a job who have been actively seeking work within the last 4 weeks and are available to start work within the next 2 weeks.

Regional unemployment

Regional estimates for the unemployment rate are quite volatile, which needs to be allowed for when considering the pattern of change over time.

The unemployment rate for people aged 16 and over for the UK was 5.5%, for the period May to July 2015. This remained unchanged compared to the previous period for comparison (February to April 2015).

The UK region with the highest rate was the North East, at 8.5%. The latest increase in the estimate for the North East follows a period of very sharp falls in late 2014 and early 2015. This was also the region with the highest rate, for the same period last year, at 9.8%. The next highest rates were seen in Wales, at 6.5% and London, at 6.4%. The regions with the lowest rate were the South West, at 4.1%, followed by the South East, at 4.5% and the East Midlands and the East of England, both at 4.7%.

The region with the largest decrease in the unemployment rate on the previous period (February to April 2015), was the West Midlands, at 0.7 percentage points, followed by Yorkshire and the Humber, at 0.6 percentage points and the North West and East Midlands, both at 0.2 percentage points. The largest increase was in the North East, with an increase of 1.1 percentage points, followed by the South East, with an increase of 0.4 percentage points. Generally the pattern is still for gently falling unemployment rates, although those falls may be starting to level off.

Figure 5: Unemployment rates by region, seasonally adjusted, May to July 2015

UK regions

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 5: Unemployment rates by region, seasonally adjusted, May to July 2015

Image .csv .xlsAll regions are showing decreases in the unemployment rate compared with a year ago, with the exception of the South East, which has remained unchanged. The largest decreases were in the West Midlands, at 1.6 percentage points, the North West and North East, both at 1.3 percentage points and the East Midlands and Yorkshire and The Humber, both at 0.9 percentage points. The smallest decrease in the rate was in Wales and Scotland, both at 0.1 percentage point.

An interactive chart showing regional unemployment rates over time is available on our website.

Where to find data about unemployment

Unemployment estimates are available for each region at Tables HI00 – Headline LFS indicators for all UK regions and HI01 to HI12 – Headline indicators for individual UK regions (Table 2(2)), and Tables LI01 to LI05 – Local indicators for sub-regional areas of Great Britain, for further estimate breakdowns by age or geographies.

These tables contain data produced from the LFS and APS. A note in the section "Understanding and working with Labour Market Statistics" on the relationship between the LFS and APS entitled "What is the relationship between the APS and the LFS?" is included in this bulletin.

Back to table of contents9. Claimant Count (experimental statistics)

Special note: Changes to the Claimant Count

In editions of this statistical bulletin prior to June 2015, the headline measure of the Claimant Count included claimants of Jobseeker’s Allowance (JSA) only. Since the June 2015 edition, the headline measure of the Claimant Count includes some claimants of Universal Credit as well as JSA claimants. These Universal Credit estimates are still being developed by the Department for Work and Pensions. We have therefore decided that the Claimant Count estimates including Universal Credit (which have been published as an alternative measure since July 2014) will continue to be designated as experimental statistics even though they are now the headline measure.

The coverage of the Universal Credit estimates does not precisely match the Claimant Count definition, because it includes some claimants who are not required to seek work. However, our analysis indicates that any bias in the new experimental measure of the Claimant Count is now less than in the old measure which only included JSA claimants.

What is the Claimant Count? The Claimant Count measures the number of people claiming benefit principally for the reason of being unemployed:

from November 2013, the Claimant Count includes all out of work Universal Credit claimants as well as all JSA claimants

between May 2013 and October 2013, the Claimant Count includes all claimants of Universal Credit (including those who were in work) as well as all JSA claimants

between October 1996 and April 2013, the Claimant Count is a count of the number of people claiming Jobseeker’s Allowance (JSA)

between January 1971 (when comparable estimates start) and September 1996, it is an estimate of the number of people who would have claimed unemployment-related benefits if the current benefit system had existed at that time

Ideally only those Universal Credit claimants who are out of work and required to seek work should be included in the Claimant Count but it is not currently possible to produce estimates on this basis. The Claimant Count therefore currently includes some out of work claimants of Universal Credit who are not required to look for work; for example, due to illness or disability.

The Claimant Count includes people who claim unemployment-related benefits but who do not receive payment. For example, some claimants will have had their benefits stopped for a limited period of time by Jobcentre Plus. Some people claim JSA in order to receive National Insurance Credits.

See "Notes for Claimant Count" 1,2,3,4,5 at the end of this section and background notes for further details.

Regional Claimant Count

The seasonally adjusted Claimant Count rate for the UK was 2.3% in August 2015; unchanged from July 2015, with the level up 1,200.

The UK region with the highest rate was Northern Ireland, at 4.7%; a decrease of 0.1 percentage point from the previous month. The next highest rates were in the North East, at 3.9%, Wales, at 3.1% and the North West and Yorkshire and The Humber, both at 3.0%. Northern Ireland was also the region with the highest rate for the same period last year, at 5.9%.

The regions with the lowest rate were the South East and South West, both at 1.3%. The next lowest rates were seen in the East of England, at 1.6% and London, at 2.0%. The largest change in the Claimant Count level from the previous month was seen in the North West, with an increase of 3,500. This was exceptionally large compared to the mixture of small increases and decreases across the other regions. The North West is where the roll-out of Universal Credit is furthest progressed, which is likely to account for the difference.

The Claimant Count levels for men are showing increases across most regions of the UK, except in Yorkshire and The Humber, London, and Northern Ireland, where there have been decreases of 100, 500, and 700 respectively. The increase in the majority of the regions for males is contributing to the increase in the overall Claimant Count level. The levels for women show most regions have decreased, with the exception of the North West and Wales, which increased by 900 and 100 respectively and the South West, which has remained unchanged.

Figure 6: Claimant Count rates by region, seasonally adjusted, August 2015

UK regions

Source: Department for Work and Pensions

Download this chart Figure 6: Claimant Count rates by region, seasonally adjusted, August 2015

Image .csv .xlsWhere to find data about Claimant Count

Claimant Count estimates are available for each region at Tables HI01 to HI12 – Headline indicators for individual UK regions (Table 7) and at Tables CC01 – Claimant Count by unitary and local authority and CC02 – Claimant Count by parliamentary constituency for further estimate breakdowns by geographies.

Tables showing estimates of Jobseeker’s Allowance are still available at HI01 to HI12 – Headline indicators for individual UK regions (Tables 7(1), 8 and 8(2)), and in Tables JSA01 – Jobseeker’s Allowance for local and unitary authorities in the UK, JSA02 – Jobseeker’s Allowance for Westminster parliamentary constituencies in the UK, JSA02.1 – Jobseeker’s Allowance for Scottish parliamentary constituencies and JSA03 – Jobseeker’s Allowance for Local Enterprise Partnerships in England, for further estimate breakdowns by sub-regional geographic areas. However these estimates are not designated as National Statistics. The back data for Jobseeker’s Allowance, at a regional level, is available from Nomis. Workplace-based denominators used for the Claimant Count are also available at Table (S03) – Claimant Count denominators (137.5 Kb Excel sheet) .

Notes for Claimant Count (experimental statistics)

The Claimant Count now includes people claiming Universal Credit. The background notes to this statistical bulletin have further details

The Claimant Count includes people who claim Jobseeker’s Allowance but who do not receive payment. For example, some claimants will have had their benefits stopped for a limited period of time by Jobcentre Plus; this is known as “sanctioning”. Some people claim Jobseeker’s Allowance in order to receive National Insurance Credits

An article explaining how unemployment and the Claimant Count series are defined and measured and the difference between the 2 series is available, along with an article to help users interpret labour market statistics and highlight some common misunderstandings

Universal Credit has not yet been introduced in Northern Ireland and so the "Claimant Count" for Northern Ireland will only be the number of people claiming Jobseeker's Allowance

Estimates of Claimant Count by region are available on a comparable basis back to April 1974. The figures from April 1974 to September 1996 are estimates of the number of people who would have claimed unemployment-related benefits if JSA had existed. The national records start in 1971, and some data back to 1881 (which do not have National Statistics status) are available from the “Historic Data” worksheet within data table CLA01 – Claimant Count (experimental statistics) in the UK Labour Market bulletin

10. Economic inactivity

Economically inactive people are not in employment but do not meet the internationally accepted definition of unemployment. This is because they have not been seeking work within the last 4 weeks and/or they are unable to start work within the next 2 weeks.

Regional economic inactivity

The inactivity rate for people aged from 16 to 64 for the UK was 22.1%, for the period May to July 2015. This has decreased by 0.1 percentage points compared to the previous period for comparison (February to April 2015). The UK region with the highest rate was Northern Ireland, at 27.5%, followed by the North East, at 25.5%. The region with the lowest rate was the South West, at 17.9%, followed by the East of England, at 19.1% and the South East, at 19.6%. The rate for the South West is the lowest economic inactivity rate estimate recorded for any region, since records began in 1992.

The region with the largest increase in the inactivity rate on the previous period (February to April 2015), was the West Midlands, with an increase of 0.8 percentage points, followed by the North East, at 0.6 percentage points and the North West, Yorkshire and The Humber, and Northern Ireland, all at 0.5 percentage points. The South West had the largest decrease in the rate, with a decrease of 1.3 percentage points, followed by Wales, at 1.2 percentage points.

Over the year, the regions with the largest increase in the inactivity rate were the North East, with an increase of 1.9 percentage points, followed by Yorkshire and The Humber, with an increase of 0.7 percentage points and the West Midlands, with an increase of 0.5 percentage points. The largest decrease in the rate was in Wales, at 2.5 percentage points, followed by the South West, at 1.9 percentage points.

Northern Ireland also had the highest inactivity rate, at 27.2%, in the same period in 2014, increasing by 0.4 percentage points over the last year. The rate is now 5.4 percentage points higher than the UK rate.

Figure 7: Economic inactivity by region and comparison year on year, seasonally adjusted, May to July 2014 and May to July 2015

UK regions

Source: Labour Force Survey - Office for National Statistics

Download this chart Figure 7: Economic inactivity by region and comparison year on year, seasonally adjusted, May to July 2014 and May to July 2015

Image .csv .xlsWhere to find data about economic inactivity

Inactivity estimates are available for each region at Tables HI00 – Headline LFS indicators for all UK regions and HI01 to HI12 – Headline indicators for individual UK regions (Tables 10 and 11), and Tables LI01 to LI05 – Local indicators for sub-regional areas of Great Britain, for further estimate breakdowns by age, reason or geographies.

These tables contain data produced from the LFS and APS. A note in the section "Understanding and working with labour market statistics" on the relationship between the LFS and APS entitled "What is the relationship between the APS and the LFS?" is included in this bulletin.

Back to table of contents11. Local labour market indicators

Local labour market indicators cover employment, unemployment, economic inactivity, Jobseeker’s Allowance and jobs density, for sub-regional geographic areas such as local and unitary authorities, counties and regions in the UK for the most recent 12 month period available of the Annual Population Survey (APS). The job density of an area is the number of jobs per head, of resident population, aged 16 to 64.

Indicators from the Annual Population Survey (first published on 15 July 2015)

For the period April 2014 to March 2015, the UK local authorities with the highest employment rate in Great Britain were the Orkney Islands, at 89.3%, Surrey Heath, at 86.6%, Winchester, at 86.4% and Tonbridge and Malling, Epsom and Ewell, and Chichester, all at 85.4%. Liverpool is the local authority with the lowest rate, at 60.0%. For the same period last year, the highest rates were in Uttlesford and North Dorset, at 86.7%; these areas are now 79.0% and 81.9%, respectively.

For the period April 2014 to March 2015, the local authority with the highest unemployment rate in Great Britain was Middlesbrough, at 11.8%, followed by Wolverhampton, at 11.3% and Hartlepool, at 11.1%. The local authority with the lowest rate was Stratford-on-Avon, at 2.4%, followed by South Northamptonshire, at 2.5%. These were followed by 5 local authorities, all at 2.6%, 3 local authorities, all at 2.7% and a further 10 local authorities, all under 3.0%. For the same period last year, there were only 5 local authorities with a rate of less than 3.0%.

Indicators using Claimant Count data (experimental statistics)

In August 2015, excluding the Isles of Scilly, the UK local authorities with the lowest proportion of the population, aged from 16 to 64 years, claiming Jobseeker’s Allowance or out-of-work Universal Credit, were Stratford-on-Avon, Surrey Heath, Hart in Hampshire, Mid Sussex and South Oxfordshire, all at 0.4%, followed by 15 local authorities, all at 0.5% and 28 other local authorities, all at 0.6%. There were a further 60 local authorities with a proportion of less than 1.0%.

The proportion was highest in Derry and Strabane, at 7.1%, followed by Belfast, at 4.8% and North Ayrshire, at 4.4%, which are the local authorities with the highest rates in Great Britain. These were followed by Birmingham, at 4.2% and South Tyneside, Middlesbrough and Kingston upon Hull, all at 4.1%. There were a further 31 local authorities with a proportion of 3.0% or more in the UK.

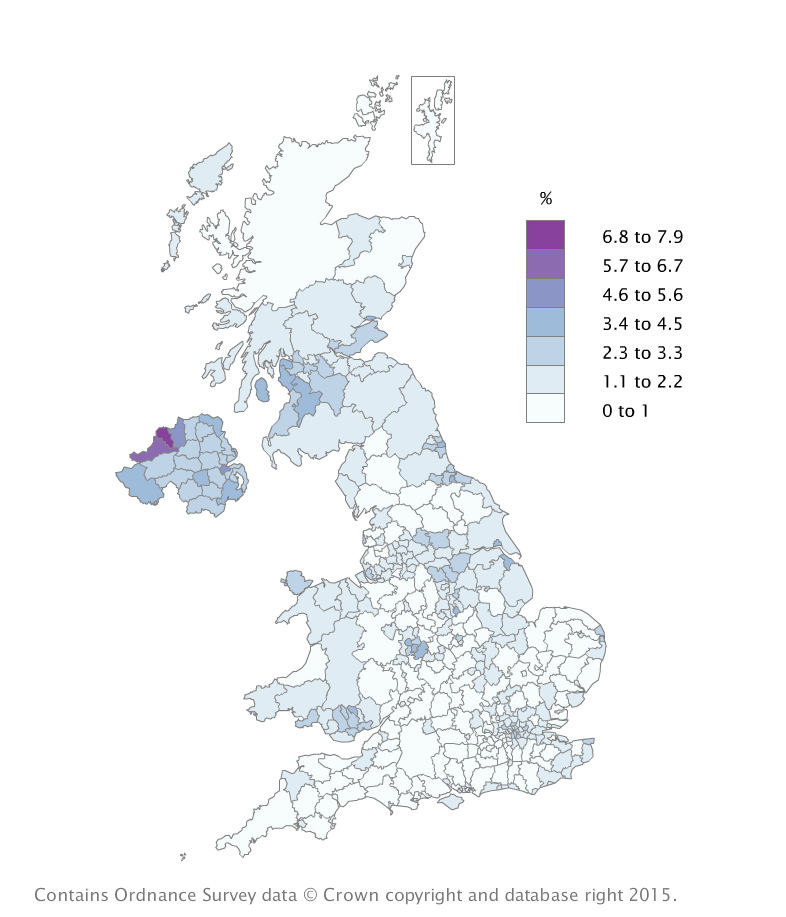

Currently it’s not possible to produce a detailed map for local areas using Claimant Count based on claimants of Jobseeker’s Allowance and Universal Credit. Consequently, the local authority map in Figure 8 reflects claimants of Jobseeker’s Allowance only, which will be affected by the roll-out of Universal Credit.

Figure 8: Jobseeker's Allowance map, August 2015

Proportion of people aged 16 to 64 claiming Jobseeker’s Allowance in local authorities in the UK

Source: Department for Work and Pensions

Download this image Figure 8: Jobseeker's Allowance map, August 2015

.png (187.0 kB)An interactive version of this map showing Jobseeker’s Allowance proportions by local authority over time is available. It shows Jobseeker’s Allowance proportions for males, females, 18 to 24 year olds and those claiming for over 12 months.

Job densities (first published on 17 April 2015)

The job density of an area is the number of jobs per head, of resident population, aged 16 to 64. In 2013, the highest jobs density in Great Britain was the City of London, at 81.79 and the lowest was East Renfrewshire, at 0.40. Westminster (4.35), Camden (2.15) and Islington (1.36), all in London, were the next highest jobs densities. The highest jobs density outside London was Watford, at 1.32. After East Renfrewshire, the lowest jobs densities were Lewisham, at 0.41, followed by Barking and Dagenham, at 0.44 and East Dunbartonshire, Waltham Forest, Redbridge and Haringey, all at 0.45.

Where to find data about local labour market indicators

APS estimates are available at Tables LI01 to LI05 – Local indicators for sub-regional areas of Great Britain and Claimant Count estimates are available at Tables CC01 – Claimant Count by unitary and local authority and CC02 – Claimant Count by parliamentary constituency in this statistical bulletin.

These tables contain data produced from the APS. A note in the section "Understanding and working with labour market statistics" on the relationship between the LFS and APS entitled "What is the relationship between the APS and the LFS?" is included in this bulletin.

Back to table of contents12. Where to find more information about labour market statistics

Other tables within the regional labour market release:

Guide to Tables in Regional Labour Market statistical bulletin

Summary of headline indicators (S01)

Sampling variability and revisions summary (S02)

Model based estimates of unemployment (M01)

Estimates of employment by age (experimental statistics) (X01)

Estimates of unemployment by age (experimental statistics) (X02)

Estimates of inactivity by age (experimental statistics) (X03)

Regional public and private sector employment (RPUB1)

Other regularly published labour market releases:

Young People who were Not in Employment, Education or Training (NEET)

regional and local area statistics are also available at NOMIS®

We have also produced:

Historic articles published in Economic and Labour Market Review and Labour Market Trends

Articles about labour market statistics were published in Labour Market Trends (up until 2006) and in Economic and Labour Market Review (from 2007 to 2011). Editions of Labour Market Trends are available from July 2001 until December 2006 when the publication was discontinued. Editions of Economic and Labour Market Review are available from the first edition, published in January 2007, up until the last edition published in May 2011.

Get all the tables for this publication in the data section of this publication .

Back to table of contents13. Quality information

One indication of the reliability of the main indicators in this bulletin can be obtained by monitoring the size of revisions. These summary measures are available in Table S02 regional labour market sampling variability spreadsheet and show the size of revisions over the last 5 years.

The revised data may be subject to sampling or other sources of error. Our standard presentation is to show 5 years worth of revisions (that is, 60 observations for a monthly series, 20 for a quarterly series). Further information on the quality of and methods for workforce jobs estimates can be found in the summary quality report.

Other quality information

Quality and methodology information papers for labour market statistics are available. Further information about the Labour Force Survey (LFS) is available from:

Back to table of contents